Bank of America recently announced a rewards program platform for business customers. The program correlates similarly to Bank of America’s consumer Preferred Rewards Program. There is three achievable status altitudes: “Gold, Platinum and Platinum Honors” with each higher tier, an incremental increase in benefits, bonuses, but also requirements. This program allows you to obtain a new Business Advantage Relationship Rewards Program while earning upwards of 5.25% Cash Back on Gas Purchases! If you would like to learn more about this offer as well as information on other promotions, be sure to check out our Bank of American Bonuses!

Bank of America recently announced a rewards program platform for business customers. The program correlates similarly to Bank of America’s consumer Preferred Rewards Program. There is three achievable status altitudes: “Gold, Platinum and Platinum Honors” with each higher tier, an incremental increase in benefits, bonuses, but also requirements. This program allows you to obtain a new Business Advantage Relationship Rewards Program while earning upwards of 5.25% Cash Back on Gas Purchases! If you would like to learn more about this offer as well as information on other promotions, be sure to check out our Bank of American Bonuses!

| Chase Business Complete Checking®: Earn $300 or $500 when you open a new Chase Business Complete Checking® account. For new Chase business checking customers with qualifying activities. Learn More---Chase Business Checking Review |

| U.S. Bank Business Checking: Earn a $500 bonus when you open a Silver Business Checking Account or $900 when you open a Platinum Business Checking Account online with promo code Q1AFL25 and complete qualifying activities, subject to certain terms and limitations. Offer valid through March 31, 2025. Member FDIC. Apply Now---U.S. Bank Business Checking Review |

| Huntington Bank Unlimited Plus Business Checking: Earn $1,000 bonus when you open a Huntington Unlimited Plus Business Checking account and make total deposits of at least $20,000 within 30 days of account opening. The $1,000 bonus will be deposited into your account after all requirements are met and your account is open for 90 days. Apply Now---Huntington Unlimited Plus Business Checking Review |

| Huntington Bank Unlimited Business Checking: Earn $400 bonus when you open a Huntington Unlimited Business Checking account and make total deposits of at least $5,000 within 60 days of account opening. The $400 bonus will be deposited into your account after all requirements are met and your account is open for 90 days. Apply Now---Huntington Unlimited Business Checking Review |

| Bank of America Business Advantage Checking Bonus Offer Open a new Bank of America Business Advantage checking account and complete the eligible requirements to earn a $200 cash bonus offer. See offer page for more details. Additional terms and conditions apply. See offer page for more details. Learn More---Bank of America Business Checking Review |

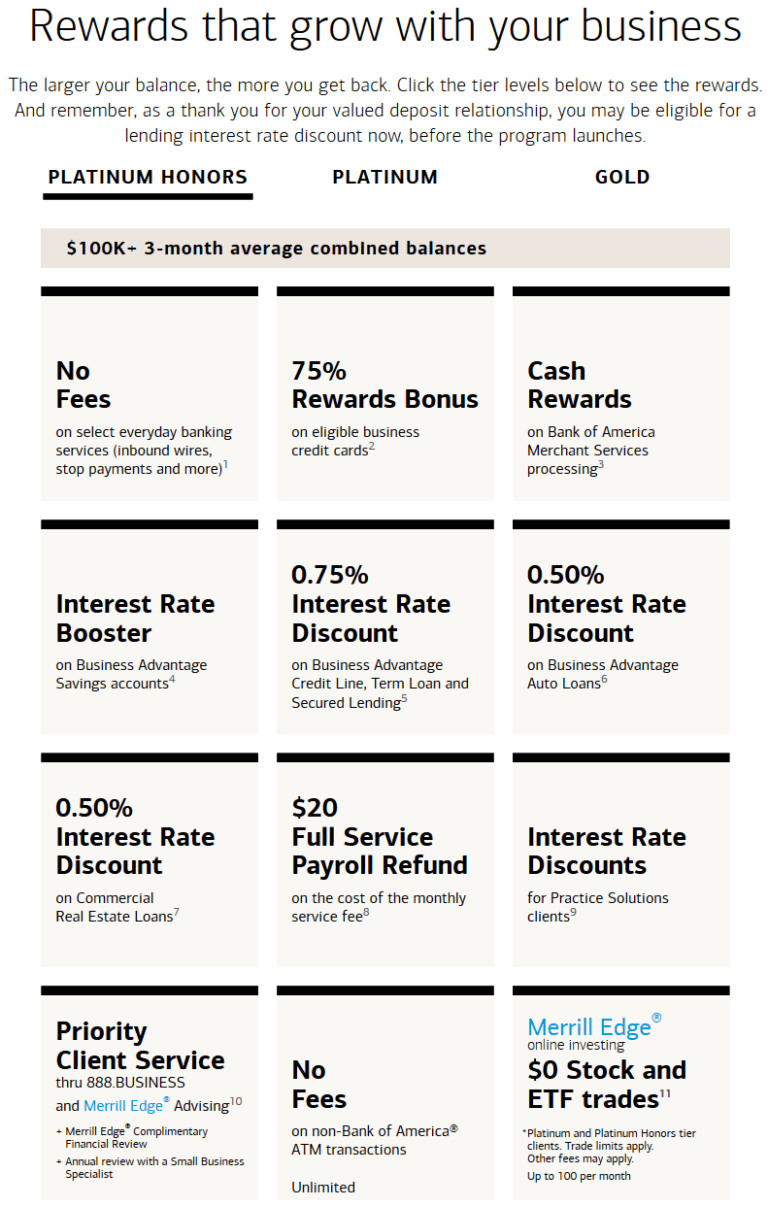

Preferred Rewards Status Altitudes:

You will be able to achieve three statuses with the Preferred Rewards Program: Gold, Platinum, and Platinum Honors with a direct correlation between the status/benefits and the amount of money you have with Bank of America or Merrill. Holdings are as followed:

- Preferred Rewards Platinum Honors: $100,000+ 3 months combined average balances

- Preferred Rewards Platinum: $50,000-$100,000 3 months combined average balances

- Preferred Rewards Gold: $20,000 – $50,000 3 months combined average balances

- No status: $19,999 or less

Editor’s Note: One qualification you’d need prior to engaging yourself in the Business Advantage Rewards program is an eligible Business checking account.

Tiered Credit Card Rewards:

There is also a direct correlation between your credit cards rewards and your status structure. You should expect a incremental increase in rewards tiered towards your given status.

- Preferred Rewards Platinum Honors: 75% bonus

- Preferred Rewards Platinum: 50% bonus

- Preferred Rewards Gold: 25% bonus

- No status: 10% bonus as long as you have a Bank of America Business checking account

Editor’s Note: The bonus WILL replace any other customer related bonus you might have received from Bank of America.

Cards Eligible for BoA Preferred Rewards Program:

- Bank of America Cash Rewards for Business MasterCard Credit Card (You can get upwards of 5.25% Cash Back with this card if you’re a platinum honors).

- No annual fee

- Earn 1% cash back on all purchases, 2% on purchases at restaurants and 3% on purchases at gas stations and office supply stores (up to $250,000 in gas station and office supply store purchases annually, 1% after that)

- Redeem your cash rewards for cash back or apply them to a Bank of America savings or checking account

- Start redeeming for cash back at $25

- Get employee cards at no additional cost to you and with credit limits you set

- Get a flexible suite of online services that adapts to your business needs with MyReport Center

- Download your transactions onto QuickBooks for easy account management

- Link your credit card to a business checking account for overdraft protection

- Schedule hassle-free electronic payments with automatic bill paymentEnjoy greater security and peace of mind with a credit card enhanced by chip technology – soon to be the security standard in the U.S. Plus, chip credit cards are accepted in more than 130 countries including Canada, Mexico and the United Kingdom

- Business Advantage Travel Rewards World Mastercard Credit Card

- 25,000 bonus points when you make $1,000 in purchases in the first 60 days of your account opening

- Earn unlimited 1.5 points for every $1 you spend on all purchases

- 0% on purchases for 9 billing cycles from account opening

- No international transaction fees

- Flexibility to redeem points for a statement credit to pay for flights, hotels, vacation packages, cruises, rental cars or baggage fees; option for cash back and gift cards

- Online & Mobile Access

- Travel Accident Insurance

- Chip Cards

- Overdraft Protection

- Earn 3 points per every dollar spent when you book your travel (car, hotel, airline) through the Bank of America Travel Center – powered by Orbitz.

- No annual fee

Qualifying For Status:

In order to qualify for this program, you’ll first need an eligible Bank of America Business Checking account and 3-month average combined business balances of $20,000 or more in a qualifying Bank of America Business deposit or Merrill Edge business investment account.

Business Cash Rewards

The cash rewards excels in gas and grocery spending with a prosperous 3X on Gas and office supply stores; 2x on purchases at restaurants and 1% cash back elsewhere. This makes it all the more necessary to evaluate the most optimal cash back with each status.

Gas & Office Supple Stores:

- Gold: 3.25% cash back on gas station & Office Supple Stores purchases

- Platinum: 4.5% cash back on gas station & Office Supple Stores purchases

- Platinum Honors: 5.25% back on gas station & Office Supple Stores purchases

Restaurants:

- Gold: 2.25% cash back on restaurants

- Platinum: 3% cash back on restaurants

- Platinum Honors: 3.5% back on restaurants

Business Travel Reward

This card will earn you 1.5x the points on all purchases with a 1¢ a piece when redeeming them against travel expenses. Note that you will only be able to get 0.6¢ out of your redemption if redeemed for cash.

- Gold: 1.87x points on all purchases

- Platinum: 2.25x points on all purchases

- Platinum Honors: 2.625x points on all purchases

Conclusion:

The Business Advantage Relationship Rewards Program from Bank of America basically runs the same rewards tier and benefits from the consumer variant “Preferred Rewards Program.” Pretty nice considering that the program does what it’s intended to do; boost staple Bank of America credit cards as well as banking products. One of the reasons why Bank of America customers prefer BoA’s business card portfolio is because they don’t report business cards to the bureaus. Now $100,000 in combined average balances can be a difficult requirement for some of you, but if you’re looking to maximize the Platinum Honors benefits, it’s going to be a requirement that you cannot sleep on. Don’t forget to check out our complete list of Credit Card Promotions today!