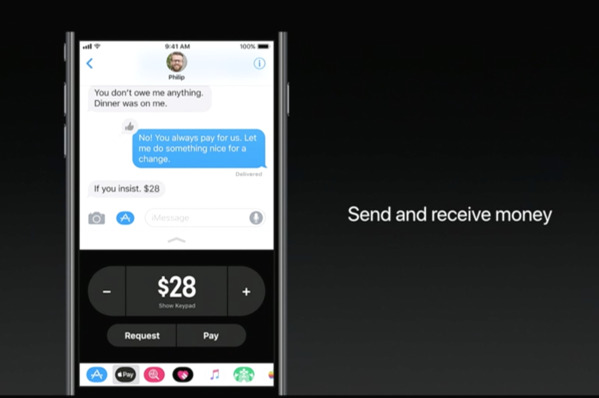

Apple’s recent update makes it possible for individuals to do person to person payments through iMessage. You’ll be able to send payments from a debit or credit card that is stored in your Apple pay wallet and when you receive the funds, it will be further stored in a Apple Pay Cash Card awaited that you withdraw those funds to your bank account or decide to transfer it.

Apple’s recent update makes it possible for individuals to do person to person payments through iMessage. You’ll be able to send payments from a debit or credit card that is stored in your Apple pay wallet and when you receive the funds, it will be further stored in a Apple Pay Cash Card awaited that you withdraw those funds to your bank account or decide to transfer it.

| BONUS LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up To $700 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

Apple Pay Cash Account Review:

- Apple is to introduce a P2P integrated through Apple Pay

- Send money via iMessage

- Receive money and have it stored in an Apple Cash Card readily available to transfer to bank or someone else

- VISA/MC/Discover Credit Cards will incur a 3% transaction fee

- *Update 12/07/2017: American Express credit card will now be usable under Apple Pay with a standard 3% transaction fee attached.

- Debit Cards will incur no fees

- Apple Cash Card will be backed by Green Dot

Conclusion:

Now, I know that some of you are quite skeptical about Apple’s P2P service surfacing and being successful on the premise that P2P is not a new thing. Apple did not pioneer P2P, and yet have they made this service universally capable. Meaning by this, you will only be able to transfer with individuals with the same device, however, with over 700 million apple users out there, this service definitely stands convenient. A 3% transaction fee is attached to money transfers via credit cards, which is quite similar to Venmo. On the other end of the spectrum, you can just use Venmo, which is compatible on practically every device. Definitely on the look out to see if there’s any rewards. Be sure to check out our list of Best Credit Card Promotions for all of your credit card necessities.