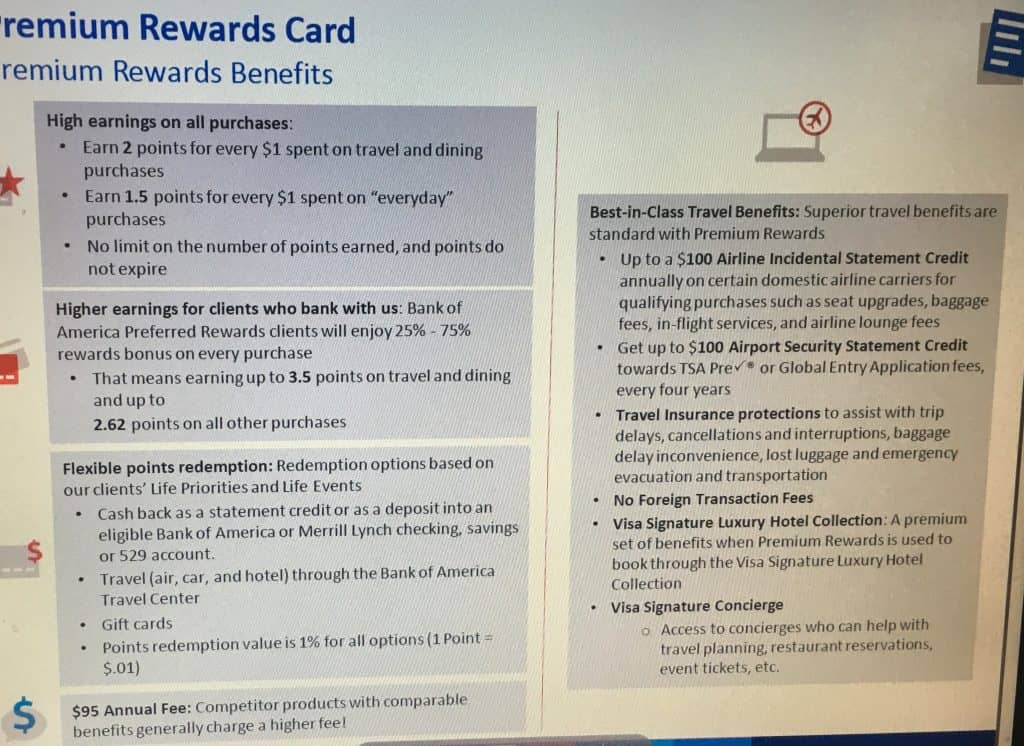

Incoming mid-September, you should expect Bank of America to release their Premium Rewards Card. We previously assumed that the card will be pushed as a rival-competition for the Chase Sapphire Reserve, U.S. Bank Altitude, and the Platinum Card from American Express ,however, that may not be the case as the card rolls out to be a competitor towards the Chase Sapphire Preferred® Card. Smart moves from Bank of America considering making a premium $450 annual fee card would have been a self-destructive nature at this point. Some of the benefits you should expect is $100 in travel fee reimbursement, $100 Global Entry/TSA PreCheck credit once every four years, 1.5x everywhere and 2x on travel/dining all on top of a remarkably affordable $95 annual fee.

| BONUS LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up To $700 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

Alternative Credit Card Bonuses:

- Chase Sapphire Preferred® Card

- Platinum Card® from American Express

- Barclaycard Arrival PlusTM World Elite MasterCard®

Bank of America Premium Card Aspects:

- To be released Mid-September of 2017

- 50,000 Sign-up Bonus after accomplishing a $3,000 spending threshold

- 1.5x everywhere and 2x on travel/dining; Preferred Rewards customers will get up to 2.6 everywhere and 3.5 on travel/dining

- $100 Domestic airline incidentals credit; seat upgrades, baggage fees, in-flight services, and airline lounge fees mid (does not include airfare)

- $100 Global Entry/TSA PreCheck credit once every four years

- Point redemption is 1% for all option ($.01 per point)

- No transfer partners

- No foreign transaction fee

- $95 annual fee

- Visa Signature Benefits

Right off the bat, we already see some of the evident flaws with Bank of America’s new Premium card and that coincides with Bank of America having no transfer partners, however, they may have very well compensated for that with just integrating their Preferred Rewards structure eligibility towards this card.

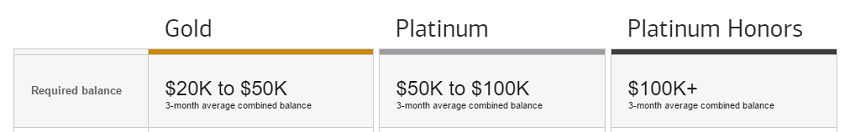

Preferred Rewards Status Altitudes:

You will be able to achieve three statuses with the Preferred Rewards Program: Gold, Platinum, and Platinum Honors with a direct correlation between the status/benefits and the amount of money you have with Bank of America or Merrill. Holdings are as followed:

- Preferred Rewards Platinum Honors: $100,000+

- Preferred Rewards Platinum: $50,000-$100,000

- Preferred Rewards Gold: $20,000 – $50,000

- No status: $19,999 or less

Those of you who are able to reach Platinum Honors will be able to reap a 75% rewards bonus on top of a number of benefits, so this may be rather exciting to see attached to this new Premium Travel Rewards card.

Conclusion:

There’s plenty of things to consider when it comes to valuing the soon-to-be Bank Americard Premium Rewards Card. Firstly, of course, the sign-up bonus, and then the annual travel credit, earning rates, etc. Roughly from the intel we received on this card now, we can assume the card most closely rivals the Chase Sapphire Preferred® Card with a 50,000 Bonus Point offer, $100 Domestic airline incidentals credit, $100 Global Entry/TSA PreCheck credit, a remarkable 2x on dining and travel and 1.5x everywhere else with a chance to pursue Preferred Rewards program benefits. One thing I truly hoped would be configured into the card is a travel rewards redemption at 1.5%, however, we’ll just be getting a measly 1% for all option ($.01 per point). Perhaps another card from our complete list of Credit Card Promotions could be of use, if you’re not interest of course.