There’s no doubt that Amazon has always been the go-to place for discounted merchandise with no hefty fees primarily due to lower margins and heavier volume.

There’s no doubt that Amazon has always been the go-to place for discounted merchandise with no hefty fees primarily due to lower margins and heavier volume.

If you bought from Amazon within the last couple of weeks, odds are, you’re quite familiar with what Prime Day is, but for those that aren’t, Prime Day is considered to be Amazon’s “Black Friday.” You have from now until Midnight to claim exclusive offers from Amazon themselves.

While, the deals are endless and the discounts are all in all, attractive to say the least, there will always be a way to maximize your return on spending during this festive Amazon one-day sale and as a matter of fact, we’re excited to put together a credit card list that’ll benefit you today!

Editor’s Note: Keep in mind that if you’re not a Amazon Prime account holder, you can always sign up for their free trail for 30 days or if you’re a student, you will receive an extended free 6 months trial membership.

| BONUS LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up To $700 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

The Discover IT Card is a rotating 5% category bonus card (quite similar to the Chase Freedom Card); Given that this quarter, you’ll earn 5% cash back on categories including home improvement stores and purchases on Amazon.com, in which the 5% cash back fluctuates accordingly to the quarterly category (maximum of $1,500, and 1% cash back on all other purchases).

If you haven’t signed up for the card yet, apply now and Discover will also match all the cash back you earn at the end of the first year. This card is perfect for all your Prime Day shopping needs, and there’s no annual fee attached to this card as well as no foreign transaction fees.

Editor’s Note: If you’re just now applying for this card, you won’t be able to take advantage of the Prime Day sales + 5% Cash Back. If you’re new to the cashback category game, I recommend that you check out our 3rd Quarter 5% Category Review.

Discover It Card Summary:

- Apply Now

- Maximum Bonus: Earn $50 bonus after first purchase.

- Spending Requirement: Make 1 purchase within 3 months.

- Annual Fee: $0

- Bonus Worth: Total yearly maximum of $6,000 for 5% cash back purchases plus amount earned for all 1% cash purchases which does not have a limit.

- Expiration Date: None

- Additional Advice:

- New customers can double the cash back earned at the end of the first year, up to the maximum of $1,500 each quarter for 5% cash back purchase categories and no limit for all other 1% cash back purchases. Refer your friends and receive $50 each, up to 10 referrals, for a total of $500 extra cash.

- Shop with Discover Deals online portal to take advantage of extra rewards since purchases are also doubled during the promotion period. Discover makes it easy to redeem your rewards with Amazon.com and increase the value of gift cards or ecertificates by as much as $20 from over 150 top major retailers and brands.

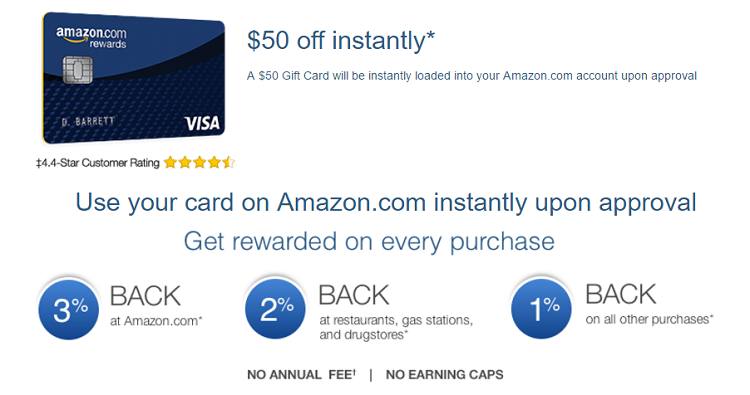

The Amazon.com Rewards Visa Card is another option to look into with Amazon Prime Day Purchases today. You’ll receive a $50 gift card after approval. It’s been reported that if you apply for this card today and you are approved, you’ll be able to use this $50 credit in the duration of the sale.

With this card, you’ll earn 3% points back on Amazon.com purchases, in addition to 2% points back at restaurants, gas stations and drugstores and 1% points back on all other purchases. The points that you earned from your spend can also be used back on your purchases, so 100 points is equivalent to a dollar when redeeming on Amazon.com. You’ll also receive $30 off purchases $150+ during Prime day only.

Amazon.com Rewards Visa Card Summary:

- Apply Now

- Maximum Bonus: $50 Amazon gift card

- Spending Requirement: None

- Annual Fee: None

- Bonus Worth: $50

- Expiration Date: None

- Additional Advice: Take advantage of the $30 off $150 worth of purchase now until midnight only

Now, the Chase Freedom Unlimited is a great option for those that don’t want to mess with category points earnings. The card will earn you 1.5% cash back on every purchase with no limit, which equals 1.5 Ultimate Rewards points per dollar. If you’re a card holder of a more premium UR credit card (Chase Sapphire Preferred or Chase Ink Plus Business Card), you will have the ability to choose whether you want to receive your sign-up bonus and any cash back earned as Ultimate Rewards points or not.

It’s recommended that you choose UR points though primarily because UR points are valued at an all-time high, having the utmost flexibility in regards to cash back or UR points makes this a better option when making those shopping purchases on this big day!

Editor’s Note: The card current has a $150 sign-up bonuses attached, equivalent to 15,000 UR points, after you make a spend of $500 within the first three months that your account is opened. Add an additional user and you’ll also earn $25 equivalent to 2,500 UR points.

Chase Freedom Unlimited Card Features:

- New! Unlimited 1.5% cash back on every purchase – it’s automatic· Earn a $150 Bonus after you spend $500 on purchases in your first 3 months from account opening

- 0% Intro APR for 15 months on purchases and balance transfers. After the intro period, a variable APR of 14.24-23.24%. Balance transfer fee is 5% of the amount transferred, $5 minimum

- Redeem for cash – any amount, anytime

- Cash Back rewards do not expire as long as your account is open

- No annual fee

Now, Starwood Preferred Guest Points has reign in popularity for a while now considering they have the most valuable point currency out there right now; Primarily due to the prominence in Transfer partners and redemption option flexibility with their program, you can earn yourself a beautiful 2.5 cents a piece. the 2.5 cents a piece point value alone, urges me to earn starpoints on Amazon Prime Day purchases, furthermore optimizing my returns.

Editor’s Note: The Starwood Preferred Guest from American Express also has a 25,000 SPG points attached after you make a spend of $3,000 within a given three months of account opening. If you have a Business SPG card, odds are you’ve been targeted for their 10,000 SPG points promotion when you spend $10,000 on your SPG card as well.

Starwood Preferred Guest Credit Card Summary:

- Apply Now

- Maximum Bonus: 25,000 bonus Starpoints

- Spending Requirement: You must spend $3,000 in purchases within the first 3 months.

- Annual Fee: $0 introductory annual fee for the first year ($95 thereafter)

- Bonus Worth: We estimate Starpoints to be worth 2.4 cents, so we estimate this bonus is worth $600.

- Expiration Date: None

- Additional Advice: If you choose to transfer Starpoints to miles, you may want to wait until you’ve accumulated at least 20,000. Additionally, for every 20,000 points you transfer to a frequent flier program, you’ll receive an additional 5,000 Starpoints. So if you were to transfer these 20,000 Starpoints to American, you’d actually end up with 25,000 AAdvantage miles.

- Alternative Credit Cards:

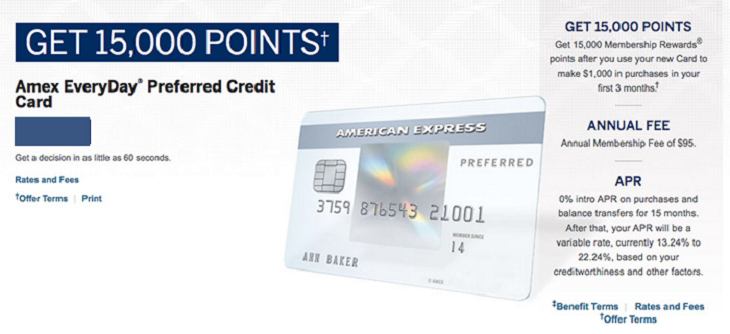

The Amex EveryDay Preferred Card is another great options for Prime Day Purchases primarily because you could earn 2x points on Amazon Purchases through July 31 if you’re enrolled through AMEX Offers. Also, you can take advantage of the 50% more points on purchase quantity of 30 or more. If you’re intentions are on buying a plethora of separate items during Prime Day, then this could quite potentially rake you up some savings; if and only if you can make the 30 purchases threshold.

Editor’s Note: The EveryDaySMPreferred Credit Card from American Express also has a 15,000 MR points attached after you make a spend of $1,000 within a given three months of account opening.

AmEx EveryDay Preferred Credit Card Credit Card Summary:

- Apply Now

- Maximum Bonus: 15,000 bonus points

- Spending Requirement: You must spend $1,000 in purchases within the first 3 months.

- Annual Fee: $95

- Bonus Worth: American Express Membership Rewards are worth 0.5 cents to 1 cent each, depending on how you redeem them (bill charges are 0.6 cents/point, Amazon purchases are 0.7 cents/point, and airfare is 1 cent/point) . We estimate this bonus to be worth $150.

- Expiration Date: No expiration

- Additional Advice: In order to maximize the total value of this card, you’ll have to get more than 1 cent of value out of a Membership Rewards point. At 1 cent per point, the most value you can earn is 4.5% back on groceries and 3% back on gas, which is less than majority credit card bonuses. Because of this, we recommend getting around 1.5 cents of of value out of a Membership Rewards point by converting it to airline miles.

Conclusion:

Today’s the day that you can reap Amazon’s “Prime Day” Promotion and there’s plenty of ways that you can maximize your spending and potentially increase your purchasing power drastically. Provided that you are using the right card, you’ll not only be saving big bucks, but you’ll be maximizing returns on all your Amazon purchases made today as well.

This is quite interesting, considering that Amazon’s Prime Day last year was a fluke for me, but seemingly enough, with more than 100,000 deals exclusively for Prime members, Amazon has really stepped it up since last year. I recommend that you check out the Discover IT card primarily because it’s quite rewarding with it’s 5% category currently for all Amazon.com Purchases. Don’t forget to also check out our complete list of Credit Card Promotions today!