To put on some perspective before I start this post. ClearXChange is a P2P money sending-transfer system used by most top US Banks: Chase, Bank of America, Capital One, US Bank, etc. Note that they will be rebranding coining this system the ‘Zelle’ in the near future.

To put on some perspective before I start this post. ClearXChange is a P2P money sending-transfer system used by most top US Banks: Chase, Bank of America, Capital One, US Bank, etc. Note that they will be rebranding coining this system the ‘Zelle’ in the near future.

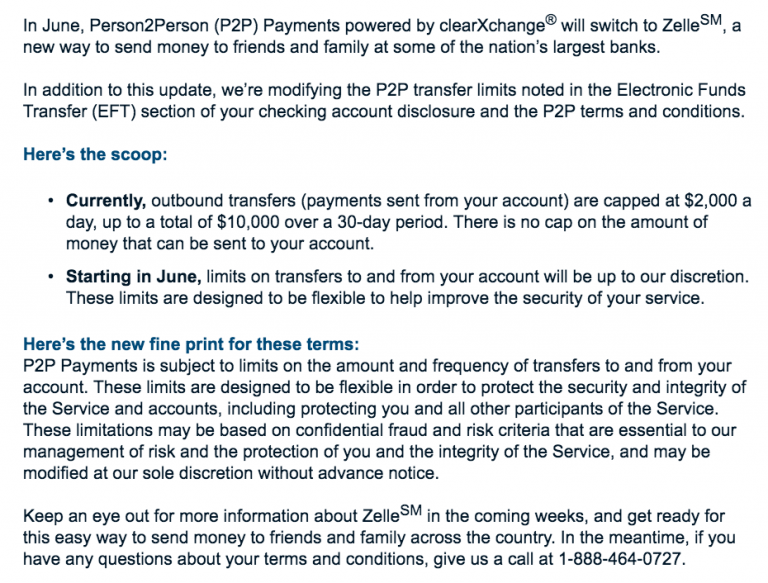

Currently, Capital One is sending out emails to their customers regarding such a change in their P2P transfer limits. As of now, outbound transfers sent or payments sent from your account will be capped at $2,000 a day, totaling in a maximum of $10,000 over a month’s period. This cap will not be subjective to the money being sent into your account.

Recommended Capital One Cards:

Capital One clearXchange Increased Limits Summary:

- Currently, outbound transfers (payments sent from your account) are capped at $2,000 a day, up to a total of $10,000 over a 30-day period. There is no cap on the amount of money that can be sent to your account.

- Starting in June, limits on transfers to and from your account will be up to our discretion. These limits are designed to be flexible to help improve the security of your service.

Fine Print:

- P2P payments is subject to limits on the amount and frequency of transfers to and from your account.

- These limits are designed to be flexible in order to protect the security and integrity of the service and accounts.

- These limitations may be based on confidential fraud and risk criteria that are essential to our management of risk and protection of you and the integrity of the service, and may be modified at our sole discretion without advance notice.

Conclusion:

This may be good news for anyone that utilizes Capital One’s ClearXChange services as Capital One rolls out with a new name coined the ‘Zelle’. Starting in June, limits on transfers to and from your account will be up to our discretion. These limits are designed to be flexible to help improve the security of your service. P2P payments is subject to limits on the amount and frequency of transfers to and from your account. These limits are designed to be flexible in order to protect the security and integrity of the service and accounts. Also, don’t forget to check out our complete list of Credit Card Promotions today!

With the American Express® High Yield Savings Account: • Earn 1.90% APY as of 9/15/22 on your deposits. Your High Yield Savings account earns interest daily and is posted to your account monthly. • Links easily with your current bank accounts. No need to switch banks. • FDIC Insured. Your account is insured to at least $250,000 per depositor. • 24/7 Account Access |