Now is the time to register your 5% cash back credit cards with rotating quarterly categories for the second quarter (Q2) of 2019. Here are the details for the Chase Freedom, Discover it, US Bank Cash+, Citi Dividend, and ABOC Platinum Rewards credit cards from April 1st – June 30th, 2019, along with activation links for your bonuses.

Now is the time to register your 5% cash back credit cards with rotating quarterly categories for the second quarter (Q2) of 2019. Here are the details for the Chase Freedom, Discover it, US Bank Cash+, Citi Dividend, and ABOC Platinum Rewards credit cards from April 1st – June 30th, 2019, along with activation links for your bonuses.

The credit cards featured below offer up to 5% cash back on specific categories that rotate each quarter. You must register these cards to get their respective bonuses, but it can add up to $100+ in additional rewards per year without changing your spending habits. In addition, new cardholders may also get a sign-up bonus.

Chase Freedom

The Chase Freedom FlexSM offers a $200 bonus after spending $500 on purchases in your first 3 months from account opening. 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR. You'll earn: • Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter! • 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • Unlimited 1% cash back on all other purchases You cash back rewards do not expire as long as your account is open and there is no minimum to redeem for cash back. This card has no annual fee. |

Bonus cash back categories:

- Grocery Stores (excludes Target & Walmart)

- Home Improvement Stores

Cash back limit:

- Earn 5% cashback on up to $1,500 spend in combined purchases of this quarter’s categories

Enroll each quarter at ChaseBonus.com. As long as you activate by the end of the quarter, the rewards are retroactive. All other purchases earn 1% back, with no tiers or expiration of rewards. You earn your bonus in the form of Ultimate Rewards points which can also be converted to frequent flier miles instead of cash. Activate Here.

See our full Chase Freedom Review

Discover it

With the Discover it® Cash Back: • Get a $50 Statement Credit with your first purchase within 3 months. • Earn 5% Cash Back at different places each quarter like gas stations, grocery stores, restaurants, Amazon.com and more, up to the quarterly maximum, each time you activate. Plus, earn unlimited 1% cash back on all other purchases — automatically. • Low Intro APR: 0% Intro APR for 14 months on purchases, then a variable rate, currently 14.24% – 25.24% APR, applies. • With Cashback Match™, Discover will match all the cash back you've earned at the end of your first year, automatically. • No Annual Fee. • Terms Apply. • See Rates & Fees |

With the Discover it® Student Cash Back: • Earn 5% Cash Back at different places each quarter like gas stations, grocery stores, restaurants, Amazon.com and more, up to the quarterly maximum, each time you activate. Plus, earn unlimited 1% cash back on all other purchases — automatically. • Low Intro APR: 0% Intro APR for 6 months on purchases, then a variable rate, currently 15.24% to 24.24% APR, applies. • Get $20 statement credit each school year your GPA is 3.0 or higher for up to next five years. • With Cashback Match™, Discover will match all the cash back you've earned at the end of your first year, automatically. • No Annual Fee. • Terms Apply. • See Rates & Fees |

Bonus cash back categories:

- Gas Stations

- Uber

- Lyft

Cash back limit:

- Earn 5% cashback on up to $1,500 in combined purchases of this quarter’s categories

The 5% bonus cash back category can be enabled on both the Discover it card and the Discover it Student card. Enroll after logging into your online account. Check the right-hand side. Your 5% rewards won’t apply until after you activate your rewards, so it is best to activate immediately before you forget. Activate Here.

See our full Discover it Review

See our full Discover it Student Review

US Bank Cash+

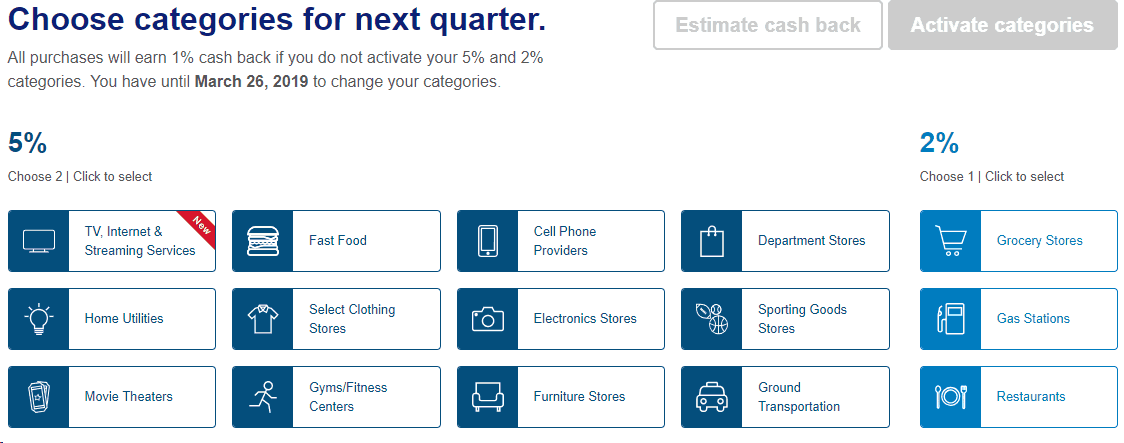

Bonus cash back categories:

Choose two of the following:

- Home Utilities

- Electronics Stores

- Sporting Goods Stores

- Ground Transportation

- TV, Internet & Streaming (this replaces Car Rentals)

- Department Stores

- Select Clothing Stores

- Gyms/Fitness Centers

- Furniture Stores

- Cell Phones

- Fast Food

- Movie Theaters

Cash back limit:

- Earn 5% cashback on your first $2,000 in combined net purchases in your selected 5% categories

Unfortunately, with this card, you can’t pick a broad category like gas stations, restaurants, or grocery stores. Make sure you choose your categories each quarter, even if you want them to stay the same. If you don’t choose your categories, all purchases revert to only earning 1% cash back for that quarter. Activate Here.

See our full U.S. Bank Cash+ Review

Citi Dividend

Bonus cash back categories:

- Drugstores

- Fitness Clubs

Cash back limit:

- Earn 5% cashback with a maximum of $300 cashback earned in bonus categories per calendar year

This card is no longer available to new applicants, but if you still have the grandfathered card, you can activate it to get 5% cash back rewards. Activate Here.

ABOC Platinum Rewards

Bonus cash back categories:

- Home Improvement (Home Improvement Stores, Home Supply Stores, Warehouse & Wholesale Clubs)

Cash back limit:

- Earn 5% cashback on your first $1,500 in combined purchases each quarter

ABOC is not a name you see out there like Chase or Discover. Instead, ABOC focuses on fostering deep ties to their customers and their community, serving the banking needs of many businesses, organizations, institutions and individuals, for multiple generations.

Unlike the cards above, you just need average credit to apply and get approved. Thus, this card is helpful for building your credit while earning a generous 5% cash back. Activate Here.

See our full ABOC Platinum Rewards Review

Conclusion

Each quarter, each of these 5% cash back credit cards require activation to receive your bonus 5% cash back. Credit card companies do this to save them millions of dollars each year in case you were to forget.

Because issuers know people are forgetful and perhaps somewhat lazy, they’ve added this crutch to ensure that some users won’t bother with activation and will be satisfied with their 1% cash back all year long.

Generally, activation begins one month before the quarter starts, and ends two weeks before the quarter ends. If you activate late, which is usually after the quarter has started, and you’ve spent money on the bonus category, call your issuer. Ask them to apply the 5% retroactively. It may work, and it may not work, but it’s worth trying. Some issuers, like Chase, will allow you to earn rewards retroactively as long as you activate it before the middle or end of the quarter.

You can find more credit card bonuses and their respective reviews, here on BCS if you’re interested. Let us know in the comments below on your experience with these 5% cash back credit cards!