Bank of America and Citibank are both great banks in America that offer a wide variety of different products from checking to savings accounts. Although Bank of America has over 5,000 branches while Citibank only has 700, Citibank is still comparable and offers features that Bank of America doesn’t. If you’re debating on where to… [Continue Reading]

BMO Harris Bank vs Bank of America

BMO Harris Bank has about 600 locations in the Midwest. Their Smart Advantage checking account comes with no fees and balance requirements if you get eStatements. Plus, their Savings account just need about $100 to open. Normally, the Special CD Rates need at least a $5k deposit to open. Meanwhile, Bank of America is one… [Continue Reading]

PNC Bank vs Bank of America: Which Is Better?

Bank of America is one of the largest banks in the United States, however PNC Bank ranks pretty high as well. PNC Bank has 2,600 branches in 19 states that are generally in the east. On the other hand, Bank of America has over 5,000 locations and 16,000 ATMs. Both of these banks offer a… [Continue Reading]

Bank of America vs Wells Fargo: Which Is Better?

Bank of America and Wells Fargo are both one of the largest banks in America, so it might be a tough decision choosing which one to bank with. Bank of America has over 5,000 locations and 16,000 ATMs and is known for their great customer service and long hours. On the other hand, Wells Fargo… [Continue Reading]

Bank of America vs US Bank: Which Is Better?

Bank of America has more than 5,000 locations and 16,000 ATMs nationwide. They offer many different accounts: checking, savings, CDs, IRA and investment accounts through Merrill Edge. They are highly praised for their good customer service with extended hours. Whereas, US Bank has 3,000 branches across 26 states. It has somewhat high minimum balance requirements… [Continue Reading]

BMO Harris Bank vs Wells Fargo

BMO Harris Bank is a midwest bank with options for low and high-balance customers. But how do they compare with Wells Fargo? Both banks are some of the largest in the business so how do you know which to choose from? Read below and learn about which bank better suits your financial needs! Conclusion Wells… [Continue Reading]

How to Open a Business Bank Account

Having a business bank account is absolutely essential and most definitely the most crucial part for a new business owner. Even if you are good at managing your expenses, a business checking account acts as a safety blanket that keeps check of your records which organizes and separates your personal and professional finances. This article… [Continue Reading]

HSBC Apple Pay Mobile Payments – Tap & Pay, Fast & Easily

Are you tired of carrying your wallet around? If you own an Apple device you’re in luck, because that’s all you’ll need. HSBC Bank is currently offering Apple Pay, which lets you pay with your device. This process is easy and secure, and with contactless technology and security features, you can be sure your money… [Continue Reading]

Advantages of Online Savings Account

Finding time to manage your banking experience on a day to day basis can be quite stressful. Shopping for groceries, running errands or even work can sometimes get in the way of your to-do list. So when exactly do you find time to take care of your expenses? Back in the day, doing so would… [Continue Reading]

Associated Bank vs BMO Harris Bank

Associated Bank has about 230 branches in Midwest, and are very well known for their amazing community bonds. They offer 2 checking accounts with different alternatives to waive their fees. There are a variety of personal and business account options to choose from. But, how does Associated Bank compare with BMO Harris Bank? BMO Harris… [Continue Reading]

Basic Features You Should Expect From Your Bank

There are over thousands of different banks that offer many different financial products for their members. However, you should know the basic features of an account when picking the best bank for you. Knowing their perks well help you decide which account will benefit you the most. Continue reading below to see more information on… [Continue Reading]

Are Online Savings Accounts FDIC Insured

Online savings accounts are FDIC insured. If the bank were to fail, your money (up to $250,000) would be protected. Online banks are treated the same as any other financial institution in terms of government protection. Keep reading below to find out about online savings accounts being FDIC Insured. Are Online Accounts Safe? Online banks… [Continue Reading]

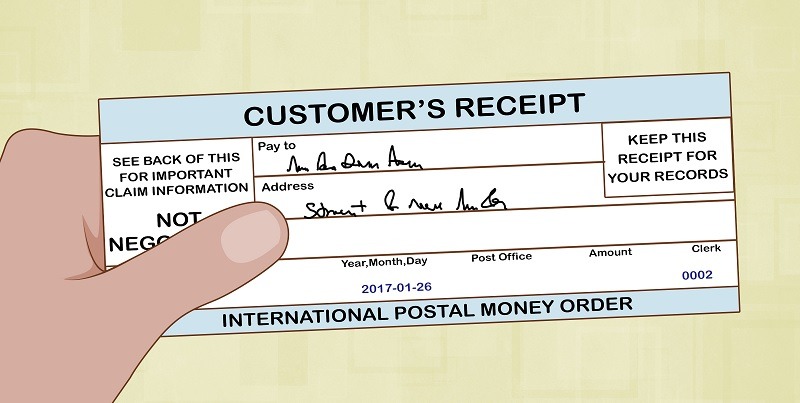

How Money Orders Work: What You Should Know

Money Orders are a certificate, usually issued by the government or a bank, that gives you access to cash. Similar to a check, they are a printed order for payment. Continue reading to find out more about Money Orders. How Money Orders Work Money orders operate similar to a check. All you need to do… [Continue Reading]

How To Login Discover Bank Online

Discover Bank offers a diverse portfolio of banking products. Typically being known for their popular Discover IT Cards and their generous rewards value. One of the contributing factors towards Discovers success is their exceptional services that could even push to be the best in the industry. Their banking services offers useful and supportive tools necessary… [Continue Reading]

Fidelity CD Rates: How They Compare

Fidelity’s certificates of deposit differ from traditional bank CDs in that they’re brokered CDs, which are CDs issued by banks but available only to brokerage customers. Below, you can learn about Fidelity CD rates and how they compare. How Fidelity CD’s Work Getting brokered CD’s is a more complex process than opening bank CD’s: An… [Continue Reading]

What Is A CD Early Withdrawal Penalty & How To Avoid It

CDs are great investments for those who prefer to keep their money safe. Funds can be FDIC-insured, and you’ll earn more interest than you would from a savings account. But CDs are designed to be longer-term investments. Unlike your checking account which allows multiple deposits and withdrawals, CDs are meant to be left alone. Cashing… [Continue Reading]

Are CDs Safe?

A Certificate of Deposit (CD) account is a savings account that’s federally insured. It will offer a fixed interest rate and a date of withdrawal (maturity date). The best part of owning a CD account is that most do not charge monthly fees. I’ll go over what a CD account is, and if it’s safe… [Continue Reading]

FSA Debit Cards vs. Bank Debit Cards: When to Use Each

An FSA card is the debit card that allows you to access money in your flexible spending account. This is an account that is set up alongside your health insurance, and you can choose to have pretax dollars from your paycheck routed into it. Those funds can then be used to pay for certain qualifying… [Continue Reading]

What is an Overdraft Fee?

When you overdraw from your bank account, and the bank covers your withdrawal or payment. This overdraft fee is charged to your account if your bank doesn’t cover the account going over it’s balance. However, there are several banks that will offer an overdraft protection service if this happens. Most overdraft protection services will charge… [Continue Reading]

Why Do I Have a Limit of 6 ACH Transfers Per Month With My Savings Accounts?

Did you know that you know that you are limited to just six transfers out of a savings account per billing cycle? Find out Why Do I Have a Limit of 6 ACH Transfers Per Month With My Savings Accounts? Banks will fine you for exceeding your limit. Some of these fines are pretty hefty… [Continue Reading]

- « Previous Page

- 1

- …

- 13

- 14

- 15

- 16

- 17

- …

- 31

- Next Page »