Available nationwide, the Upgrade Premier Savings account offers 3.05% APY on your funds to help you reach your goals faster. Update 11/1/25: The rate has decreased to 3.05% APY from 3.42%. Consider opening a savings account with Upgrade! You can rest assured that your funds are safe with up to $250K in FDIC or NCUA… [Continue Reading]

Northpointe Bank High Yield Savings Review: $1000 Bonus + 4.12% APY (Nationwide)

Northpointe Bank is offering 4.12% APY + up to $1,000 bonus when you open a High Yield Savings account – available nationwide powered by Raisin. Update 10/31/25: The rate has decreased to 4.12% APY from 4.16%. You can currently earn a highly competitive rate. The up to $1,000 bonus has been extended through November! For a limited… [Continue Reading]

Primis Bank Business Savings Review: $100 Bonus + 4.00% APY (Nationwide)

Available nationwide, Primis Bank is offering a $100 bonus + 4.00% APY when you open their Business Savings Account. Update 10/28/25: The $100 bonus offer is available through 10/31/25. Primis Bank Business Savings Account Learn More at Primis Bank What you’ll get: $100 bonus + 4.00% APY Eligible account: Business Savings Credit inquiry: Soft Pull or Hard … [Continue Reading]

American Express® High Yield Savings Account Review: 3.50% APY (Nationwide)

Available nationwide, the American Express® High Yield Savings Account is offering a 3.50% Annual Percentage Yield (APY) Rate. Update 10/24/25: Many are reporting that Amex is offering a targeted $400 bonus when opening a new savings account with $25,000 and maintaining that balance or 60 days. YMMV. May see this as a pop-up when logged into… [Continue Reading]

Barclays Tiered Savings Review: $200 Bonus + Up to 4.10% APY (Nationwide)

Available nationwide, the Barclays Tiered Savings account is offering up to 4.10% APY. Update 10/14/25: The $200 bonus is back through 12/31/25. The rate has decreased to 4.10% APY from 4.20%. Barclays Tiered Savings $200 Bonus New Barclays Tiered Savings Customers can earn up to 4.10% APY and a $200 bonus after depositing $25,000. How to… [Continue Reading]

Discover Online Savings Review: Earn 3.40% APY (Nationwide)

Interested in opening a Discover® Online Savings account? Available to residents nationwide, apply for the Discover Online Savings account to earn 3.40% APY. The account has no fees, no minimum balance requirements, and no hassle! Update 10/10/25: The rate has decreased to 3.40% APY from 3.50%. I’ll review the Discover Savings offer below. The information for… [Continue Reading]

BlueVine Business Checking Review: $300 Bonus + 1.5% APY + No Hidden Fees + Unlimited Transactions

Bluevine is currently offering a $300 bonus + an attractive 1.5% APY on balances up to $100,000 for its Business Checking Account. If you’d like to learn more about BlueVine and how they can help your business, check out our post below. Update 9/29/25: There is currently a $300 bonus available through 12/31/25. If you… [Continue Reading]

Synchrony Bank High Yield Savings Review: 3.80% APY (Nationwide)

Available for residents nationwide, Synchrony Bank High Yield Savings is offering 3.80% APY when you open an account. Update 9/22/25: The rate has decreased to 3.80% APY (from 4.00%). Open an account Synchrony Bank High Yield Savings Review Synchrony Bank has no physical locations, so you are able to save more money while still being… [Continue Reading]

Fitness Bank Savings Account Review: 4.45% APY (Nationwide)

Available nationwide, Fitness Bank Savings is offering a competitive 4.45% APY Rate when you meet a step requirement. If you keep reading, you can find out everything you need to know about the attractive account and rate. Update 9/19/25: The rate has decreased to 4.45% APY from 4.55%. Great account to earn a competitive rate while… [Continue Reading]

State Bank of Texas Jumbo Money Market Review: 4.18% APY (Nationwide)

Available to residents nationwide, State Bank of Texas is offering an attractive 4.18% APY. Definitely continue reading below for everything you would need to know about the attractive account and rate! Update 9/19/25: The rate has decreased to 4.18% APY from 4.54%. State Bank of Texas Jumbo Money Market Review State Bank of Texas (SBT)… [Continue Reading]

Peak Bank Envision Savings Review: 4.35% APY (Nationwide)

Peak Bank is offering 4.35% APY when you open an Envision Savings account powered by Raisin – available nationwide. Update 9/19/25: The rate has decreased to 4.35% APY from 4.44%. This account currently offers one of the best rates available! Peak Bank Envision Savings Rate Learn More at Peak Bank Eligible account: Envision Savings Credit… [Continue Reading]

TotalBank Money Market Review: 4.26% APY (Nationwide)

Available to residents nationwide, TotalBank Money Market is offering a 4.26% APY. Update 9/19/25: The rate has decreased to 4.26% APY from 4.41%. TotalBank Money Market Review TotalBank is a division of City National Bank of Florida. Additionally, they were founded in Miami more than 70 years ago, today City National Bank is the premier… [Continue Reading]

Primis Bank Savings Review: 4.20% APY (Nationwide)

Available nationwide (excluding Alaska and Hawaii), Primis Bank is offering 4.20% APY when you open their Savings Account. Update 9/19/25: The rate has decreased to 4.20% APY from 4.35%. About Primis Bank Savings Primis is headquartered in Tappahannock and is the 10th largest bank in the state of Virginia. It is also the 360th largest… [Continue Reading]

CFG Bank Money Market Review: 4.25% APY (Nationwide)

Available for residents nationwide, CFG Bank is offering a High Yield Money Market Account with 4.25% APY. Update 9/19/25: The rate has decreased to 4.25% APY from 4.32% APY. CFG Bank High Yield Money Market Review CFG Bank was founded in 1927, when La Corona Building and Loan Association, Inc., was formed to meet the… [Continue Reading]

Rising Bank High Yield Savings Review: 4.20% APY (Nationwide)

Available for residents nationwide, Rising Bank is offering 4.20% APY when you open their High Yield Savings account. Update 9/19/25: The rate has decreased to 4.20% APY from 4.30%. We recommend our top pick savings account from Western Alliance Bank! Rising Bank High Yield Savings Review Rising Bank is an online subsidiary of Midwest BankCentre…. [Continue Reading]

Colorado Federal Savings Bank Premier Savings Review: 4.15% APY (Nationwide)

Available nationwide, Colorado Federal Savings Bank is now offering 4.15% APY for their Premier Savings Account. Keep reading to learn more about the attractive account and rate! Update 9/19/25: The rate has decreased to 4.15% APY from 4.25%. Colorado Federal Savings Bank Premier Savings Review Colorado Federal Savings Bank is a federally insured bank serving… [Continue Reading]

Colorado Federal Savings Bank High Yield Savings Review: 4.10% APY Rate (Nationwide)

Colorado Federal Savings Bank is now offering residents nationwide a 4.10% APY for their High Yield Savings Account. Update 9/19/25: The rate has decreased to 4.10% APY from 4.20%. This nationwide bank will give their clients rates that have a large range of Savings and CDs choices. To begin, you must have an opening deposit that’s… [Continue Reading]

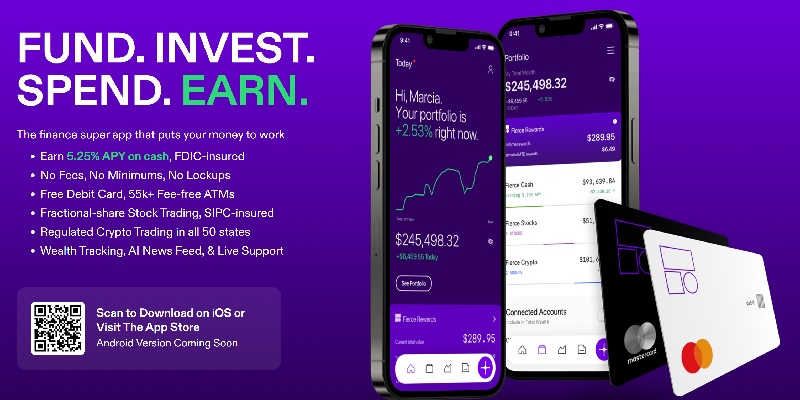

Fierce Finance Cash Review: 4.00% APY (Nationwide)

Available nationwide, Fierce Finance is offering 4.00% APY when you open their Cash Account. Update 9/19/25: The rate has decreased to 4.00% APY from 4.25%. About Fierce Finance Cash Account Fierce is the financial super app that brings everything together and makes managing your portfolio while earning rewards easy—and powerful. Fierce has one singular, fundamental… [Continue Reading]

Merchants Bank Money Market Review: 4.00% APY (Nationwide)

Available for residents Nationwide, Merchants Bank Money Market Account is offering a 4.00% APY. Update 9/19/25: The rate has decreased to 4.00% APY from 4.25%. Merchants Bank Money Market Review Merchants Bancorp is a diversified bank holding company headquartered in Carmel, Indiana operating multiple lines of business, including multi-family housing and healthcare facility financing and… [Continue Reading]

My eBanc SuperSaver Money Market Review: 4.35% APY (Nationwide)

Available nationwide, My eBanc SuperSaver Money Market is offering up to 4.35% APY Rate. Definitely continue reading below for everything you would need to know about the attractive account and rate! Update 9/19/25: The rate has increased to 4.35% APY (from 4.25%). My eBanc SuperSaver Money Market Review As an online-only institution, My eBanc serves… [Continue Reading]

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 56

- Next Page »