The federal government is currently swaying towards increasing the limits on the amount credit card issuers that charge on late fees and starting January, it seems that American Express is the first to respond by charging upwards of $38 if the deemed customers are late more than once in a six-month time period. Considering how hefty… [Continue Reading]

Electronic Express Card Review

Sign up for a Electronic Express Credit Card from Synchrony Bank and you could receive 12 Months of Special Financing on purchases of $499 and up. Expect a no annual fee attached to this card on top of having the ability to take advantage of Special Cardholder-Only Offers. The Electronic Express card could be a good option… [Continue Reading]

Ebates Credit Card Review: Up to 3% Cash Back

Apply for the eBates Credit Card from Synchrony Bank and you could earn yourself a $10 Cash Bonus after making your first purchase. This card has attractive prospects attached with 3% cash back on all purchases made through the eBates portal in addition to whatever cashback eBates is offering (currently offering 1% on American Express Gift… [Continue Reading]

Best Credit Cards to Use with Lyft

It’s no doubt that in some cities, Lyft is a more popular alternative in the vast of Ride-Sharing companies to date. What makes it a more popular option is because Lyft is the more cheaper alternative towards a taxi or an Uber, considering that Uber now charges surge-pricing. Certainly enough, it’s all the more necessary… [Continue Reading]

Saving Big with the AMEX-American Airlines Partnership

Greats news for American Express cardholders and American Airlines frequent flyers! Amex and American Airlines announced a preferred partnership not too long ago (late September), allowing Amex travel agents to provide their cardholders with discounted fares on selected routes. Travel counselors and Relationship Managers will also have access to AA Flex Funds account where they… [Continue Reading]

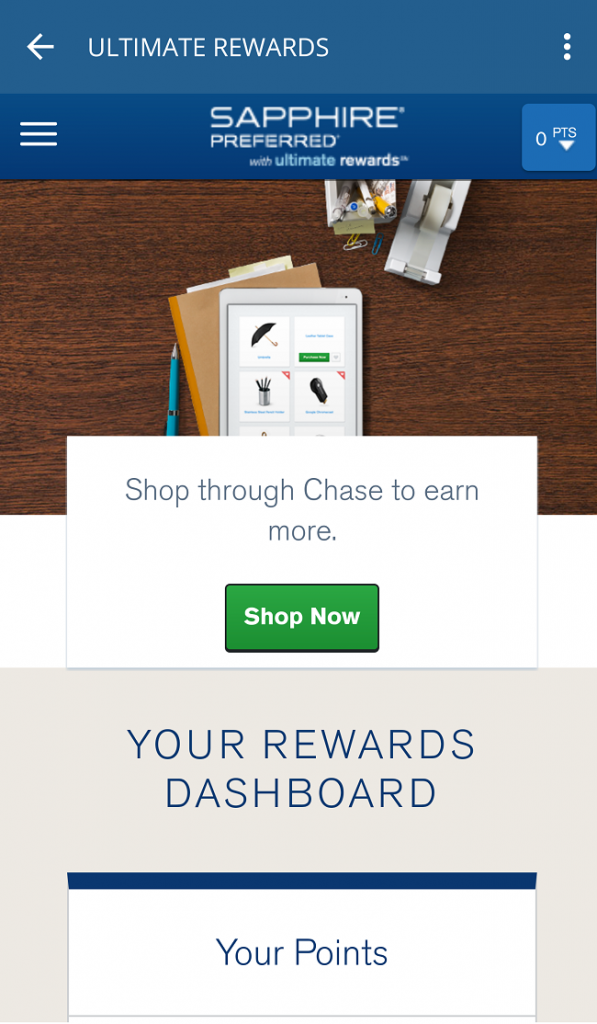

Chase Rewards Dashboard Feature Review: Easily Track Spending Categories

You will now be able to view your bonus spend on all your Chase UR-Earning Cards so much more conveniently with Chase’s new and improved Tracking platform. From the bountiful 5x rotating categories of the Chase Freedom to the Chase Ink Cash® Business Card, you’ll be able to easily track your rewards when you log into your Ultimate Rewards… [Continue Reading]

Citi Mistakes Offer Targeted Consumers 1K ThankYou Points

According to a few Citi Prestige cardholders on Reddit, Citi has been sending letters to certain customers, notifying them of a lower annual fee and a 15% relationship bonus. Unfortunately, they sent these letters to the wrong people. A spokesperson for Citi has apologized for the mistake and decided to provide these cardholders with 1,000 ThankYou… [Continue Reading]

AccountNow Gold Visa Prepaid Card Review

The AccountNow Gold Prepaid VISA Card is basically a debit card with a pricey monthly fee coming standard with online account access, online bill pay, free direct deposit, etc., on top of a 100% guaranteed approval upon successful ID verification; No Credit check, No ChexSystems check, And no existing bank account required. Now, be aware that… [Continue Reading]

Chevron and Texaco Techron Advantage Card Review

The Chevron/Texaco Advantage Credit Card from Synchrony Bank is a card designed specifically for those that fill up at Chevron or Texaco often. Your potential earning will be the same as the non-premium: 10 cents per gallon for the first 60 days of account opening. You will also be earning 3 cents a gallon in… [Continue Reading]

Chevron and Texaco Credit Card Review

The Chevron/Texaco Credit Card from Synchrony Bank could be an exceptional card for you if you commute very frequently. You will be earning 3 cents a gallon in fuel credits every time that you fill up with this card. On top of that, you will be earning 10 cents a gallon when you spend $300… [Continue Reading]

What Credit Bureau Does Discover Card Pull?

Discover Financial possesses the third largest brand credit card in the United States with some pretty interesting credit cards and a variety of perks and benefits rewarding their cardholders for their spend. Now, this makes it all the more necessary for us to evaluate Discover’s stance towards which credit bureau is pulled in regards to applying for a… [Continue Reading]

Indigo Platinum Mastercard Review *Expired*

With the Indigo Platinum Mastercard, you will be able to build yourself towards that higher credit score that you’ve been striving for. If you have less-than-stellar credit history then you can get pre-qualified today with no impact towards your credit score! With a Indigo, there’s no security deposit required and your account history will be reported… [Continue Reading]

Indigo Platinum Mastercard Review *Expired*

Sign up for the Indigo Platinum Mastercard and build that credit that your looking for. Before applying, you can get pre-qualified without any factors affecting your credit score so you can get a better idea of whether you are approved or not. Depending on how strong your credit is, they will match you with an annual… [Continue Reading]

Old Navy Store Credit Card Review

Get your hands on the Old Navy Credit Card is currently and take advantage of 15% off on your first purchase. Keep in mind that this is a card meant solely for Old Navy/Gap Inc.’s Family brands frequent shoppers considering that your rewards will be given to you in the form of Old Navy gift certificates. Now,… [Continue Reading]

Gap Store Credit Card Review

If you’re a frequent Gap Store shopper and you want to reap the benefits of discounts and further rewards then the Gap Store Credit Card may very well be a great option for you. You could get 15% off your first purchase with the card. Not only that but you will earn 5 points per $1… [Continue Reading]

What Credit Bureau Does CitiBank Card Pull?

CitiBank is a big contender in what we should call the “Big four” in regards to top leading banks which makes it a necessity to evaluate Citi’s current stance when it comes to what bureau to pull from: Experian, Equifax, or TransUnion. It’s also all the more detrimental that we evaluate any circumstances around the… [Continue Reading]

Banana Republic Store Credit Card Review

Good news for frequent Banana Republic shoppers. You can get your hands on the Banana Republic Store Credit Card and take 25% off your first online purchase of $75 or more or 15% off purchases below $75. On top of that, you will earn 5 points for every $1 spent at Old Navy, Gap, Banana Republic and Athleta and… [Continue Reading]

What Credit Bureau Does Chase Card Pull?

We will be further answering towards Chase’s standards in regards to what credit pull that will be imposed through the three major credit bureaus: Experian, Equifax, and TransUnion. Chase will pull your credit depending on your location so it’s all the more necessary to make a complete list correlating between the bureau pulled and the… [Continue Reading]

Wayfair Store Credit Card Review: $40 Off First Order of $250 or More

Get your hands on the Wayfair Credit Card from Comenity Bank and you could receive 18-Month Special Financing on orders over $600, now and through December 31, 2016. Now keep in mind that although this card is entitled as a “credit card,” it is perceived more as a store card considering that it only works for Wayfair,… [Continue Reading]

Avianca LifeMiles Credit Card Review: Ended Partnership with U.S. Bank

Coming soon! The new Avianca LifeMiles credit card is expected to launch within a few weeks which you can earn up to a 60,000 Avianca mile sign-up bonus after meeting spending requirements. The card offers 3X Avianca miles per $1 you spend on Avianca, 2X Avianca miles per $1 you spend at gas stations and… [Continue Reading]

- « Previous Page

- 1

- …

- 12

- 13

- 14

- 15

- 16

- 17

- Next Page »