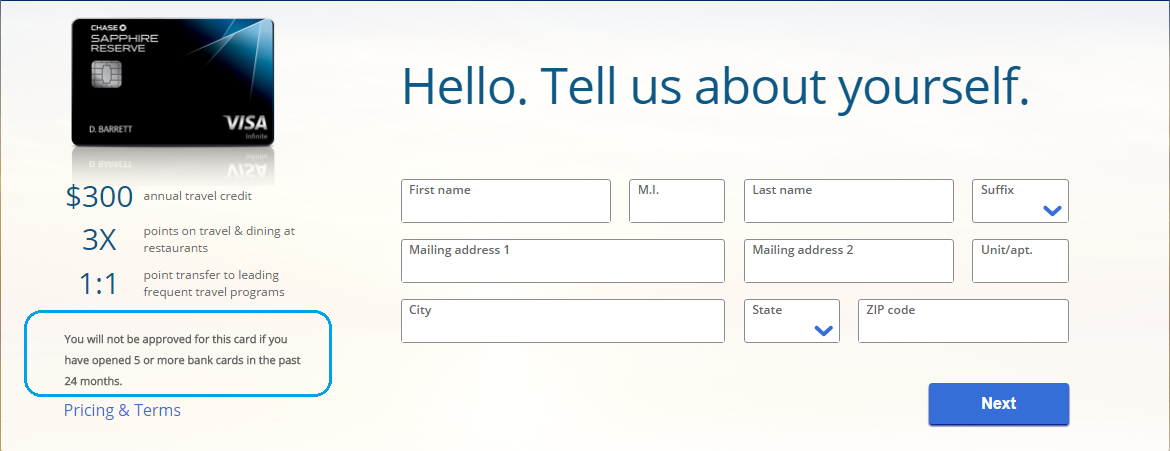

Chase has now official put in their terms and condition that the Chase Sapphire Reserve will abide by the 5/24 Rule and will determine whether you are approved or denied on the premise that you have had 5 or more new revolving credit accounts opened in the past 24 months. Of course, since this rule is a staple in most Chase products, it’s all the more necessary to make it clear as to why people got unknowingly denied for the card within the past few weeks.

Chase has now official put in their terms and condition that the Chase Sapphire Reserve will abide by the 5/24 Rule and will determine whether you are approved or denied on the premise that you have had 5 or more new revolving credit accounts opened in the past 24 months. Of course, since this rule is a staple in most Chase products, it’s all the more necessary to make it clear as to why people got unknowingly denied for the card within the past few weeks.

Editor’s Note: As we further know, this is new language for Chase cards and only appears on the Sapphire Reserve.

| BONUS LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up To $700 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

Avoiding the 5/24 Rule:

The two most effective methods to avoiding the 5/24 Rule seems to be In-Branch pre-approvals or being a Chase Private Client. I suggest that anyone looking to pursue the card attempt to get a In-branch pre-approval first and it will increase your chances of getting the pre-approval if you consult with a Reserve representative in-branch. Also, be sure to read our extended in-depth review on how to Bypass the 5/24 Rule for more information.

Conclusion:

As far as we know, this is new language regarding the 5/24 Rule and isn’t currently seen on any other Chase Issued Card except for the Chase Sapphire Reserve, but as of now, we should all be quite familiar with the Chase Sapphire Reserve and if you got denied for the CSR within the given past weeks, there could be a reasonable chance that you didn’t get approved on the premise of your status with the 5/24 Rule. Considering that they used the term “Bank Cards,” you can develop a firm understanding of this Rule without any misleading or condescending language. This will be further affirmation for people over 5/24 hoping to get approved online and I do hope they put this language in all their issued cards soon! As always, be sure to check out our complete list of Chase Card Promotions or Credit Card Promotions.

With the American Express® High Yield Savings Account: • Earn 1.90% APY as of 9/15/22 on your deposits. Your High Yield Savings account earns interest daily and is posted to your account monthly. • Links easily with your current bank accounts. No need to switch banks. • FDIC Insured. Your account is insured to at least $250,000 per depositor. • 24/7 Account Access |