Chase’s mobile app allows you utter convenience with the ability to check balances, pay bills, transfer money and deposit checks using Chase QuickDeposit at the comfort of your own home.

Chase QuickDeposit makes depositing checks faster and easier, saving you a trip to your local Chase bank branch or ATM. Keep reading to learn How to Use Chase QuickDeposit.

| BONUS LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up To $700 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

The Chase Mobile® App

The Chase Mobile® App is one of the best online banking apps on the market. Furthermore, Chase has integrated a bunch of wonderful features that virtually eliminates the need to visit a branch or ATM.

To start using the Chase Mobile® App, you will need a Chase Checking Account with Online Banking, savings account, or Chase Liquid® Card. If you do not have a checking account with Chase yet, view our full list of Chase Coupon Codes that can earn you a bonus along with an amazing banking experience.

Next you can download the Chase Mobile® App using the Apple, Google, and Android Store. Now you are can start using the the Chase Mobile® App for things such as finding a Branch or ATM, requesting a Stop Payment, Chase QuickPay for Money Transfers, or Chase QuickDeposit.

How to Set-Up Chase QuickDeposit

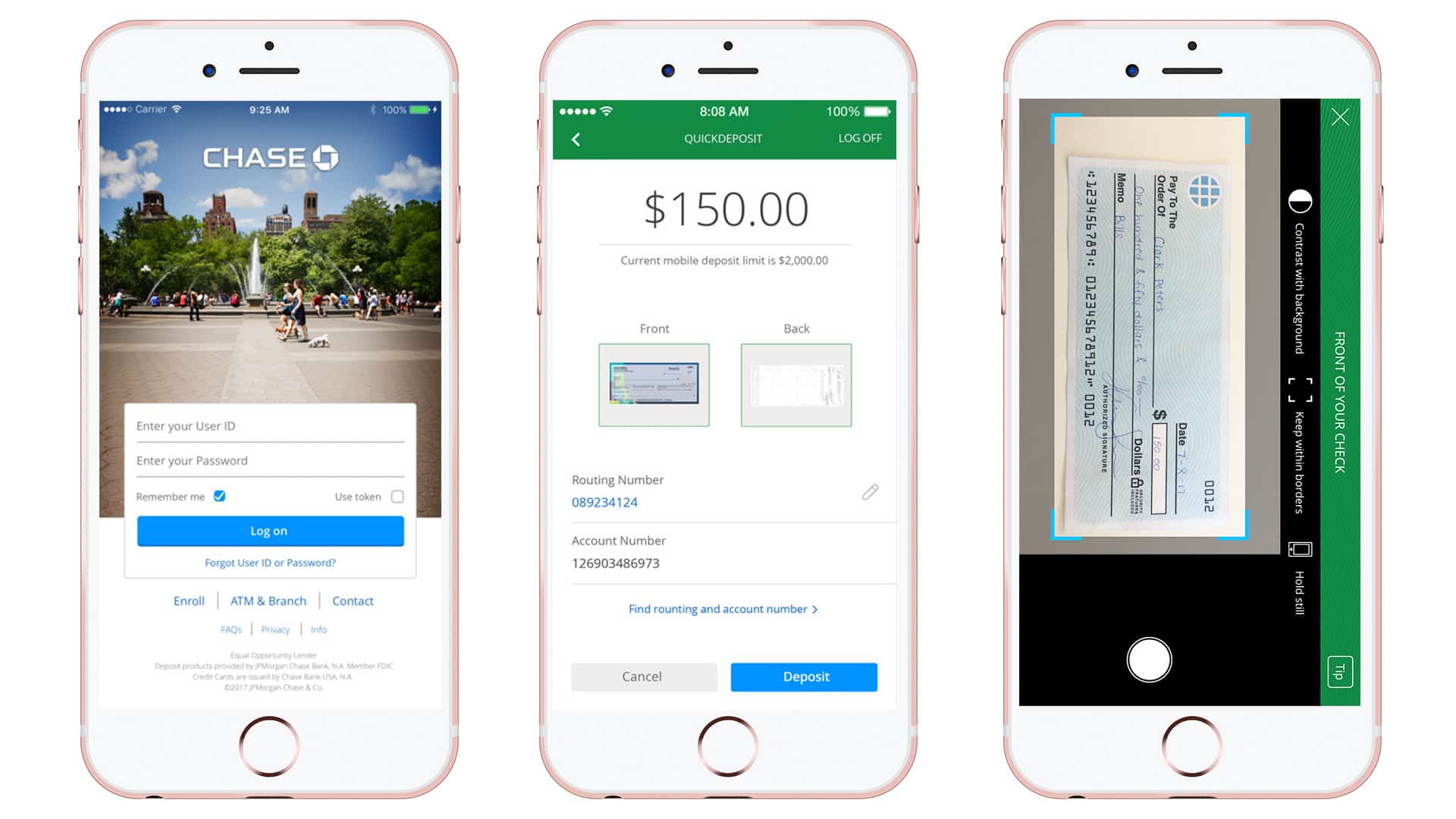

It takes only a few minutes or less to make a Mobile Quick Deposit. Be sure to follow these step-by-step guidelines if you’re having any trouble making a Chase Mobile Quick Deposit:

- Download the Chase Mobile App from either “The App Store” for IPhone users, or “Google Play” for Android users.

- Log onto the app with your Chase username and password.

- If you haven’t registered yet, you will have to go to Chase.com and do so.

- Print your signature on the back of the check. Write “For Deposit Only” underneath your name.

- Find the part of your check where it says “Do not write, stamp or sign below this line.” Try to keep your entire signature within the area above the line.

- Tap on the navigation menu at the top left of the main screen and choose “Deposit Checks.”

- You may be asked to review and accept Legal Agreements if it’s your first time using the app.

- Select the account that you wish to deposit your check to. ex. Chase Total Checking® or Chase SavingsSM.

How to Use Chase QuickDeposit

- Enter the dollar amount of your deposit (minus the dollar sign) and tap “Done” when you’re done.

- In the “Check Front” section, tap “Take Picture.” This allows access to your mobile device’s camera. You may receive a notification for this.

- Put the check on a flat surface and take a visible/clear picture of the check. make sure that it’s aligned with the template (blue box)

- Tap the camera icon to take the photo.

- Repeat step 8 to capture the back of your check

- Tap “Next.” You will proceed to a verification screen

- Review all the necessary information and tap “Submit” if all the information is correct.

Editor’s Note: Mobile deposit limitations can be applicable to you depending on your account type with Chase.

Chase Check Deposit Clear

Once you’ve made your mobile deposit, you’ll get an email notification from Chase regarding a confirmed receipt.

If you deposited the check prior to 11 p.m. EST on a business day, your funds will be available the next business day. I’ve never had this problem, but it’s recommended that you keep the paper check until you see your funds available in your account. You should be getting a second email from Chase when your check is accepted or not.

Chase QuickDeposit Limits

Mobile deposit limitations can be applicable to you depending on your account type with Chase. When you select the account you want to make your deposit to, your limit will appear below the amount field. Click on the note icon at the bottom if you want to find your maximum daily deposit and 30-day limit.

Conclusion

Making a Chase QuickDeposit is simple and perhaps the most efficient way for you to deposit your checks. To summarize, it eliminates almost every flaw associated with paper checks. Most important of all it saves you time and money.

Additionally, be sure to look at below Chase Coupons if you decide to open a new account. These Chase Coupons offer cash bonuses when you open a new checking or savings account.

The Best Bank Offers are updated here. See the below pages to get started with some of the best offers: • Chase Bank Offers. Chase offers a range of attractive Checking, Savings and Business Accounts. Chase has a great selection of sign-up bonuses in comparison to other big banks. • HSBC Bank Offers. HSBC Bank routinely has offers for several of their Personal Checking and Business Checking accounts. They also have a good referral program. • Huntington Bank Offers. Huntington Bank has high bonus amounts available through their Checking and Business Checking. Huntington also offers a Business Premier Money Market Account. • Discover Bank Offers. Discover Bank offers top cashback, savings, money market accounts and CD rates for you to take advantage of. Discover has industry leading selections to cater to your banking needs. • TD Bank Offers. TD Bank consistently offers a fantastic selection of checking accounts to cater to your banking needs. However, savings account offers are less frequently available. |