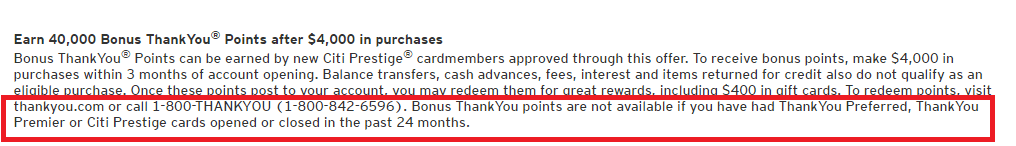

There’s going to be some changes regarding Citi’s churning policy on ThankYou points earned credit cards and it confirmed to be coming to Citi’s Co-branded cards as well. To summarize this rule; You can’t get the sign-up bonus on a new card if you’ve opened or closed a card within that brand within a given past 24 months.

There’s going to be some changes regarding Citi’s churning policy on ThankYou points earned credit cards and it confirmed to be coming to Citi’s Co-branded cards as well. To summarize this rule; You can’t get the sign-up bonus on a new card if you’ve opened or closed a card within that brand within a given past 24 months.

Prior to that, you could apply for the Citi Prestige and still apply for the Citi Premier two months after you’ve applied for the Citi Prestige. “Bonus ThankYou Points are not available if you have had Thank You Preferred, Thank You Premier, or Citi Prestige cards opened or closed in the past 24 months.”

Recommended Cards From Citi:

- Expedia®+ Voyager Card from Citi

- Expedia®+ Card from Citi

- Citi® Double Cash Card – 18 month BT offer

- Citi Hilton HHonors Visa Signature Card

- Citi® Hilton HHonors™ Reserve Card

| BONUS LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up To $700 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

The Previous Rule

For quite some time now, Citi didn’t have any published churning rules for credit cards (The Golden Age of Churning), but lets face it, Banks deem churners as invaluable, or unreliable customers. Some cards could be churned every few months while others couldn’t be churned, which eventually led to them instituting a 18 months rule. This 18 month rule has now been extended to a pretty strenuous 24 months.

Business Cards & Personal Cards

Restrictions will now treat business cards differently from personal cards. Keep in mind that you can get the sign-up bonus on a American Airlines Business Card if you haven’t had an open or closed American Airlines Business Card within the past 24 months. When you’ve acquired or closed a personal credit card doesn’t factor in.

Ways Around Citi’s Rule

Cancel Your Cards Strategically- Keep in mind that your 24 months will start as soon as you cancel your card. I can confirm that downgrading your card will also reset your 24 months, but you might be better off keeping a card opn for an additional year and paying the annual fee so that you can get the sign-up bonus on another card within the brand in a shorter term.

Keep good track of your 24 months. Time to time, Citi will offer quite generous retention offers and considering that their retention department just opened back up, these offers should be able to compensate you for your annual fees quite a bit.

When you think you’re in the clear, you can apply for a new card and have your 24 months reset within that brand and then cancel any other card you have within card you have within that brand, that you no longer have a need for of course. One considerable advice I have is to strategize which card is the best card from each brand since you’re limited to one card per brand, 24 months is a considerable amount of time, so you really do need to choose more shrewdly.

Also, keep in mind that Business Cards from Citi do retain more value than their personal cards. All business cards will be considered separate systematically from Citi’s personal cards. So, you can get a business card even if you’ve opened or closed a personal American Airlines within the last 24 months span. Example: If you’ve closed aCiti® / AAdvantage® Platinum Select® MasterCard®, you can open a CitiBusiness®/ AAdvantage® World MasterCard® as soon as you closed the Platinum Select Personal card.

Considering American Airlines, Citi’s co-branded partners, I’m quite sure that they would like to have the ability to target their consumers without this restriction, so it’s highly likely that we’ll be seeing targeted offers in the future.

Conclusion:

Currently, prominent card issuers are making things incredibly difficult for people to churn sign-up bonuses. It’s evident that Citi’s major changes will help to clean up people deemed as non-profiting customers. Of course, this is a big leap for Citi as they extend their 18 months Rule to 24 months but it’s nothing particularly new. These restrictions will no longer just apply for Citi Prestige, Citi Premier and Citi ThankYou Preferred cards but other branded cards as well.

Without a doubt, this rule isn’t as seemingly bad as American Express’s “Once per Lifetime,” or Chase’s 5/24 Rule, in which approval varies if you have 5+ cards within a given 24 months. Now, whether or not Citi decides to strictly enforce this policy really depends solely on them. Of course, this wouldn’t necessarily affect the average consumer. Find our complete list of Credit Card Promotions today!