Some things you want to keep in mind with a CitiMortgage is that they do offer a full range of home loan products, including low-down payment options and that they consider alternative credit, including rent and child support payment history. On top of that they also offers discounts for Citibank customers.

Some things you want to keep in mind with a CitiMortgage is that they do offer a full range of home loan products, including low-down payment options and that they consider alternative credit, including rent and child support payment history. On top of that they also offers discounts for Citibank customers.

A large percentage of Citi customers have a mortgage with Citi on the basis that they already have a banking relationship with grounds on Citi, making it all the more reasonable why they have a mortgage with them in the first place. Now, in this post, we will be going over the application process and what exactly it is that Citi provides you in terms of their mortgages.

| BONUS LINK | OFFER | REVIEW |

CitiMortgage In-depth Analysis:

CitiMortgage’s fixed-rate mortgage loans options include 10, 15, and 30 years. Also offering adjustable-rate mortgages ranging from 10/1 ARMs to 1/1 ARMs, in which rates are fixed for 10 years or one years.

Citi’s low down-payment morgage options go beyond FHA and VA loans with a HomeRun loan program that allows you to put down as little as 3% w/out requirements of having to pay private mortgage insurance. To qualify, you must be earning 80% or less than the median income in your area, however, in certain instances within low- to moderate-income areas, the program is available regardless of your income with loans going up to $417,000 and maybe pushing $625,000 in the more expensive areas. CitiMortgage’s minimum loan amount is $10,000 with the maximum reaching extremities of $8 million for WELL-qualified buyers who meet Citi’s high-net-worth requirements. Read more below for CitiMortgage’s Requirements.

CitiMortgage Summary:

- Apply Now

- Account Type: Mortgage Loans

- Availability: Nationwide

- Expiration Date: None

- Additional Advise: Have the necessary documents and validation information ready to make your process as smooth as possible.

CitiMortgage Basic Requirements:

Before getting into this section, it’s necessary to be mindful that Debt-to-Income ratio requirements do vary among products and programs. In most cases, 43% is the limit. For non-tranditional credit, a history of paying rent is considered. If you’re self-employed, you’ll have to provide information including federal tax returns from the past two years and current profit/loss marginal statements showing year-to-date revenue/expenses. Your property must be in good shape and completely finished. You’ll have to pay a $100 application fee and an origination fee varying among your residency location and loan type you plan to take out.

Income Documents:

- Pay Stubs covering the customer’s most recent two pay periods for each applicant.

- W-2 Forms for the previous two years.

- Two most recent years’ federal tax returns (e.g. for a loan in 2015, the customer need to submit the customer’s 2014 and 2013 federal tax returns). All the pages and all schedules.

- If the customer is self-employed, the two most recent years’ business tax returns are also needed.

- For self–employed or investment income, the two most recent years’ 1099’s and K-1 forms are also needed

- For self–employed business income,year-to-date profit and loss statement and balance sheet.

- For retired customers, copy of Social Security and/or Pension “award letters” detailing the amount of retirement income.

Asset Documents:

- Two most recent months’ bank statements. All of the pages.

Other Documents:

- Homeowner’s Insurance statement(s) for all properties owned showing the customer’s coverage and the annual premium.

- Mortgage statements for all properties owned that have liens.

- Copy of driver’s license or State I.D.card for all customers.

- If divorced, the customer’s fully executed divorce decree.

Conclusion:

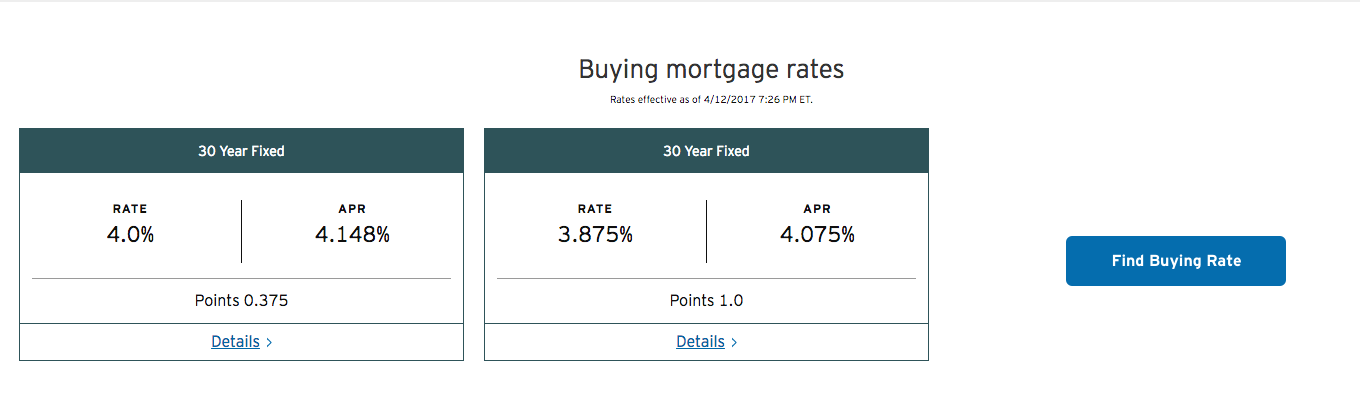

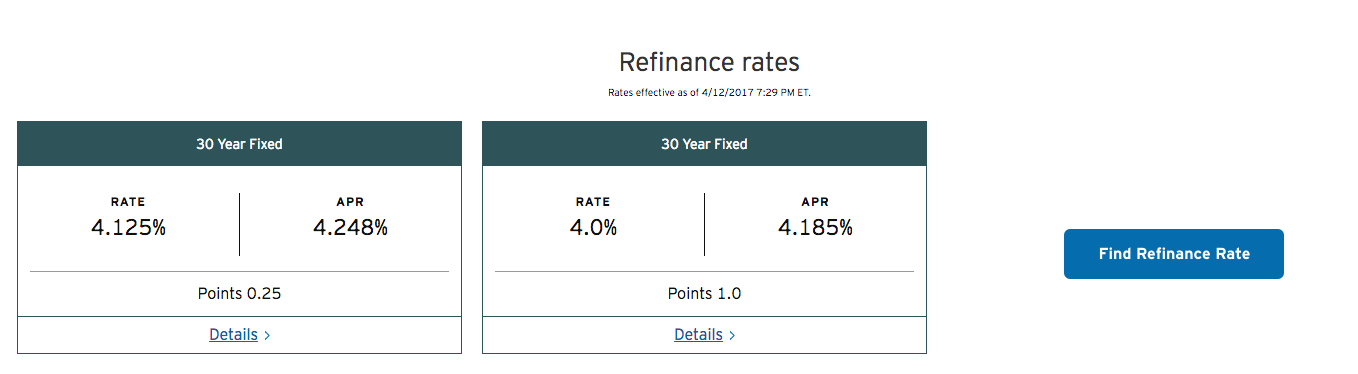

Most of CitiMortgage product holders are already relationship bankers with them, meaning that Citi may offer your quite the attractive relationship discount with consideration of your ability to pay your rent, credit score, relationship status with Citi, etc. Now, Citi’s Mortgage Rates are ‘eh’ to me, if you can find a better mortgage rate elsewhere, then, go for the better rate! It’s necessary to keep in mind that Citi also imposes a $100 application fee with variations of origination fees attached. Citi loan officers may be quite the hassle to deal with as well. Be sure to check out our Best Mortgage Rates for all your home-buying needs!

With the American Express® High Yield Savings Account: • Earn 1.90% APY as of 9/15/22 on your deposits. Your High Yield Savings account earns interest daily and is posted to your account monthly. • Links easily with your current bank accounts. No need to switch banks. • FDIC Insured. Your account is insured to at least $250,000 per depositor. • 24/7 Account Access |