When you look at your Travel Rewards card, moreover, Premium Travel Rewards Card’s benefits, most of the time, you’ll see a benefit attached called “Annual Travel Credit,” which generally, within each varying credit issuer has a different terminology towards what they consider eligible annual travel credit redemptions.

When you look at your Travel Rewards card, moreover, Premium Travel Rewards Card’s benefits, most of the time, you’ll see a benefit attached called “Annual Travel Credit,” which generally, within each varying credit issuer has a different terminology towards what they consider eligible annual travel credit redemptions.

More along the lines, this list will help you maximize such credit with regards to each card issuer and their various cards that offer annual travel credit. Note that travel credit is not cash, but there’s plenty of ways to use it; whether you want to lower your Annual Fee Cost, or use it for qualifying travel purchases, hopefully this guide will serve it’s purpose of guiding you towards better available options.

| BONUS LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up To $700 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

Platinum Card from American Express:

Platinum Card from American Express:

- $200 Airline Fee Credit + $200 Uber Credit

- Period: Calendar Year

- Annual Fee (Business): $450

- Annual Fee (Personal): $550

- Eligible Usage: Baggage fees, in-flight food and drink

- To use the credit, you need to select a qualifying airline.

Within ineligible usage, the credit does not cover airfare, upgrade fees, mile purchasing, and so on so forth. One option could very well be redemptions for gift cards from airlines; indirectly used for flight tickets. Note that if you’re planing to redeem for GC, there’s steps involved and limitations for tickets, so it can prove to be a hassle for quite a sum of you.

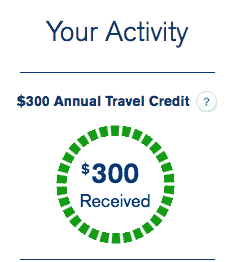

Chase Sapphire Reserve VISA Infinite Card:

Chase Sapphire Reserve VISA Infinite Card:

- $300 Travel Credit

- Period: Calendar Year

- Annual Fee: $450

- Eligible Usage: All Travel Purchases!

- Credit is automatically applicable

The Annual Travel Credit can be triggered with merchants in the travel category including airlines, hotels, motels, timeshares, campgrounds, car rental agencies, cruise lines, travel agencies, discount travel sites, and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages. Summing it up, it’s overall any travel-related purchase should count towards the annual credit.

Citi Thank You Prestige:

Citi Thank You Prestige:

- $250 Airfare Credit

- Period: Calendar Year

- Annual Fee: $450

- Eligible Usage: Airfare, baggage fees, in-flight purchases, lounge access.

- Credit is automatically applicable

Citi Prestige’s Airfare Credit is easily versatile and can be used for airfare making it a tremendous value (over AMEX).

Ritz-Carlton Rewards Credit Card:

- $300 Travel Credit

- Period: Calendar Year

- Annual Fee: $450

- Eligible Usage: Seat upgrades, baggage fees, in-flight entertainment, in-flight meals preferred lounge memberships or passes

- You need to call in (J.P. Morgan Priority Services) after using the card for an eligible purchase. (Call in within 4 billing cycles of making your purchase)

Eligible usage only applies to incidental credit only. This should include airline lounge day passes, yearly lounge membership, airline seat upgrades, baggage, in-flight Internet/entertainment and in-flight meal.

U.S. Bank Altitude Reserve:

- $325 Credit

- Period: Cardmember year

- Resets with regards to when you applied for the card and got approved.

- Annual Fee: $400

- Eligible Usage: Airlines, hotels, car rental companies, taxis, limousines, passenger trains and cruise lines

- Credit is automatically applicable

Definitely some general terminology that makes the credit so versatile, and therefore lucrative. The credit is easy to use, however, you may want to make your minimum spendings ORGANICALLY, considering the Altitude has been reportedly famous for shutting down accounts on premise of manufactured spending.

Bank of America Premium Rewards:

- $100 Travel Credit

- Period: Calendar Year

- Annual Fee: $95

- Eligible Usage: Qualifying transactions are those purchases made on domestic-originated flights on U.S.-domestic airline carriers that include: preferred seating upgrades, ticket change/cancellation fees, checked baggage fees, in-flight entertainment, on-board food and beverage charges, and airport lounge fees affiliated with eligible airline carriers.

- Credit is automatically applicable

Some things to note, Bank of America’s travel credit is not eligible for airfare and is considerably restrictive to domestic originated flights WITH domestic carriers. However, considering that the card has a plausibly affordable annual fee of $95, the credit shouldn’t be demeaned in any way.

American Express Premier Rewards Gold Card:

American Express Premier Rewards Gold Card:

- $100 Airline Fee Credit

- Period: Calendar Year

- Annual Fee: $195

- Eligible Usage: Baggage fees, in-flight food and drinks

- To use the credit, you need to select a qualifying airline.

The credit holds the same value as the Platinum Card with the exception that the card’s annual fee is $195, WAIVED for the first year.

Conclusion:

The distinctions between each annual travel credit issued by varying credit issuers is as clear as day; with some being more flexible and more lucrative than other. At the end of the day, my top pick for annual travel credit will always be either the Chase Sapphire Reserve or the Citi Prestige Card on the sole premise that they offer credit applicable towards airfare travel and automatic credit applies as well. Sadly, the Chase Sapphire Reserve switched from cardmember year to calendar year, in terms of period, not too long ago; however, the card still fends as the most lucrative travel credit to surface the credit card industry nonetheless. Be sure to also take a gander at our compiled list of Credit Card Promotions.