Getting a credit limit increase is an all-around positive,as in, you’ll be able to further boost your buying power with the additive benefit that you’re also lowering your credit utilization. However, there will always be an impending right or wrong time to request a credit limit increase.

Getting a credit limit increase is an all-around positive,as in, you’ll be able to further boost your buying power with the additive benefit that you’re also lowering your credit utilization. However, there will always be an impending right or wrong time to request a credit limit increase.

Timing is essential, and surprisingly enough, the best time to ask for new credit is when you don’t necessarily need it. This is when you’ve attained a viable credit score, you’ve recently gotten a raise, and your payment history is consistent. You’ll have better chances if your account has been open for six months to a year. In this post, we’ll be going over which credit card issuer imposes hard pulls or soft pulls pertaining to credit limit increases.

| BONUS LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up To $700 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

Credit Card Companies Credit Limit Increases:

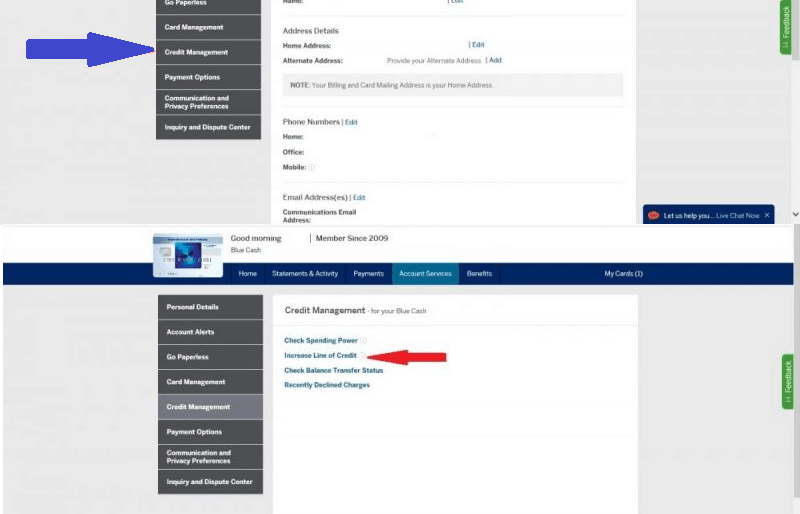

American Express

- American Express doesn’t do hard pull for credit limit increases. Relatively easy to get a high credit limit increase from American Express. For more information, be sure to check out the American Express Card Promotion. Under “Things You May Not Know…” there’s tons of info that could be surprisingly beneficial for you.

- Requesting a Credit Line Increase from American Express

- Start by logging into your American Express account

- Hover over to “account services” and click on “Credit Management“

- From there, click on “Increase Line of Credit”.

Bank of America

- Expect a hardpull from Bank of America for all credit limit increases. Typically, they’ll do a hard pull via TransUnion for current card members; hardpull via Experian for new applications. Bank of America has reportedly given out automatic credit limit increases without a hard pull attached. This is assuming that you are at a 12 month’s card membership with them.

- Reallocations via call ins been reportedly getting soft pulled, however YMMV.

Barclaycard

- Expect a hard pull from Barclaycard for an initiated credit limit increase. On another note, they do stay on top of giving automatic credit increases at a card membership 6-12 month’s mark.

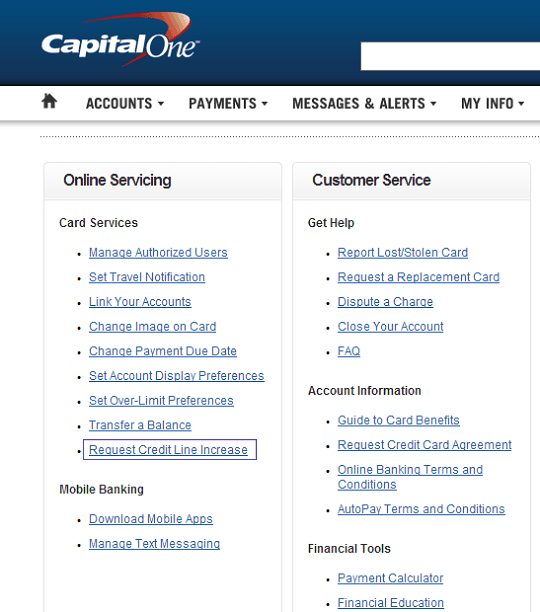

Capital One

- Capital One allows you to request a credit limit increase once every 6 months with your selection of Capital One cards at an attached soft pull reported.

- All you have to do is log into your Capital One account and go to “Card Services” and click on “Request Credit Line Increase.”

- Some accounts aren’t eligible for increased credit lines upon request. Accounts that are usually ineligible:

- Are less than three months old.

- Are secured credit cards.

- Have received a credit line increase or decrease in the last six months.

- Even if your account does not meet either of these criteria, a credit line increase may still be declined for other reasons.

- Capital One cardholders reportedly have a hard time getting a credit limit increase from requesting online alone. If so, be sure to contact Capital One’s executive office ([email protected]). You should include why you deserve a credit line increase. Try to push the boundary a little and urge cancellation of a current credit card if you don’t receive a CLI.

Chase

- Chase is one of the easier credit card companies to get a credit limit increase from, however, expect a hard pull with an initiated credit limit increase.

- You can call:

- Chase credit analyst (888-245-0625).

Citi Credit Cards

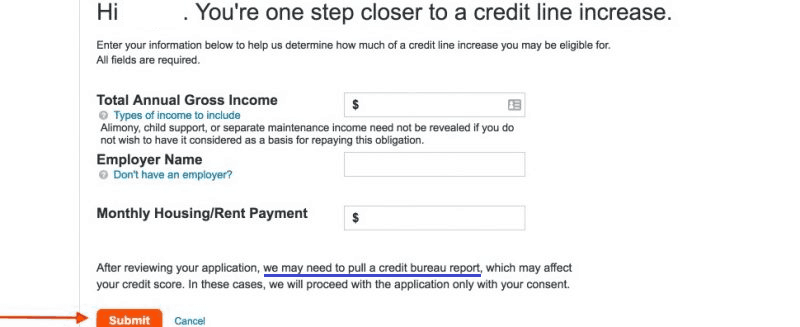

- Here’s what you should expect with Citi: They do both soft and hard pulls. Typically when they come back with an instant decision, a soft pull was laid out; if it takes some time, a hard pull will be performed. Citi online or a customer service rep should be able to tell you if you will be getting a soft or hard pull in the process. You can also request an increase via the Citi App and they’ll tell you if it’s going to be a hard or soft pull.

Discover Card

- Log into your Discover account

- Click on “Manage”

- Hover over until you see “Credit Line Increase”

Getting a hard pull or soft pull from Discover typically depends on how large of a credit limit increase you want. Smaller increases will be done with no attached soft pull.

US Bank

- You should now expect a soft pull via initiated credit line increase with U.S. Bank. Use their online request form or call them at (1-866-659-6801)

Wells Fargo

- Wells Fargo typically does soft pulls. I recommend contacting a customer service rep prior, to fully ensure whether you’re getting an attached soft or hard pull.

Conclusion:

When it comes to Credit Limit Increases, timing is detrimental. Before requesting for an increase, I recommend that you have your credit score aligned, your payment history backed and have a bit of history with the credit card company prior (6-12 months minimum). When you’re requesting a credit limit increase, you should already be expecting the benefit of doubt and assume you’ll be getting a hard pull. Most credit card issuers will tell you whether you’re getting a soft or hard pull attached to your increase; whether it be card representatives or via online. Don’t forget to check out our full list of Credit Card Bonuses if you’re not interested at the moment.