A lot of credit cards nowadays offer extended warranty protection. This means that if you new laptop, camera, or phone break and it’s past the 90 day warranty, the card may be able to reimburse you when the manufacturers don’t! People will often pay for a warranty extension when purchasing electronics and appliances, they probably don’t realize that such coverage comes free on many credit cards!

A lot of credit cards nowadays offer extended warranty protection. This means that if you new laptop, camera, or phone break and it’s past the 90 day warranty, the card may be able to reimburse you when the manufacturers don’t! People will often pay for a warranty extension when purchasing electronics and appliances, they probably don’t realize that such coverage comes free on many credit cards!

Many of these popular card issuers will grant one to two years of extra warranty protection. These have coverage of up to $10,000 per year! The benefit is offered by big name issuers like Amex, Chase, and Citi. However, the details of each plan is specified by each issuer.

These protection benefits don’t require any registration so when something goes wrong, simply file a claim, send all documentation, and the bank will either pay for a repair, send you a new one, or reimburse you for the original purchase price.

Keep in mind that this protection benefit only kicks in if there’s a manufacturer warranty plan. If the product does not come with one, the bank will not help.

If you didn’t know, there are even more benefits that you can acquire from your credit card! Be sure to check out our posts on Annual Fee Refund Policies, Price Protection Policies, Purchase Protection Policies, Return Protection Benefit.

General Details

These are details that generally come with all banks and issuers.

- Max $10,000 per claim. There’s often a $50,000 cap per year or for the lifetime of the card account.

- Only applies to items purchased in USA and territories.

- Coverage applies even if only part of the purchase was paid for with your card; however, coverage will not exceed the amount charged to the card (e.g. if you paid $50 with a gift card and the remaining $200 with a credit card, you’ll be covered up to $200, not the full $250).

- Sales tax is refunded.

- Shipping, installation, or handling costs will not be covered.

- Purchases paid for with points are eligible as well (Amex Membership Rewards, Chase Ultimate Rewards, or Citi ThankYou points).

- Must have copy of receipt and the original manufacturers warranty copy.

Common Exclusions

Here is a small list of common exclusions:

- animals

- live plants

- consumables/perishables like food

- perfume

- light bulbs

- batteries

- cars

- boats

- items purchased for resale or commercial use

- services

- cash equivalents like gift cards

- tickets

- books

- magazines

- jewelry

- seasonal items

- used item

- medical equipment

- computer software

Keep in mind that these lists vary per card issuer/bank. Be sure to look into the details of what’s covered and what’s not.

Refurbished Items

Used items are not covered, even when sold by the manufacturer, with a warranty. Manufacturer refurbished items will probably be covered if they come with a manufacturer warranty.

American Express

All Amex credit and charge card have an Extended Warranty Protection benefit, personal card and small business cards alike, which doubles the manufacturers warranty up to 24-months.

Keep in mind that American Express only doubles the manufacturers original warranty – it’s not always a full year or two. Most manufacturer’s warranties are 90 days or 1 year, and Amex will only match that, not more. They only double the manufacturer warranty (whether free or purchased), but not secondary/supplementary warranty purchased from an outside company.

Sample:

- Manufacturer offers 90-day warranty – get an extra 90 days from Amex

- Manufacturer offers 1-year warranty – get an extra year from Amex

- Manufacturer offers 18 month warranty – get an extra 18 months from Amex

- Manufacturer offers 2 year warranty – get an extra two years from Amex

- Manufacturer offers 5-year warranty – get an extra two years from Amex

- Manufacturer offers 6-year warranty – no benefit

- Manufacturer offers 90 day warranty and you bought an extra year on a service plan from a third-party provider – get an extra 90 days of protection from Amex

How To File a Claim

- Click here

- Click Enter Claims Center now

- File your Claim

If you wish to talk to a human, call 1-800-225-3750 to speak with a representative.

Chase

Most cards come with one year extended warranty protection. This is better than American Express, because they’ll add an additional year after the original manufacturers warranty – not double it.

Sample:

- Manufacturer offers 90-day warranty – get an extra year from Chase

- Manufacturer offers 3-year warranty – get an extra year from Chase

- Manufacturer offers 4-year warranty – no benefit

How To File a Claim

- Click here

- File a claim

To speak with a human, call 1-888-320-9961 to speak with a representative.

Citi

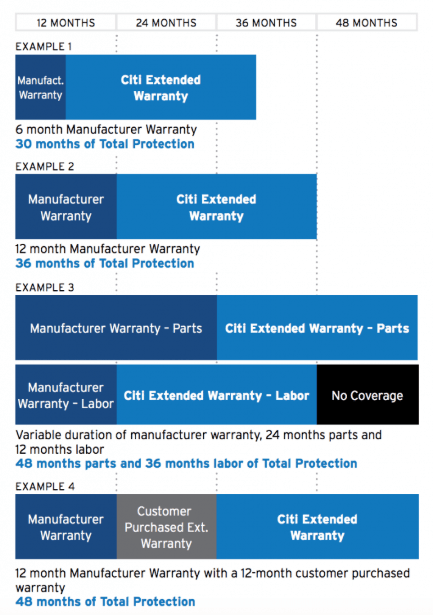

Citi has by far the best extended warranty protection. Most card come with a 24 month extended warranty protection plan regardless of how long the manufacturers original warranty comes with.

Sample:

- Manufacturer offers 90-day warranty – get an extra 2-years from Citi

- Manufacturer offers 2-year warranty – get an extra 2-years from Citi

- Manufacturer offers 5-year warranty – get an extra 2-years from Citi

- Manufacturer offers 6-year warranty – get 1-year from Citi (coverage never goes past 84 months)

- Manufacturer offers a 1-year warranty and you bought an extra 1-year service plan from a third-party provider – get an extra two years from Citi (year 3 and 4)

How To File a Claim

- Click here

- File your claim

To speak with a human, call 1-866-918-4670 to speak with a representative.

Discover

Unfortunately, Discover no longer offers this benefit.

Mastercard Benefits

Mastercard offers an extended warranty benefit for up to 1 year (link). If the manufacturer’s warranty is more than 3 years, no extended warranty is offered. Keep in mind that not all Mastercard’s necessarily have this benefit it all, and the details may vary a bit by the card or bank issuer. All World or World Elite Mastercards have the benefit.

Sample:

- Manufacturer offers 90-day warranty – get an extra 90 days from Mastercard

- Manufacturer offers 1-year warranty – get an extra year from Mastercard

- Manufacturer offers 3-year warranty – get an extra year from Mastercard

- Manufacturer offers 4-year warranty – no benefit

- Manufacturer offers a 1-year warranty and you bought an extra 1-year service plan from a third-party provider – get an extra year from Mastercard world (year 3 and 4)

How To File a Claim

- Click here

- File a claim

If you wish to speak to a human, call 1-800-MasterCard to speak with a representative.

Visa Signature

This issuer will double the manufacturers original warranty up to one year. If the manufacturer’s warranty is more than three years, no extended warranty is offered.

Sample:

- Manufacturer offers 90-day warranty – get an extra 90 days from Visa Signature

- Manufacturer offers 1-year warranty – get an extra 1-year from Visa Signature

- Manufacturer offers 2-year warranty – get an extra 1-years from Visa Signature

- Manufacturer offers 4-year warranty – no benefit

- Manufacturer offers a 1-year warranty and you bought an extra 1-year service plan from a third-party provider – get an extra year from Visa Signature (year 3)

Basic Visa cards do not have any Extended Warranty benefit, unless the bank decides to offer it on their own.

How To File a Claim

- Click here

- File a claim

If you wish to speak to a human, call 1-800-551-8472 to speak with a representative.

Other Banks

Bank of America

Bank of America extended warranty runs with standard Visa and Mastercard benefits with 1 year additional assuming a manufacturer warranty of 3 years or less. As noted, these depend on the card, and some cards may not have the benefit at all.

Barclays

Barclay’s extended warranty runs with standard Visa and Mastercard benefits with 1 year additional assuming a manufacturer warranty of 3 years or less. As noted, these depend on the card, and some cards may not have the benefit at all.

Capital One

Capital One extended warranty runs with standard Visa and Mastercard benefits with 1 year additional assuming a manufacturer warranty of 3 years or less. As noted, these depend on the card, and some cards may not have the benefit at all.

U.S. Bank

U.S. Bank extended warranty runs with standard Visa and Mastercard benefits with 1 year additional assuming a manufacturer warranty of 3 years or less. As noted, these depend on the card, and some cards may not have the benefit at all.

Wells Fargo

Wells Fargo extended warranty runs with standard Visa and Mastercard benefits with 1 year additional assuming a manufacturer warranty of 3 years or less. As noted, these depend on the card, and some cards may not have the benefit at all.

Conclusion

Instead of purchasing the extended warranty that the manufacturer offers, be sure to take advantage of your extended warranty protection!

Out of all the issuers, Citi Bank is the clear winner. They offer a two year extension on all warranties – even on a 90 days to one year warranty. While Amex recently enhanced their benefit to two years, it only helps on a 2-year warranty, not on a one-year warranty.

Be sure to take advantage of this benefit whenever you can to save yourself extra money!

The Chase Freedom Unlimited® Card offers a $250 bonus after spending $500 on purchases in your first 3 months from account opening. Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR. In addition, you can earn: • 6.5% cash back on travel purchased through Chase TravelSM, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase TravelSM, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases. There is no minimum to redeem for cash back & your cash back rewards do not expire as long as your account is open. This card comes with no annual fee and you'll get a free credit score that is updated weekly with Credit JourneySM. Member FDIC |