It’s about that time, as we’re approaching 2018, it’s a complete necessity that we lay out some of the Best Annual Airline/Travel Credits on credit cards that we may or may not have, just so that we can have a game plan towards using all of the credits and arise towards any newer credit card applications in a timely manner within accordance to the airline credit’s calendar schedule.

The cards we’ll be discussing within this post are a majority of premium annual fee cards from the Chase Sapphire Reserve, Platinum Card® from American Express, and Ritz-Carlton Rewards VISA Infinite to the Bank of America Premium Rewards and so much more. Whether you’re looking for airlines, or flexibility with your travel, we got it here at BankCheckingSavings!

| BONUS LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up To $700 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

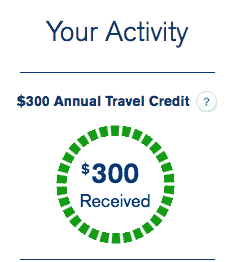

One of the most unrivaled benefits that the Chase Sapphire Reserve inhibits is the $300 travel credit, which used to be based on a calendar year, however, within May, Chase put the travel credit under some new renditions towards being per cardmember year. Standard CSR sign-up bonus is currently at 50,000 points, however, within speculation, we’re highly unsure if there will be any bonus higher than that coming soon, but I still recommend that you hold it out until a more attractive offer comes along.

So if you’re applying for a new Chase Sapphire Reserve card, just note that there’s no particularly special reason to apply prior to the end of the year. You will only be able to get one travel credit during your first year and maybe if you’re meticulous as ever, you can double-dip a second credit in after the year renews. You can then do as you choose: cancel or downgrade the card to save yourself from the impending annual fees.

Current and existing Chase Sapphire Reserve cardholders, depending on when you applied, you may either be on a calendar year or cardmember year schedule. If you applied prior to May 21, you’ll be getting ahold of a calendar schedule. If either one is the case, you should still be using up your 2017 credit as the 2018 credit comes along.

Editor’s Note: Remember that if you’re on a calendar year’s basis, your December statement will be closing soon; perhaps even as early as December 1, depending on when you applied. Give the charges some extra days to go from pending to sitting.

Whether you have a Platinum Card®, Business Platinum Card®, or Premier Rewards Gold Card from American Express, you should expect an airline incidental credit each year: for the Platinum card(s), you’ll receive $200 annually and $100 annually if you have a Premier Rewards Gold card.

Airline credit will be based on calendar year. The airline incident charges can be made anytime prior to December 31 for 2017 or whatever year is current. Again, give the charges enough time to go from pending to sitting. If you’re interested in applying for one of these cards, you will still have enough available time to get 2017 credits issued.

The Ritz-Carlton Rewards VISA Infinite Credit Card earns you $300 towards airline incident charges including airline lounge day passes, yearly lounge membership, airline seat upgrades, baggage, in-flight Internet/entertainment and in-flight meal. You’ll also be getting $100 Hotel Credits & a $100 multi-passengar ticket benefit.

The benefits will be based on calendar year instead of cardmember year, so it’ll run depending on when you applied for the Ritz-Carlton. Be sure to use up all remaining credit prior to December 31 so you can begin using your 2018 credit that starts on January 1.

Your Citi Prestige Card earns you $250 in airline credit. Credit will be up for eligible usage within airfare, baggage fees, in-flight purchases, lounge access. Since Citi goes by calendar year, you should keep an eye on your December statement closing date.

Give it a few days for the charge to go from pending to sitting and if you already have a Prestige card, be sure to use up all of your 2017 credit as soon as possible. You’ll only have a few weeks left until your December statement closes and if you’re looking to apply for the Citi Prestige, do it before the December statement closes to get 2017 credits.

The U.S. Bank Altitude Reserve VISA Infinite gives you $325 annual travel credit based on a cardmember year. Eligible usage is on airlines, hotels, car rental companies, taxis, limousines, passenger trains and cruise lines; credit automatically applicable.

The U.S. Bank Altitude Reserve VISA Infinite gives you $325 annual travel credit based on a cardmember year. Eligible usage is on airlines, hotels, car rental companies, taxis, limousines, passenger trains and cruise lines; credit automatically applicable.

If you have the Altitude Reserve card, you should reap all of this year’s credit and look forward to the next year. If you’re looking to apply, there’s still plenty of leeway within the time-span for this card, so there shouldn’t be any urgent reason to apply for the card asap. A good sum of y’all applied for the card when it launched (May, 2017), so you’ll still have until May of 2018 to use up all of your first year credits.

The Bank of America Premium Rewards Credit Card released not too long ago with a $100 airline incidental credit attached with eligible usage including: preferred seating upgrades, ticket change/cancellation fees, checked baggage fees, in-flight entertainment, on-board food and beverage charges, and airport lounge fees affiliated with eligible airline carriers.

Since the card is on a calendar year basis, you will have until December 31 to properly use the airline incidental credits. There’s also a possibility that they’ll finish your calendar year based on when your December statement closes, so finish up your credit as soon as possible so you can start using your new credit on January 1.

Some things to note, Bank of America’s travel credit is not eligible for airfare and is considerably restrictive to domestic originated flights WITH domestic carriers. If I had this card in hand, I would buy gift cards at the beginning of January.

Conclusion:

Travel or Annual Credit is quite a nifty thing to receive and as we’re dialing it up to 2018, any existing cardholders should already be using up all of their 2017 credit and looking forward to 2018 credits to come through. Note that each credit card issuer varies with their terminology or eligible usage for credits. Be sure to take a look at our full list of Credit Card Annual Travel Credits Review if you need help with redeeming your travel/annual credit. and as always, be sure to check out our complete list of Credit Card Promotions today!