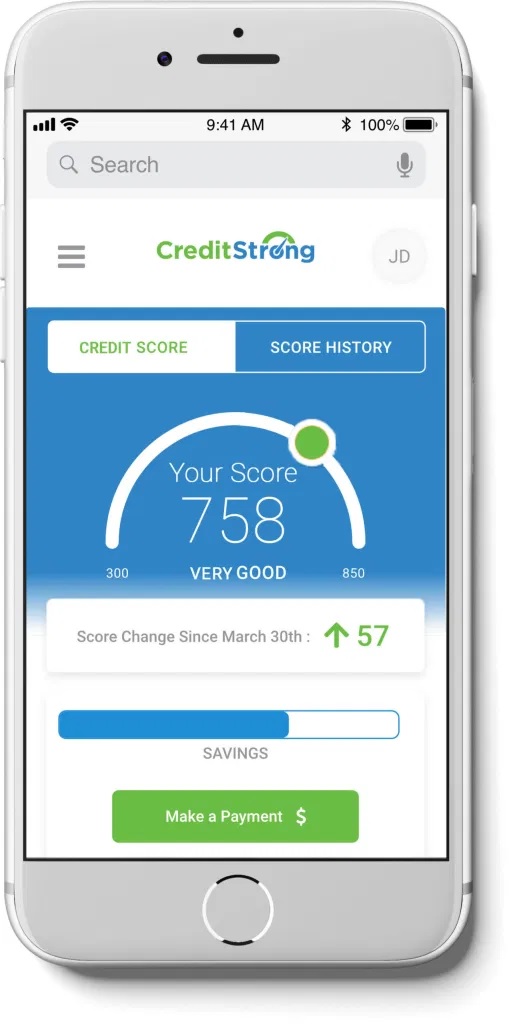

Credit Strong comes with credit builder loans, a viable option for people with poor credit history or no credit history at all. The company will give a special way for you to better your credit score and rack up your savings as well.

Credit Strong comes with credit builder loans, a viable option for people with poor credit history or no credit history at all. The company will give a special way for you to better your credit score and rack up your savings as well.

Compare it with Self.inc for credit builder accounts.

Read below for more information on what their current products are.

Credit Strong Features

Credit Strong is a division of Austin Capital Bank. They’re designed to help people that are in a bad credit cycle. The company also offers some of the longest and largest credit builder loans available on the market:

- Loan Term: 12 to 120 months

- Loan Amount: Up to $18,000

With this in mind, you also don’t have to pay an upfront deposit. You’ll have some savings when you finish making payments, and you can cancel at any time without penalty. Additionally, Credit Strong also gives your monthly FICO Score with no additional fee, so you can accurately track your progress.

(Visit for more information)

How Does Credit Strong Work?

Credit Strong comes with a variety of different products, each prioritizing one of the following:

- Lowest monthly payment

- Build savings while building credit

- Build credit for a future large loan

You’ll be able to pick your loan type based on what you’re trying to achieve, and the funding you have available. Then, apply for a Credit Strong account and there’s no hard credit check needed, the application is fast and simple.

While you make your monthly payments to Credit Strong, the company will report your payments to all 3 credit bureaus. With on-time payments, it will increase your credit score significantly. Otherwise, your credit score will take some damage.

Credit Strong gets a portion of an FDIC-insured account held at Austin Capital Bank with every payment. After you repay the loan in full, you’ll unlock the savings. If you don’t think you’ll be able to make your monthly payment, you’ll be able to cancel it with no penalty.

Credit Strong Pricing & Fees

With Credit Strong, they offer 3 different types of plans, one for each loan product.

Subscribe loans are made for people that want to build credit, but they don’t have a lot of free capital. Most likely, these people will prioritize the lowest monthly payment possible. There’s a perfect way for you to build your credit and your savings without having to make a big commitment.

| Subscribe 1000 | Subscribe 2500 |

| $1,000 installment account | $2,500 installment account |

| 120-month term | 120-month term |

| $15/month | $30/month |

Build & Save loans target those who want to improve their credit score and increase their savings.

| Build & Save 1000 | Build & Save 2000 |

| $1,000 installment account | $2,000 installment account |

| 24-month term | 12-month term | 24-month term |

| $48/month | $89/month | $96/month |

Magnum loans are meant for people that want to build a large credit line, perfect if you want to secure business financing or a large personal loan in the future.

| Magnum 4500 | Magnum 9000 | Magnum 1800 |

| $4,500 installment account |

$9,000 installment account |

$18,000 installment account |

| 120-month term | 120-month term | 120-month term |

| $49.50/month | $99/month | $198/month |

Credit Strong charges an administrative fee, which is around $8.95 or $25.00 depending on your loan of choice.

The thing to look out for with all credit builder loans, is your loan interest rate. Be sure that you do loan interest calculations before you apply. A credit builder loan will cost you thousands of dollars in interest. However, it can be worth it if you have bad credit or need help reaching your financial goals.

Credit Strong Eligibility Requirements

In order to open a Credit Strong account, you’ll need:

- To be a U.S. citizen or permanent resident.

- To be at least 18 years old.

- A valid Social Security Number or Individual Taxpayer Identification Number.

- A mobile phone number and email address.

- A bank account, prepaid card or debit card.

There is no minimum income required.

|

|

Conclusion

Credit Strong offers great options if you’re looking to make or rebuild your credit score. Their flexible plans and the ability to cancel with no additional penalties is great. Be sure to carefully consider which option is best suited for you before you pay for any services.