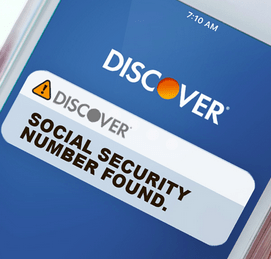

Discover cardholders, Discover Bank recently introduced their new Free Alert Services that include Social Security Number Alerts and New Account Alerts. Essentially, they’ll notify you if they find that your Social Security number may be on a risky website or if any new credit cards, mortgages, car loans or other accounts are opened on your Experian credit report. These alerts help protect your identity, however it’s worth noting that this is not complete identity protection, which usually costs $10+ a month.

Discover cardholders, Discover Bank recently introduced their new Free Alert Services that include Social Security Number Alerts and New Account Alerts. Essentially, they’ll notify you if they find that your Social Security number may be on a risky website or if any new credit cards, mortgages, car loans or other accounts are opened on your Experian credit report. These alerts help protect your identity, however it’s worth noting that this is not complete identity protection, which usually costs $10+ a month.

Editor’s Note: Discover It CashBack Match Card offers double cash back the first year. You’ll get 5% cash back in categories that change each quarter and 1% cash back on all other purchases. Be sure to also check out our full detailed list of Discover Bank Promotions!

| BONUS LINK | OFFER | REVIEW |

| Discover® Bank Online Savings terms apply | $150/$200 bonus + 3.70% APY | Review |

| Discover® Bank CD | Up to 4.00% APY | Review |

| Discover® Bank Money Market | Up to 3.65% APY | Review |

| Discover® Bank IRA CD | Up to 4.00% APY | Review |

| Discover® Checking | $360 Cash Back | Review |

Discover Free Account Monitoring Services Summary:

- New: Free Social Security Alert Services and Account Alerts available to Discover cardholders (e.g. Discover It CashBack Match Card )

- These alerts are one way to help you protect yourself from identity fraud

- Discover monitors a vast number of risky websites on the dark web – a hidden area of the Internet where stolen social security numbers can be traded or sold for the purposes of identity theft and fraud.

- Discover also monitors your Experian® credit report and notify you whenever any new credit account is reported to your Experian® credit file, even if it’s not a Discover account.

Discover Free Account Monitoring Services Features:

- Social Security Number Monitoring. Discover monitors risky websites including those included in the “dark web” where stolen SSNs are often traded and sold for the sole purposes of identity theft and fraud. You’ll receive an alert if your SSN is found.

- New Account Alerts. When you open a new account, whether it be a credit cards, mortgages, car loans or other credit accounts. IF it is reported to your Experian credit report, you’ll receive a notification on Discover’s behalf.

- If you do not recognize a new account, even if it’s not a Discover account, it can be an indication of identity theft.

Conclusion:

Discover Bank’s New Free Alert Services could efficiently help you protect your identity from theft or fraud. Firstly, their SSN monitoring service allows for monitoring risky websites, that includes websites on the dark web where a stolen SSN could be traded or sold for said theft or identity fraud. Secondly, they offer monitoring services gear towards your Experian credit report, notifying you of any new credit account that is reported to your Experian credit file. Note, I reiterate that this is not complete identity protection, which can usually costs upwards of $10+ a month. Be sure to check out our list of Best Credit Card Promotions as well as our full detailed list of Discover Bank Promotions!