When you make lots of work-related purchases, but all those charges go on the corporate card. So your company gets the rewards, and you end up with nothing.

When you make lots of work-related purchases, but all those charges go on the corporate card. So your company gets the rewards, and you end up with nothing.

Check out the best cash back shopping websites.

But, there is a way for you to collect points, miles, or cash back with spending on credit cards that don’t belong to you. Read below for more information.

Editor’s Pick Top Business Credit Card

The Business Platinum Card® from American Express has a welcome offer of 250,000 Membership Rewards points after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership. You'll earn: • 5X Membership Rewards Points on Flights, and Prepaid Hotels Booked through AmexTravel.com. • 1X points on other eligible purchases. • 1.5X points (that's an extra half point per dollar) on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more, on up to $2 million per Card Account per calendar year. Purchases eligible for multiple additional point bonuses will only receive the highest eligible bonus. • Unlock over $1,000 in statement credits on select purchases, including tech, recruiting and wireless in the first year of membership with the Business Platinum Card. Enrollment required. See how you can unlock over $1,000 annually in credits on select purchases with the Business Platinum Card • Fly like a pro with a $200 Airline Fee Credit. Select one qualifying airline to receive up to $200 back per year on baggage fees and other incidentals. • $199 CLEAR Plus Credit: Use your card and get up to $199 in statement credits per calendar year on your CLEAR Plus Membership (subject to auto-renewal) when you use the Business Platinum Card. • NEW! Make the Business Platinum Card work even harder for you. Hilton For Business members get up to $200 back per calendar year when you make an eligible purchase at Hilton properties across the globe. Benefit enrollment required. This card does come with a $695 annual fee. (See Rates & Fees) Terms Apply. |

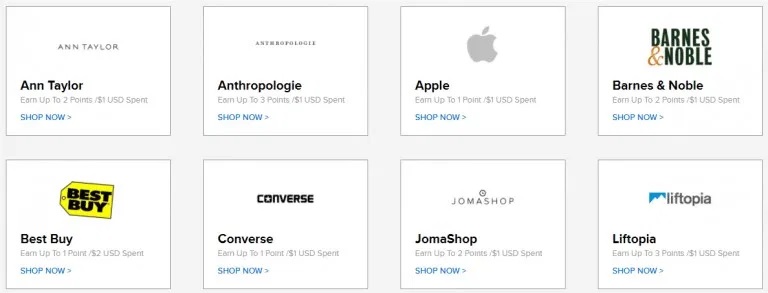

Online Shopping Portals

The secret is in online shopping portals. They are a fast and easy way for you to build up on additional points, miles, or cash back for online purchases. Plus, you’ll want to make an account with a loyalty program or cashback portal. Just click through the merchant that you want, and make the purchase as you usually would. Start with the portal, instead of directly going to the merchant’s site. Furthermore, you’ll gain bonuses into your personal account, it doesn’t matter if the credit card you use isn’t your own.

Here’s a closer look at you can earn with Delta’s shopping portal:

| Merchant | Bonus |

| Marriott | 4x miles |

| IHG | 2x miles |

| Staples Copy & Print | 4x miles |

| 123inkjets.com | 5x miles |

| ProFlowers | 6x miles |

| Walmart | 1x miles |

If you don’t think you’ll remember to go through the portal each time you have to make an online purchase. Just get the portal extension to your browser. With this extension, you’ll receive notifications at the top of your screen to go through the portal if there are bonus reards for that merchant.

|

|

Conclusion

Consider using online shopping portals when you make work-related purchases. This way, you’ll be able to earn points, miles, or cash back without having to spend any of your own money. For more information on online shopping portals check out our guide.