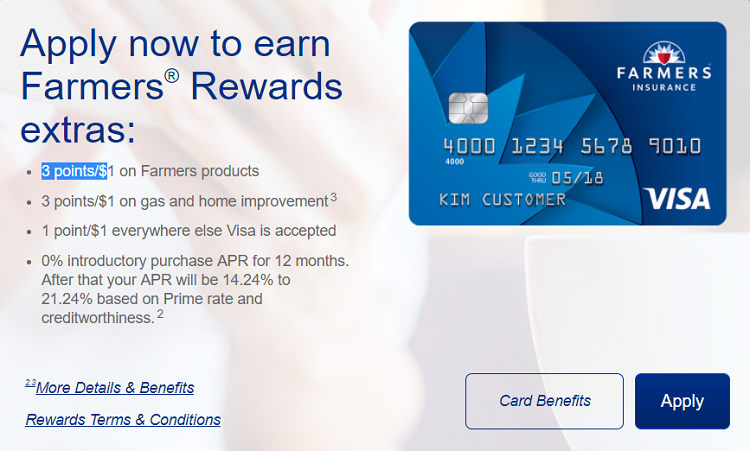

If you’re an existing Farmer’s Insurance customer, then the Farmers Rewards VISA Signature Card from Comenity Bank could be a viable option for you, especially if you’re a home or car owner. Here’s what you should expect from this card: You can earn 3x the points on Farmers products, gas purchase and home improvement purchases and 1x points everywhere else VISA is accepted. With a decent 0% intorductory APR at 12 months and no annual fee, this card is definitely a banger for your next home improvement project. I’m telling you, big savings!

If you’re an existing Farmer’s Insurance customer, then the Farmers Rewards VISA Signature Card from Comenity Bank could be a viable option for you, especially if you’re a home or car owner. Here’s what you should expect from this card: You can earn 3x the points on Farmers products, gas purchase and home improvement purchases and 1x points everywhere else VISA is accepted. With a decent 0% intorductory APR at 12 months and no annual fee, this card is definitely a banger for your next home improvement project. I’m telling you, big savings!

| Chase College CheckingSM: Get $100 as a new Chase checking customer when you open a Chase College CheckingSM account and complete 10 qualifying transactions within 60 days of account opening. Get Coupon---Chase College Checking Review |

| Chase Secure BankingSM: Earn a $100 bonus when you open a new Chase Secure BankingSM account online or enter your email address to get your coupon and bring it to a Chase branch to open an account. Make sure to complete 10 qualifying transactions within 60 days of coupon enrollment. Apply Now---Chase Secure Banking Review |

| Chase Private Client: Enjoy up to $3,000 bonus when you open a new Chase Private Client Checking account with qualifying activities. Get more from a personalized relationship when you open a new Chase Private Client Checking account with qualifying activities. Learn More---Chase Private Client Review |

Alternative Credit Card Bonuses:

- Wells Fargo Propel American Express® Card

- Amex EveryDay® Credit Card

- Blue Cash Everyday® Card from American Express

Farmers Rewards VISA Credit Card Summary:

- Apply Now

- Maximum Bonus: None

- Spending Requirement: None

- Best Feature: Up to 3% cash back

- Annual Fee: $0

- Bonus Worth: None

- Expiration Date: None

- Additional Advice: Card could be of great use for home owners; people looking forward to their next home improvement project.

Farmers Rewards VISA Credit Card Features:

- 0% introductory purchase APR for 12 months

- 3x points for $1 spent on Farmers Products

- 3x points for $1 spent on home improvement

- 3X points for $1 spent on gas

- 1X point for $1 spent everywhere else

- Points never expire

- No annual fee

Conclusion:

The Farmers Rewards VISA Signature Card could be a great rewards credit card for those of you that have a Farmers product or plan on a new home improvement project. Essentially, you’ll be earning 3x points per $1 spent on Farmers products, home improvement, and gas station purchases. All other purchases earn 1x the points and points never expire. A couple things I’d like to note before closing up this article is that if you’re relying on this card for gas, then there are so much more rewarding cards out there for that.

Check out our Best Credit Cards for Gas list if anything. Also, note that Farmers charges an additional fee of $5 for monthly premiums paid by a credit card. The fee is charged per each “billing account.” Paying directly from the bank using auto-payment could void the fee. Be sure to check out our complete list of Credit Card Promotions for other bonuses and offers.