Death is unavoidable and unpleasant to think about. However, if it happens to you, would your family be financially stable without you? There are possibilities that your family will face some hardships making ends meet without you. If this happens, you should consider getting life insurance.

Death is unavoidable and unpleasant to think about. However, if it happens to you, would your family be financially stable without you? There are possibilities that your family will face some hardships making ends meet without you. If this happens, you should consider getting life insurance.

Haven Life is a term life insurance provider that allows customers to get and manage their life insurance policy online. These policies are made by their parent company MassMutual. This is one of the largest life insurers in the United States.

Read below for more information on Haven policies, features, and prices.

Haven Life Features

Many people are intrigued by Haven Life since it enables you to easily apply for and manage a life insurance policy without having to interact with an agent. This means no commission fees, up-selling, and no hassle. But, if you have any questions, you can contact customer service to help you out.

(Visit for more information)

Policy features will be:

- Level premiums. Your monthly payment will remain the same throughout the term.

- Accelerated death benefit rider. If you get terminally ill, you’ll be able to get a portion of the policy benefit early to help with end-of-life medical care or other needs.

- Disability waiver of premium rider (available in some states and carries an additional fee). If you get completely disabled from illness or injury, you will not have to pay for premiums at that time. Plus, if the disability goes more than 6 months, a full refund will be issued.

There are several extra perks added with Haven Life Plus (in all states except FL, NY, ND, SD, WA). Perks will include:

- Free access to AAptive, an in-home fitness app (normally $99/year).

- Free legal wills for you and your partner at Trust & Will ($129 in value).

- Subscription to LifeSite for free, a secure, digital safe deposit box for you and up to 5 family members. Normally, this is $80 a year.

- Free access to Timeshifter, a travel app that helps prevent jet lag. Usually, this will cost around $24.99 a year.

- 15% discount voucher for family health services at MinuteClinic inside CVS Pharmacy and Target stores.

Haven Life Insurance Policies

Furthermore, Haven Life offers term life insurance and term simplified life insurance. But, they don’t have any permanent life insurance options like whole life insurance.

Haven Term

The term life insurance policy is a great fit for most families. It’s easy on your budget, convenient to buy and is accompanied by no-cost benefits. Haven Term is available in coverage amounts no more than $3 million.

| Product Type | Medically underwritten term life insurance. |

| Medical Exam | Likely but not in all cases |

| Age Eligibility | 18 -65 |

| Coverage Amounts | $100,000 – $3 million |

| Available Terms | 10, 15, 20 and 30 years |

| Payout | Tax-free lump sum |

| Additional Features | Level premiums Accelerated death benefit Paperless processing No obligation free look period Haven Life Plus |

Haven Simple

This term life insurance policy is designed for those who want to skip the medical exam and if paying for more than it’s great. Haven Simple is available in coverage amounts up to $500,000. Plus, this policy isn’t available for residents in CA, DE, SD, ND, and NY.

| Product Type | Simplified issue term life insurance. |

| Medical Exam | No |

| Age Eligibility | 18 – 65 |

| Coverage Amounts | $5,000 – $500,000 |

| Available Terms | 10, 15, 20 and 30 years |

| Payout | Tax-free lump sum |

| Additional Features | Level premiums Accelerated death benefit Paperless processing No obligation free look period Credit card payments accepted |

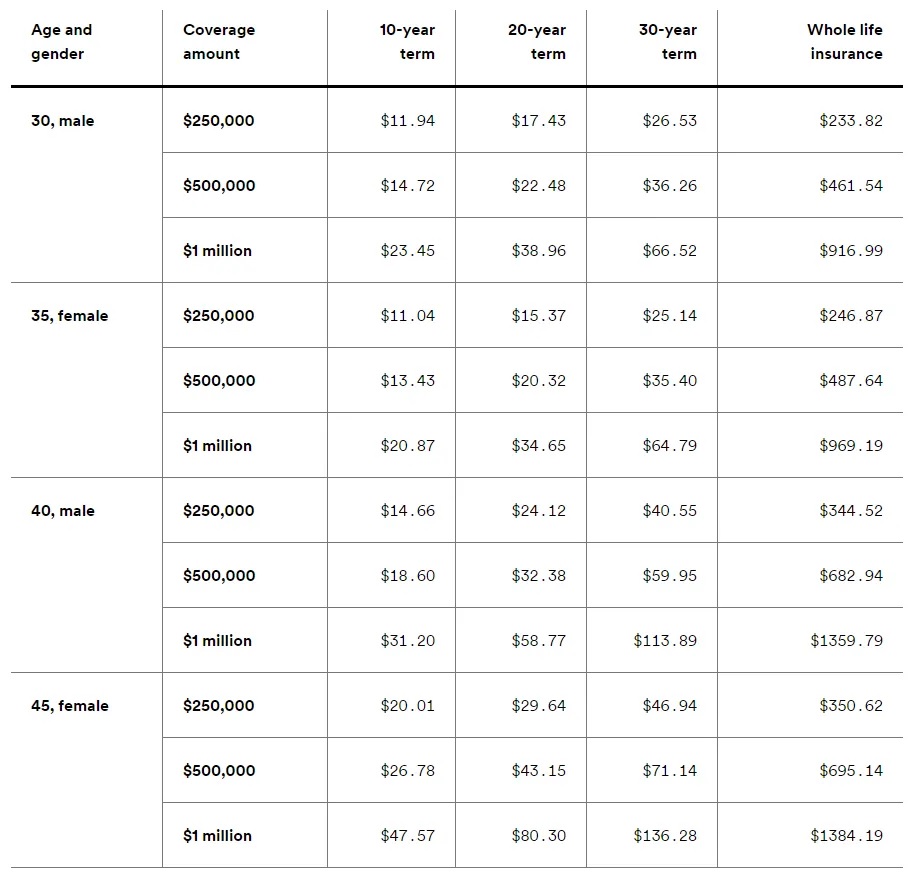

Haven Life Insurance Cost

Like any other life insurance, the cost will depend on different factors like:

- Type of coverage you purchase.

- How long the coverage lasts

- The coverage amount

- Personal factors like gender, age, and health.

Here are some quotes for life insurance, pulled from Haven Life’s website:

|

|

Conclusion

Using Haven Life is a great option for you if you want to get an affordable term life insurance online. Plus, it’s super easy to sign up for and you don’t need to contact an agent unless you have any questions.