An especially quintessential uncertainty that we always present to ourselves is “what is the magic number or threshold of necessary credit cards I should be holding in my wallet?” Truthfully, there is no deemed perfect-amount and in 2017, more people are becoming more aware of the various rewards and benefits attached to a card.

An especially quintessential uncertainty that we always present to ourselves is “what is the magic number or threshold of necessary credit cards I should be holding in my wallet?” Truthfully, there is no deemed perfect-amount and in 2017, more people are becoming more aware of the various rewards and benefits attached to a card.

On the same platform, there’s a growing number of us raking up debt that goes unwarranted, which brings me to the case of just how much credit cards you can get before hurting your credit score. Consider this, look inside your wallet. The average american has 3 credit cards, whether it be a shiny-expensive American Express or a more practical rewards gathering VISA or MasterCard, the average household has $15,000+ in credit card debt. You can easily identify your financial well-being based on the collective cards you possess.

| BONUS LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up To $700 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

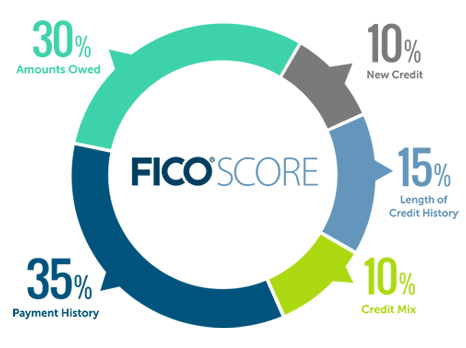

5 Factors of FICO Credit Score:

FICO is the most common scoring method utilized by bureaus and the score will range from meager 300 to a optimal 850. There are 5 factors that credit bureaus use to determine your FICO Score. Your credit history report will have positive and/or negative data composed from how well you assess these factors including Payment History, Amounts owed, length of credit history, credit mix in use or new credit.

Now, having multiple cards that you pay over time could very well help your credit score because it’s essentially lowering the amount that you owe. That constitutes as 10% of the criteria, however, new credit opened in a short duration of time can put a 10% criteria on your credit score and could affect it, however, since it’s just 10%, a few points could be sacrificed if you plan on making a consistent paying history. You should see recovery in at least a couple of months.

If you categorize yourself as a responsible credit card user, then it should go without saying that having a wide array of cards could provide you with an overwhelming amount of perks and benefits. In my book, that’s a plus! An extra bang-for-your-buckaroos is completely justified as long as you’re rewarded for the specific spending you make. Keeping at least one or two loyal no-frills, no-hassle credit cards could be a good play. As in no-frills, I’m referencing cash back credit cards with no annual fee such as the 1.5% cash back everywhere Chase Freedom Unlimited® or the Discover It CashBack Match Card, for those of you that love rotating categories.

Moving along, there’s an excellent selection of cards that reward you for specific purchases. This goes along the lines of Hotel, Airlines, Gas, retail or travel purchases. Below would be our top picks of the best credit cards from each category FOR the average consumer:

Top Picks for Hotel Rewards for the Average Consumer:

- IHG® Rewards Club Select Credit Card ($49 annual fee, waived for the first year)

- Hilton HonorsTM Card from American Express ($0 annual fee)

- Hilton HonorsTM Surpass Card from American Express ($75 annual fee)

- Starwood Preferred Guest® Credit Card ($95 annual fee, waived for the first year)

Top Picks for Airlines Rewards for the Average Consumer:

- Chase UnitedSMTravelBank Card ($0 annual fee)

- Gold Delta SkyMiles® Credit Card from American Express ($95 annual fee, waived for the first year)

- Barclaycard JetBlue Plus Mastercard® ($99 annual fee)

Top Picks for Gas Rewards for the Average Consumer:

- Blue Cash Preferred® Card from American Express

- Wells Fargo Propel 365 American Express® Card

Top Picks for Travel Rewards for the Average Consumer:

- Discover It Miles ($0 annual fee)

- VentureOne® Rewards ($0 annual fee)

- Chase Sapphire Preferred® Card ($95 annual fee, waived for the first year)

- Barclaycard Arrival PlusTM World Elite Mastercard® ($89 annual fee, waived for the first year)

Editor’s Note: Pulling your statements from the past 3-6 months would give you the most efficient perspective on where your spending is going towards. Be sure to choose the cards that offer you the most optimal rewards and perks for your specific spending.

Conclusion:

There’s some common misconceptions that go along with the ideal that too many credit cards affect your credit score/ credit history. As long as you maintain a manageable amount of credit cards that you can healthy make payments towards, then the 10% determination for new credit under your FICO Score shouldn’t really pose as a threat.

If your 0% APR introductory period is over, paying off your balance every statement cycle will give you the leeway of avoiding interest rates. Make sure to choose credit cards that fit your marginal spending. For example, if you have a family of 4+ and you take frequent trips to the supermarket, then the Blue Cash Preferred® Card from American Express could be your best bet. Find our complete list of Credit Card Promotions from our exclusive list!

With the American Express® High Yield Savings Account: • Earn 1.90% APY as of 9/15/22 on your deposits. Your High Yield Savings account earns interest daily and is posted to your account monthly. • Links easily with your current bank accounts. No need to switch banks. • FDIC Insured. Your account is insured to at least $250,000 per depositor. • 24/7 Account Access |