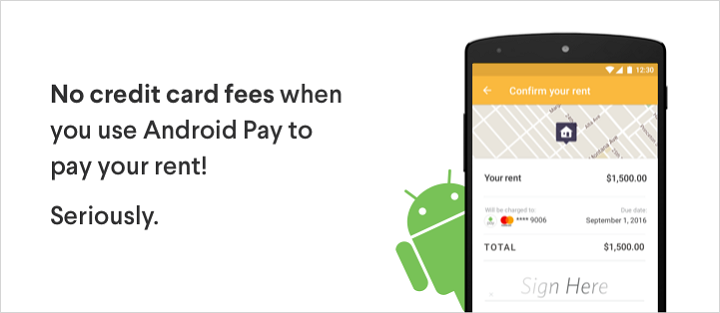

Previously, we’ve made it clear that in an earlier post, you can make automatic payments for your rent using a credit card at no extra fee with the use of RadPad’s convenient services. The main purpose of RadPad is to induce your rent payments towards earning credit card rewards, help meet minimum spend requirements on new credit cards, or help earn credit card big spend bonuses.

Previously, we’ve made it clear that in an earlier post, you can make automatic payments for your rent using a credit card at no extra fee with the use of RadPad’s convenient services. The main purpose of RadPad is to induce your rent payments towards earning credit card rewards, help meet minimum spend requirements on new credit cards, or help earn credit card big spend bonuses.

In regards to being able to earn bonus miles with your linked credit card, there are some things you should consider prior to using this service to it’s fullest capabilities.

| BONUS LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up To $700 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

1: Have real rent payments

RadPad checks with your specified landlord to get a copy of the rental contract, so I advise that you not try to counterfeit a landlord. Obviously, this is a logical process for RadPad considering that the utmost security and fulfillment of their purposes as a rent payment services is a complete necessary.

2: Pay with Android Pay

This could be a hindrance for those of us who cannot access Android Pay on the premise that our device’s running operator is either an iPhone or an NFC enabled Android device that isn’t running version 4.4 “KitKat” or later.

3: Not all credit cards are supported

A majority of banks do support Android Pay, but there’s a few or them that do not at the same time.

Major card issuers that do not support Android Pay as of yet:

- Barclaycard confirms that they have no intention of ever adapting to ever support Android Pay.

- Capital One has stated publicly that this option will be “coming soon.”

- Chase is expected to support Android Pay this year.

Major card issuers that support Android Pay:

- American Express

- Bank of America

- BBVA Compass

- Citi

- Discover

- Fidelity

- TD Bank

- US Bank

- Wells Fargo

Editor’s Note: I recommend that you check out Google’s list of Banks and Credit Unions that support Android Pay currently.

Earning Miles via rent payments:

There’s good news for those of us that aren’t android users; here’s a list of other options that you can do to get RadPad’s services:

- RadPad w/ Credit Card: RadPad can be used to pay rent with a credit card, unfortunately, RadPad cahrges a 3.49% fee, which isn’t worth it at all.

- RadPad w/ a Rewards Debit Card: RadPad will not charge any fees with a debit card. Not very much debit cards offer rewards any more, but you can still get “Signature Purchase” Rewards on some. RadPad payments via Debit Card is likely to count as signature purchases since it charges with a lack of a PIN.

- RadPad w/ a Visa/MC gift card: If you earn miles by buying gift cards; stock up on VISA and MasterCard gift cards and RadPad’s services could be utilized with no additional fees. However, this method would require you to pay your rent with multiple payment sources for each rent payment if your rent is $500 or higher.

- RadPad w/ a reload-able prepaid card: RadPad would let you unload those funds fee free. Prepaid cards are quite difficult to find earned miles on, but it is possible. Keep in mind that Amex cards such as the Serve and Bluebird are not debit cards, so they would not work for this purpose.

- Prepaid reloadable cards with free bill pay: You can use a reloadable prepaid card with free to cheap bill pay. If you can earn miles reloading it, then you could use the bill pay feature to pay for your rent.

- Plastiq w/ Credit Card: Pay your bills via credit card with a fee of 2% for MasterCard and 2.5% for AMEX or VISA. You can reduce the fees by referring your friends to Plastiq as well.

Final Analysis:

If you’re ever in the predicament where you want to use RadPad’s Rent Payment Services, but you’re not able to reap the full extent of the app primarily because you do not have an Android and cannot use RadPad + Android Pay. Of course, there is other options such as using a credit card, debit card, re loadable card, or other payment services but they all seem to have their own irrational quirks that involve high fees, and so on so forth. If you’re all out of options, consider using a reloadable prepaid card with free bill pay. If you can earn miles reloading it, then you could use the bill pay feature to pay for your rent. Don’t forget to check out our full list of Credit Card Bonuses if you’re not interested at the moment.