It’s highly plausible that the prestigious new Chase Sapphire Reserve set to be released August 21, 2016, will be subject to the 5/24 Rule off the premise that the Chase Sapphire Preferred is. That means, for a lot of you past the 5 cards within a given 24 months interval, will not be able to get approved for the well-awaited Chase Sapphire Reserve. Only word to describe this is as “disspointing” considering that the Chase Sapphire Reserve is definitely going to be a game-changer in terms of standards for Premium Credit Cards everywhere. However, don’t lose hope just yet, because there might be various ways around the 5/24 Rule and getting your hands on the CS(R).

It’s highly plausible that the prestigious new Chase Sapphire Reserve set to be released August 21, 2016, will be subject to the 5/24 Rule off the premise that the Chase Sapphire Preferred is. That means, for a lot of you past the 5 cards within a given 24 months interval, will not be able to get approved for the well-awaited Chase Sapphire Reserve. Only word to describe this is as “disspointing” considering that the Chase Sapphire Reserve is definitely going to be a game-changer in terms of standards for Premium Credit Cards everywhere. However, don’t lose hope just yet, because there might be various ways around the 5/24 Rule and getting your hands on the CS(R).

Editor’s Note: All suggested recommendations are intended to help get around the Chase 5/24 Rule. Keep in mind that there are countless other reasons as to why an individual is subject to denial for a credit card that may not help with the recommendations listed.

Alternative Credit Card Bonuses:

| BONUS LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up To $700 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

Further Planning:

- Check your credit score; If your credit score is below 700, then it’d be a better option to try and improve your score prior to applying for this card.

- Discover offers free FICO credit scores from Experian for everyone

- Experian offers free FICO credit scores via their phone app and via their freecreditscore.com website

- Consider not applying for another card for the time being. Business cards is an exception considering that it doesn’t appear on your personal credit reports.

- Try your luck and enroll in Chase Private Client Services; Chase Private Client customers apparently are not subject to the 5/24 Rule. Keep in mind that Private Client is available typically for higher net worth individuals with at least $250,000 in deposits with Chase. Note that you could become a Chase Private Client opening a joint account with a friend or family member who is already a Chase Private Client. (must include a free safe deposit box account)Initiate a new-term Relationship with a Chase Banker. Consider meeting to discuss the possibility of opening a checking or savings as well as possibly moving your retirement savings. Further compliments of Chase’s credit card products is much obliged.

- Watch your mail for a pre-qualified or pre-approved offer for the Sapphire Reserve.

- Look for mails. Chase often sends pre-approved letters by mail, in which case, you’re confirmed.

- Visit a Chase bank. Talk to a banker of your interest in applying for the Sapphire Reserve but you need to check to see if you are pre-approved first.

- Check your Pre-approved Offers online with Chase. Keep in mind that the offers aren’t usually reliable on Chase’s online pre-approval system and to know for sure, it’s best to talk to a banker.

- Try the CardMatch Tool to see if you are pre-qualified for any Chase offers.

- Try Depositing at least $10,000 with Chase ( either in one account or across several). Note that you could also earn a $500 Business Bonus as well.

Application:

- Apply in-branch with your designated new banker

- Ask your banker to check and see if you are pre-qualified or pre-approved. There may be some indications towards bypassing the 5/24 Rule.

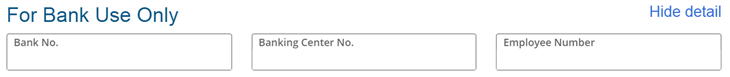

- Be sure that he/she understands fully that you are attempting to apply for the Reserve card and you want to give them necessary credit for the application. Call your banker to ask for his/her bank number, banking center number, and employee number so that you can add that info into the application (this is essential in the case that your application may be denied)

If application is pending:

- Have your banker call on your behalf for a instant decision. If you’re applying yourself, call Reconsideration at 888-245-0625.

- Be sure to come up with a logical answer as to why you’ve opened up the given amount of cards within 24 months.

- Make sure tat your analyst understands that you aren’t in need of new credit. Considering that you have other Chase cards, you can move your credit from other accounts to the designated CSR account.

- Try calling multiple times until you get someone willing to consider your position.

If denied:

If your application went from pending to denied and after several unsuccessful calls, you can request your banker to file a Special Consideration Form. Keep in mind, they can only be able to do this if you have at least $10,000 on deposit with Chase. Considering that your banker will get commission if you’re approved, they’ll want to help. Special Consideration is definitely worth a try.

Conclusion:

There’s no guarantee that you’ll get your hands on the Chase Sapphire Reserve by doing any of the listed, but the methods will likely better your chances of getting the card. Now, considering Chase’s 5/24, it may be rather difficult getting this card if you’re over the 5 card limit within a given 24 months and it’s safe to say that there may be a way around the Chase 5/24 Rule. Keep in mind that there are countless other reasons as to why an individual is subject to denial for a credit card that may not help with the recommendations listed. I wouldn’t necessarily recommend calling Chase’s Reconsideration Line (888-245-0625), until you have been confirmed denied from approval. Be sure to also check out our Chase Card Promotions, as well as our complete list of Credit Card Promotions from our exclusive list!