It’s understandable that banking technology is at an all-time high but we can’t push paper checks as obsolete and forget how to write a check. For some who’ve never written a check before, this article will be a complete guide towards how to write a check, ends and out. Whether it’s making a purchase or paying your bills and rent, paper checks can come in handy. Be sure to read the full article for details.

|

|

How to Write a Check

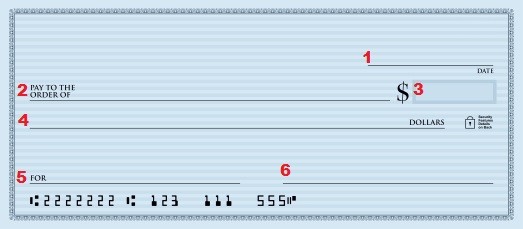

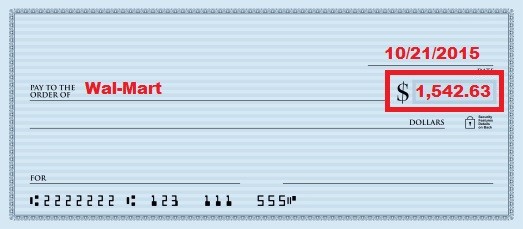

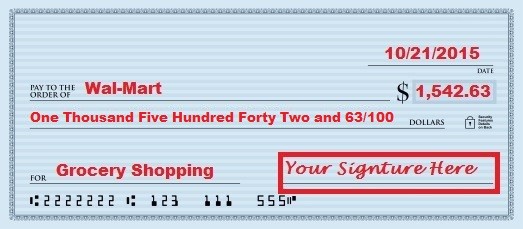

Below you will find the anatomy of a paper check. There are 6 fields that you will need to fill in with information:

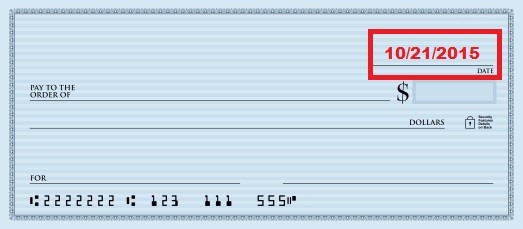

- Date – In the top right corner, you will need to fill out the date the day you are making the purchase/payment. Be sure the date is correct!

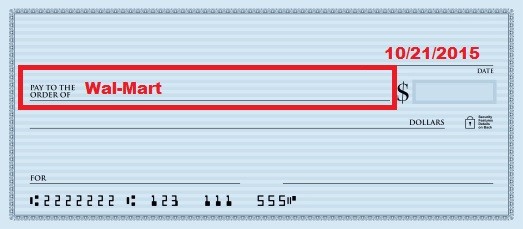

- Pay to the order of – This section will include whoever you are paying the check to. If you’re sending money to a person, you’ll have to put their name. If they’re a company, you’ll have to put the company’s name. Be sure to double check the recipient name.

- Money Box – This will include the amount you want to send to the set recipient.

- Then, write the exact amount of money in words exactly suitable to the amount of money you put in the Money Box on the line below that typically ends with “DOLLARS.” Be sure to include the cent value as well. The cent value should be written as a fraction of one hundred. $.63 cents is (63/100). It’s crucial to double check this section because if either fields are wrong, your check will become invalid.

- For or Memo – In this section, you’re basically writing what you are using the checks for. If the recipient doesn’t require you to complete this field, then you can just leave it blank.

- Signature – Your signature needs to be written on the check for validity purposes.

How to Balance a Checkbook

Every time you spend money or make a deposit, you should keep track of this in your checkbook’s check register, which can be found with the checks you received. Your check register is used for keeping track of your deposits and expenses. All transactions should be recorded, including checks, ATM withdrawals, debit card payments, and deposits.

Record Your Transactions

- If you make a payment by check, you will record the check number, found in the top right corner of the check. This also helps you keep track of your checks, helping you ensure none of your checks are missing, and reminding you when you need to reorder checks.

- Be sure to make note of the date for your records. In the “Transaction” or “Description” column, describe where the payment is made or for what. Then write down the exact amount in either the withdrawal or deposit column depending on if you spent money or received it.

- Subtract the amount of any checks, withdrawals, payments and bank fees or add in deposits to the total amount in your account from the previous transaction.

Conclusion

Overall, now that you’ve successfully made your first valid check, you can make purchases, payments or transfers to companies or P2P. There are some fields where I mentioned double checking the information you put down. But realistically, it should be worth double-checking the whole check just for precaution measures. Remember, that your wet-signature must be printed on the paper-check or the recipient cannot cash in or deposit the check. Lastly, if you liked this article, go ahead and take a look at our exclusive list of Banking Promotions here first at BankCheckingSavings.com!