If you’re in the market for a higher interest rate on your savings account, then you may have found your one-stop shop! With a Huntington Bank’s Relationship Savings account, take advantage of all the interest-bearing, benefit-packed necessities you crave. When you link a relationship savings to a Huntington checking (5 or 25Checking), you could earn even more interest! On top of that, you’ll receive free checking overdraft protection, and no monthly maintenance fee with average daily balance of $2,500 or when linked to either a Huntington 5 or Huntington 25Checking account; otherwise $10.

If you’re in the market for a higher interest rate on your savings account, then you may have found your one-stop shop! With a Huntington Bank’s Relationship Savings account, take advantage of all the interest-bearing, benefit-packed necessities you crave. When you link a relationship savings to a Huntington checking (5 or 25Checking), you could earn even more interest! On top of that, you’ll receive free checking overdraft protection, and no monthly maintenance fee with average daily balance of $2,500 or when linked to either a Huntington 5 or Huntington 25Checking account; otherwise $10.

Editor’s Note: IN, KY, MI, OH, PA, WV; Huntington Bank is offering the chance to earn a $150 Bonus when you open up a new Relationship Savings Account and deposit $10,000 or more into your new savings account within 30 days of account opening, and maintain the balance for at least 60 days.

| BONUS LINK | OFFER | REVIEW |

| Huntington Bank Unlimited Plus Business Checking | $1,000 Cash | Review |

| Huntington Bank Unlimited Business Checking | $400 Cash | Review |

| Huntington Bank Business Checking 100 | $100 Cash | Review |

Huntington Bank Relationship Savings In-Depth Analysis:

Bring the vision of modern banking to light and upgrade to a Huntington Relationship Savings account. We all need a secure option for our money and when it comes to a Savings account, I must hold a bank accountable for providing not only reassurance, but efficiency just in case an emergency is to come my way. Better news, Huntington offers up to .20% APY on their Relationship Savings account when you link it with a 25Checking from them. Definitely the best of both world suitable with your spending and savings needs. Here are some perks you might want to consider:

- No Monthly Maintenance Fees – With average daily balance of $2,500 or when linked to either a Huntington 5 or Huntington 25Checking account; otherwise $10.

- 24 Hour Grace-Overdraft Fee Relief – Get more time, not more fees.

- Link a Checking and get Free Overdraft Protection.

- Reliable Mobile app to login any time of day to check on your savings and any pending deposits or fund transfers

Huntington Bank Savings Summary:

- Apply Now

- Account Type: Relationship Savings

- Availability: Ohio, Michigan, Indiana, Pennsylvania, Kentucky, and West Virginia

- Expiration Date: December 4, 2017

- Soft/Hard Pull: Soft Pull

- Credit Card Funding: None

- Direct Deposit Requirement: None

- Additional Requirements: Deposit at least $10,000 within 30 days of account opening to earn $150 bonus

- Monthly Fee: $10; may be waived with average daily balance of $2,500 or when linked to either a Huntington 5 or Huntington 25Checking account

- Early Termination Fee: None

Huntington Bank Savings Account Features:

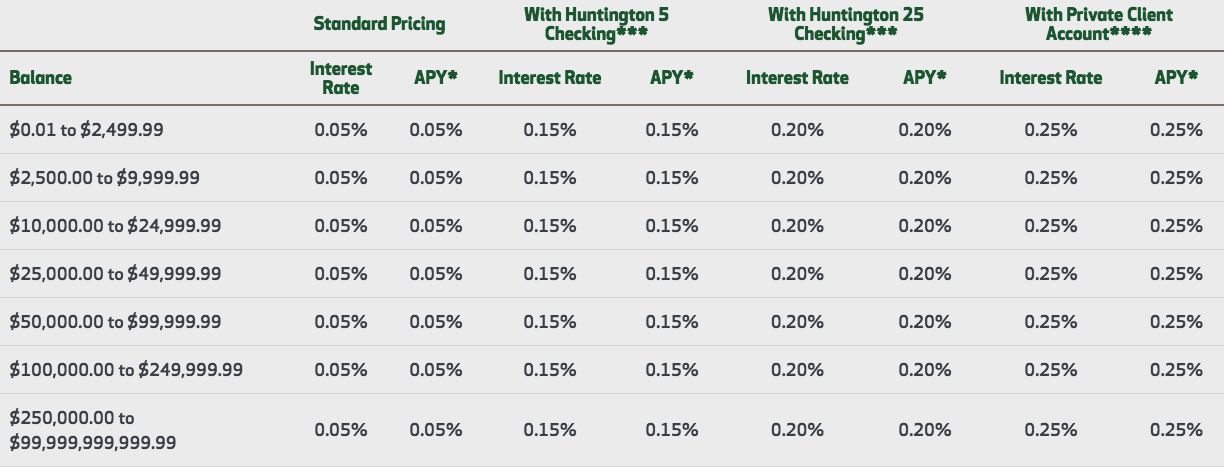

- Additional interest bump – When you link a Huntington 5 or Huntington 25Checking account

- Up to .20% with Huntington 25Checking

- No Monthly Maintenance Fees – With average daily balance of $2,500 or when linked to either a Huntington 5 or Huntington 25Checking account; otherwise $10.

- 24 Hour Grace-Overdraft Fee Relief – Get more time, not more fees.

- Free Overdraft Protection Features for Savings – If your account is overdrawn but you have enough to cover it in a linked account, we’ll transfer the money free of charge

- When checking and savings accounts are linked

- All-Day Deposit – With All Day Deposit, you don’t have to worry about cut-off times when depositing through ATMs or our Mobile App.

- Free Mobile Deposit – mobile app lets you check your balance, make deposits and transfer funds.

Conclusion:

Huntington Bank is currently offering you the opportunity to take advantage of .20%+ APY when you open a Huntington Relationship Savings Account and link a checking account. When you link a Huntington Relationship Savings to a Huntington Checking account, you’ll also receive free overdraft benefits, no monthly maintenance fees, and so much more!

On top of that, be sure to reap $150 in Bonus Cash when you open up a new Relationship Savings Account and deposit $10,000 or more into your new savings account within 30 days of account opening, and maintain the balance for at least 60 days. Remember, for tax purposes you will receive a form 1099-INT from us for your cash bonus. Check out our complete list of Bank Deals for all your banking needs!