Indiana residents, if you’re looking for a competitive mortgage rate, then be sure to check out IAB Financial Bank Mortgage. They offer lower rates than their competitors and for those of you that prefer to do your mortgages with a loan officer or mortgage loan originator, there’s plenty of branches. IAB’s selection of loans, whether you’re purchasing, refinancing or even looking for a construction loan, IAB is readily available to suit your lending needs. Considering that they’re a total online lender, they can afford to offer you such low rates on your mortgage.

Indiana residents, if you’re looking for a competitive mortgage rate, then be sure to check out IAB Financial Bank Mortgage. They offer lower rates than their competitors and for those of you that prefer to do your mortgages with a loan officer or mortgage loan originator, there’s plenty of branches. IAB’s selection of loans, whether you’re purchasing, refinancing or even looking for a construction loan, IAB is readily available to suit your lending needs. Considering that they’re a total online lender, they can afford to offer you such low rates on your mortgage.

| BONUS LINK | OFFER | REVIEW |

IAB Financial Bank Mortgage In-Depth:

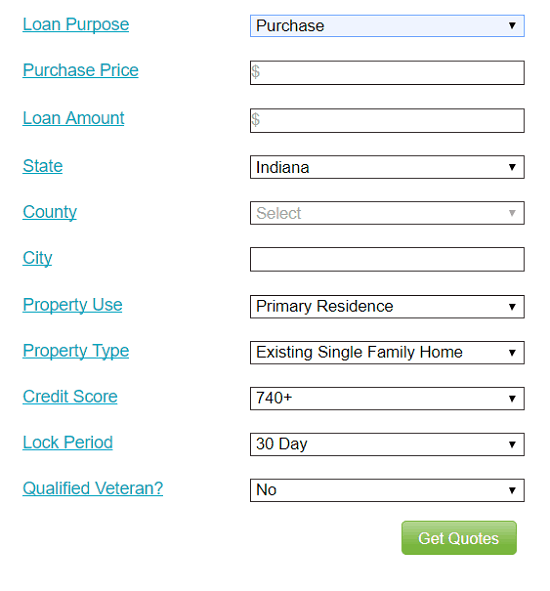

Scrolling onto the IAB Financial Mortgage landing page, the platform is accessible, modern and user-friendly, however, one of the criterias that I absolutely like to look for is there selection of loan types upfront. Only option I have of seeing their loan variations if through their online pre-qualifications service under “Loan Purpose,” even then, the only options are for purchasing, refinance, or contruction. I can’t necessarily devalue this mortgage lender on this premise alone, so moving on, their pre-qualification simulator takes less than 3 minutes to do with simple straight-forward questions and there’s no obligation attached for prequalifications.

One of the criterias that I also want them to meet is the educational resources. They offer FAQ on the pre-qualification page that is pulled up when you click “Check Rates.” Under “Resources,” you can find anything you need in mortgage loan information. So yes, they do fulfill such a criteria as a online mortgage lender. If you’re a new homeowner, it’d be my fullest suggestion to check out their “Resources.”

IAB Financial Bank Mortgage Summary:

- Apply Now

- Account Type: Mortgage Loan

- Availability: Nationwide

- Expiration Date: None

- Additional Advise: Have the necessary documents and validation information ready to make your process as smooth as possible.

- Closing Loan: Standard lock period is within 30 days or less

IAB Financial Bank Mortgage Basic Requirements:

Below are examples of supporting documents which may be included in a loan file:

Income Documents:

- Pay Stubs covering the customer’s most recent two pay periods for each applicant.

- W-2 Forms for the previous two years.

- Two most recent years’ federal tax returns (e.g. for a loan in 2015, the customer need to submit the customer’s 2014 and 2013 federal tax returns). All the pages and all schedules.

- If the customer is self-employed, the two most recent years’ business tax returns are also needed.

- For self–employed or investment income, the two most recent years’ 1099’s and K-1 forms are also needed

- For self–employed business income,year-to-date profit and loss statement and balance sheet.

- For retired customers, copy of Social Security and/or Pension “award letters” detailing the amount of retirement income.

Asset Documents:

- Two most recent months’ bank statements. All of the pages.

Other Documents:

- Homeowner’s Insurance statement(s) for all properties owned showing the customer’s coverage and the annual premium.

- Mortgage statements for all properties owned that have liens.

- Copy of driver’s license or State I.D.card for all customers.

- If divorced, the customer’s fully executed divorce decree.

Conclusion:

IAB Financial Bank Mortgage offers Indiana residents competitively low-rates on their mortgages and considering that they’re a dominantly online mortgage lender, they are better able to do so. You still do have the option to locate a loan officer in one of their plenty of branches if you prefer to do so. Whether you’re purchasing, refinancing, or working on a home improvement project, IAB offers you the ability to do so. Be sure to fill out the pre-qualifications if you’re interested. Also, be sure to check out our Best Mortgage Rates for you new or current home owners looking to purchase or refinance!

With the American Express® High Yield Savings Account: • Earn 1.90% APY as of 9/15/22 on your deposits. Your High Yield Savings account earns interest daily and is posted to your account monthly. • Links easily with your current bank accounts. No need to switch banks. • FDIC Insured. Your account is insured to at least $250,000 per depositor. • 24/7 Account Access |

Leave a Reply