One of the more mysterious cards in the banking industry is the InFirst Federal Credit Union VISA Rewards Credit Card. Definitely a low-key card that you may have never heard about… until now, considering this card does offer some pretty attractive perks such as: 4% cash back on gas purchases, 3% on restaurant and travel, 2% on all grocery stores, superstores and wholesale club purchases and 1% cash back on all other purchases. A substantial earning rate cash back on top of a no annual fee credit card redeemable for travel, merchandise, gift cards and cash back.

One of the more mysterious cards in the banking industry is the InFirst Federal Credit Union VISA Rewards Credit Card. Definitely a low-key card that you may have never heard about… until now, considering this card does offer some pretty attractive perks such as: 4% cash back on gas purchases, 3% on restaurant and travel, 2% on all grocery stores, superstores and wholesale club purchases and 1% cash back on all other purchases. A substantial earning rate cash back on top of a no annual fee credit card redeemable for travel, merchandise, gift cards and cash back.

| Chase College CheckingSM: Get $100 as a new Chase checking customer when you open a Chase College CheckingSM account and complete 10 qualifying transactions within 60 days of account opening. Get Coupon---Chase College Checking Review |

| Chase Secure BankingSM: Earn a $100 bonus when you open a new Chase Secure BankingSM account online or enter your email address to get your coupon and bring it to a Chase branch to open an account. Make sure to complete 10 qualifying transactions within 60 days of coupon enrollment. Apply Now---Chase Secure Banking Review |

| Chase Private Client: Enjoy up to $3,000 bonus when you open a new Chase Private Client Checking account with qualifying activities. Get more from a personalized relationship when you open a new Chase Private Client Checking account with qualifying activities. Learn More---Chase Private Client Review |

Alternative Credit Cards Bonuses:

- IHG® Rewards Club Select Credit Card

- Expedia®+ Card from Citi

- Hilton HHonorsTMCard from American Express

Member Eligibility:

Considering that this is a regional credit union, it’d make since that there is certain restrictions as to whom is eligible to join as a member. Firstly, most active and retired federal employees, Select Employee Groups who live, works, worships, or attends school in King George Virginia as well as their immediate family, will be eligible

List of Eligible Federal Agencies include:

Employees of the United States Office of Government Ethics, Federal Emergency Management Agency (FEMA), Federal Communications Commission (FCC), Federal Labor Relations Authority, Federal Trade Commission (FTC), Merit Systems Protection Board, Office of Personnel Management (OPM), Pension Benefit Guarantee Corporation (PBGC), Securities Exchange Commission (SEC) or Surface Transportation Board, you are automatically eligible for membership with the credit union.

You will need to join the credit union through the National Active and Retired Federal Employees (NARFE) or American Pharmaceutical Association (APhA). Members fee will apply; $40.

Editor’s Note: Although it does emphasize that you must be a federal employee to become a member with this credit union, it’s been reported that you do not have to be a federal employee for eligibility to apply. But, of course, YMMV.

Infirst FCU VISA Rewards Summary:

- Apply Now

- Maximum Bonus: Earn 1,500 bonus points

- Spending Requirement: First Purchase

- Annual Fee: None

- Bonus Worth: Considering that 5,000 Bonus Points is redeemable at a worth of $50, 1,500 Points will be equivalent to $15.

Infirst FCU VISA Rewards Features:

- Earn 1,500 bonus points for first purchase

- 4% cash back on all gas purchases

- 3% cash back on all restaurant and travel

- 2% cash back on all grocery stores, superstores and wholesale clubs

- 1% cash back on all other purchases

- Introductory offer of 1.99% APR* on PURCHASES and BALANCE TRANSFERS

- No balance transfer fee

- No annual fee

- Points redeemable for travel, merchandise, gift cards and cash back

How to redeem your points:

- Log in to Online Banking, select the Credit Card tab, then click on CU Rewards.

- Register your card. Select redeem points.

- If you select Cash, a credit will be applied to your credit card account. Points redemption for cash must be used in 5,000 point increments (5,000 points = $50.00).

How Much Are Points Worth?

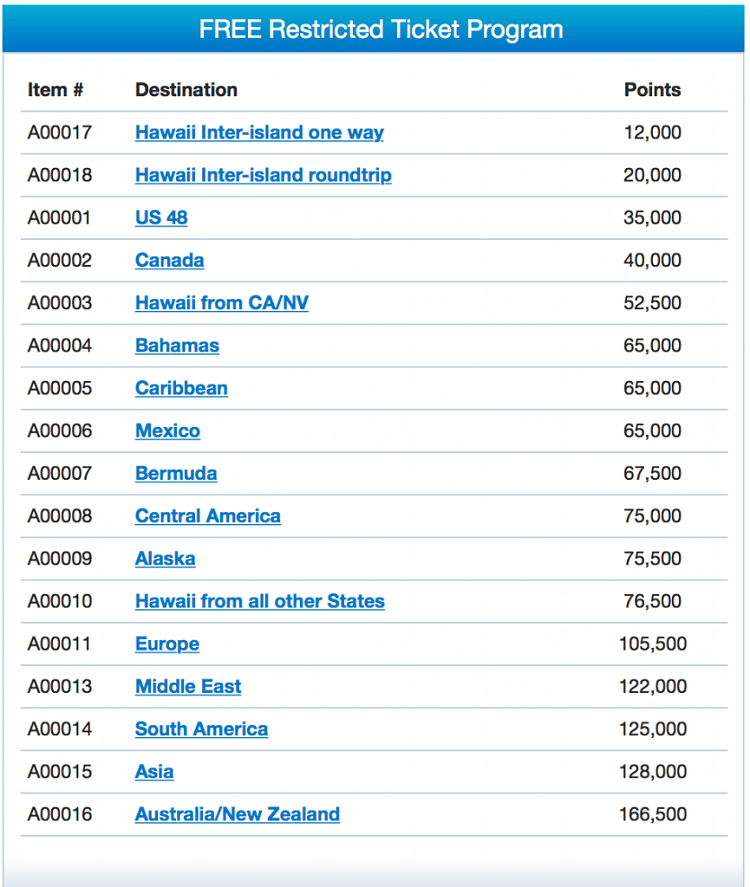

Points will be worth 4 cent a piece if you redeem for statement credit with a set minimum of 5,000 points necessary to redeem. As stated earlier, this card will earn your CU Rewards Points redeemable for travel, merchandise, gift cards and cash back. Emphasizing on travel or flight in general, if you can maximize the points necessary for flight, then this card could potentially be a better option no annual fee card for you. You also have the ability to redeem your points for unrestricted travel with flights:

- 35,000 points for a $325 credit

- 54,000 for a $525 credit

- 75,000 for a $750 credit

Infirst FCU VISA Rewards Pros:

- Generous Earning Rate

- No Annual Fee

Infirst FCU VISA Rewards Cons:

- Weak Bonus

Conclusion:

Get your hands on the InFirst Federal Credit Union VISA Rewards Credit Card and when you make your first purchase, you could receive a 1,500 Bonus worth of $15. Now, it’s not a significant bonus, but lets keep in mind that this card does offer superb earning rates on top of no annual fee and no balance transfer fee. Definitely a great contender with daily purchases involving gas or restaurants, in which case, I must add that the earning rate highly resembles Citi’s Costco cards minus the need of being a costco member. Keep in mind that eligibility will be applicable and if you’re currently not eligible, you can always find our complete list of Credit Card Bonuses for all of your credit card needs!

Any idea what travel category consists of? (flights, hotels, car rentals, etc.) No sign of it on their website, but I haven’t applied for the card yet.

If you’re not an employee of any of the Federal agencies listed, you can still join the credit union – join FAPAC for a one time fee of $10 (using promo code INFIRST), and open a savings account with the credit union with only $5. The 1500 points ($15) you earn after your first purchase negates those out-of-pocket expenses.