Partnered with One Tree Planted, Kin will plant 100 trees for each person that you’ve successfully referred to the home insurance provider. Kin offers convenient and affordable insurance for homeowners. They specialize in high-risk properties like mobile homes and areas prone to flooding. The company states the average homeowner saves $500 by switching to Kin.

Partnered with One Tree Planted, Kin will plant 100 trees for each person that you’ve successfully referred to the home insurance provider. Kin offers convenient and affordable insurance for homeowners. They specialize in high-risk properties like mobile homes and areas prone to flooding. The company states the average homeowner saves $500 by switching to Kin.

Kin is only available in Alabama, California, Florida, Georgia, Illinois, and Texas.

Read below for more information on Kin and what they have to offer.

Kin Plants 100 Trees for Every Referral

Kin offers a different kind of referral program, putting money where the values lie. For each person you refer who gets a Kin home insurance policy, they’ll plant 100 trees in your state. This is for being partnered with One Tree Planted. Here’s how it works:

- Kin gives you a referral link.

- Share your referral link with your friends.

- One of your friends gets a Kin home insurance policy.

- Kin will plant 100 trees in your state.

The trees that are planted are native species, so they have a higher chance of survival.

(Visit for more information)

Kin Home Insurance Features

To generate your homeowners insurance quote, Kin will heavily rely on data. Once you’ve put in your address, the company pulls property record, real-estate listing and even satellite images to determine your rates. All of your information and that data are used to give a quote in a matter of minutes. You won’t have to spend more than an hour of filing out forms online. Plus, you don’t need to talk to an agent over the phone. If you do need help from an agent, you’ll be able to get in touch with one on their website’s chat function.

Furthermore, Kin offers all standard home insurance coverages, including coverage for dwelling, other structure, personal liability, loss of use and medical payments. Compared to most others, Kin will give insurance based on replacement cost, rather than the actual cash value. This will take out depreciation from your claim payout. In other words, you’ll receive the full amount required to replace what you lost in the event of covered property damage.

Kin also gives:

- Scheduled property coverage for valuables like jewelry and antiques that comes with their own sub-limits.

- Identity fraud protection will cover accrued expenses, such as legal costs, and includes assistance from an identity theft specialist who gives guidance while you restore your identity.

- Flood insurance as an endorsement in Florida. There’s no 30-day wait and it will cover your property up to your specific coverage limits.

- Wind & hail coverage is part of the standard homeowners policy. You’ll get to pick between the typical amounts 1% – 10% of your dwelling coverage or a flat rate, depending on state regulations.

Other lines of insurance will include: condo, mobile home, landlord, umbrella, and second-home insurance.

Kin Home Insurance Rates & Discounts

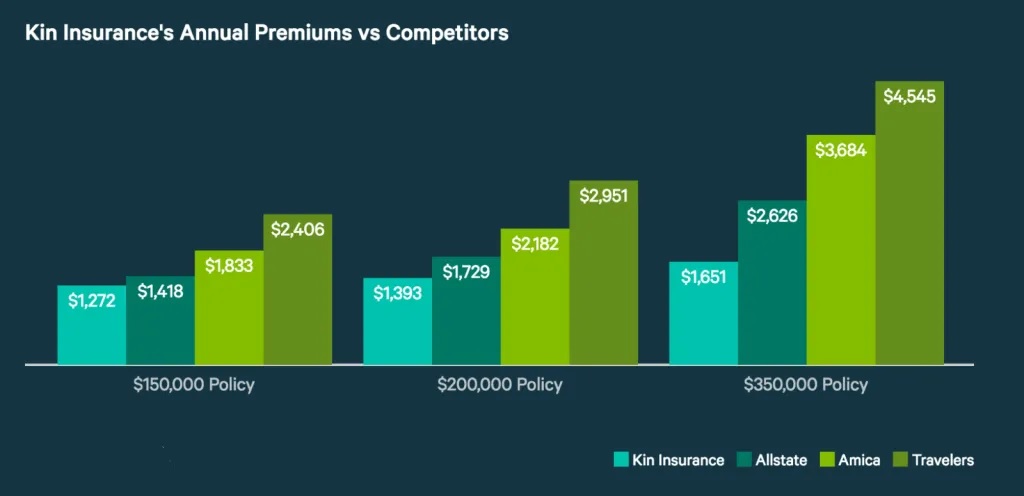

Kin Insurance offers some of the cheapest home insurance quotes on the market, compared to other big insurers like Allstate and Amica:

Standard deductibles are $50, $1,000, $2,500, $5,000 and $10,000+. Increasing your deductible will lower your annual premium. However, you’ll be responsible for more upfront costs when you file a claim.

Kin will automatically look for applicable discounts when you sign up for one of their insurance policies online like:

- Claims-free

- Electronic policy

- Home community

- New homeowner

- Mature homeowner

- Pay in full

- Wind mitigation

- Fire mitigation

- Accredited builder

- Responsible repair

- LEED-certified home

Special discounts, with Kin partners will include:

FLO installs a device in your main water line to look for irregularities in your water consumption. Additionally, the system can shut off your water supply if there’s ever an emergency, like a burst water pipe. Kin policyholders get this system for free ($499 in value). Plus, if you install it, you’re eligible for a $50 annual discount on your homeowners insurance policy.

LiveWatch is a home security system that will monitor your home for fire and carbon monozide. Kin policyholders get this system for free ($99 in value). Installing LiveWatch will make you qualified for about $100 in savings a year on your homeowners insurance policy.

MyStrongHome offers Kin policyholders financing for a new roof or better opening protection. However, this isn’t really a discount, but making home improvements will often lead to more affordable home insurance quotes.

Kin Home Insurance Limitations

Before you move forward with Kin, keep in mind the following:

- Kin only offers homeowners coverage. In other words, you won’t be able to bundle your home and car insurance with Kin. Usually, it will lower the premium for both policies.

- As mentioned above, Kin has limited availability in Alabama, California, Florida, Georgia, Illinois, and Texas.

|

|

Conclusion

Kin is a great home insurance option that is convenient and affordable. Additionally, with all the discounts they offer, it makes it more appealing to sign up for. Not to mention, they will plant 100 trees in your state with each successful referral you make to others.