After being shut down in October of 2016, it’s safe to say that RadPad is back under new ownership. Essentially RadPad is the convenient home/apartment rental finder business who has the services capable of making rent payment with credit or debit cards for a fee. Fees standard of 2.99% and $4.95 for a debit card ($9.95 if your rent is above $5k). Now there may be some things you’re wondering in regards to this platform and we will answer it so it’s advised that you keep reading on!

After being shut down in October of 2016, it’s safe to say that RadPad is back under new ownership. Essentially RadPad is the convenient home/apartment rental finder business who has the services capable of making rent payment with credit or debit cards for a fee. Fees standard of 2.99% and $4.95 for a debit card ($9.95 if your rent is above $5k). Now there may be some things you’re wondering in regards to this platform and we will answer it so it’s advised that you keep reading on!

| BONUS LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up To $700 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

RadPad In-Depth:

It’s confirmed that RadPad codes as Travel and here’s some ways you can maximize this confirmation:

- Get your $300 Sapphire Reserve credit by paying your Rent with RadPad

- ‘Buy’ UR points at 1 penny per point with Chase Ink Business PreferredSM Card which also earns 3x on travel

- ‘Buy’ UR points at 1 penny per point with the Sapphire Reserve card

- ‘Buy’ ThankYou points at 1 penny per point with Citi Prestige or the Premier card

RadPad Key Features:

- Your landlord doesn’t have to use RadPad

- Use any debit or credit card to pay your rent

- ACH payments are 100% FREE!

- Easily split & pay rent with your roommates

- Credit cards just 2.99%

- Rent payments under $5,000, just $4.95/month. Payments $5,000 or more just $9.95/month.

Why Pay Your Rent Using RadPad?

Radpad exerted consumer interest when figured that it was coded as travel purchases with Android or Apple Pay (NOT using direct credit card payment) since it would be a part of lodging and hotel categories. This would be especially interesting with the Sapphire Reserve and it’s beautiful 3x on travel purchases. We have received reports of the Prestige coded at 3x with Apple/Android Pay.

For instance, the Barclaycard Arrival Plus™ World Elite MasterCard® allows a 2% back on all purchases. The fee for using Radpad is 2.99%. In a way, you are only losing .99% back on the Barclay card comes in miles. Now, why would you want this if you’re not gaining anything from the transaction? Well, keep in mind the promotion that Barclay offers. You are able to earn 40,000 bonus miles after spending $3,000 in the first 90 days. Making high purchases on credit cards allows meeting the spending requirements for credit card promotions.

Another card you might want to use is the Citi® Double Cash Card. This cards allows you to earn 1% when you make purchases and 1% when you pay your balance for a total of 2% cash back. This will allow you to remain even when using the Citi® Double Cash Card for paying rent through RadPad. However, this card currently does not have any promotions. You might want to wait until it does to receive a bonus rather than just staying even with the cash back.

How it Works

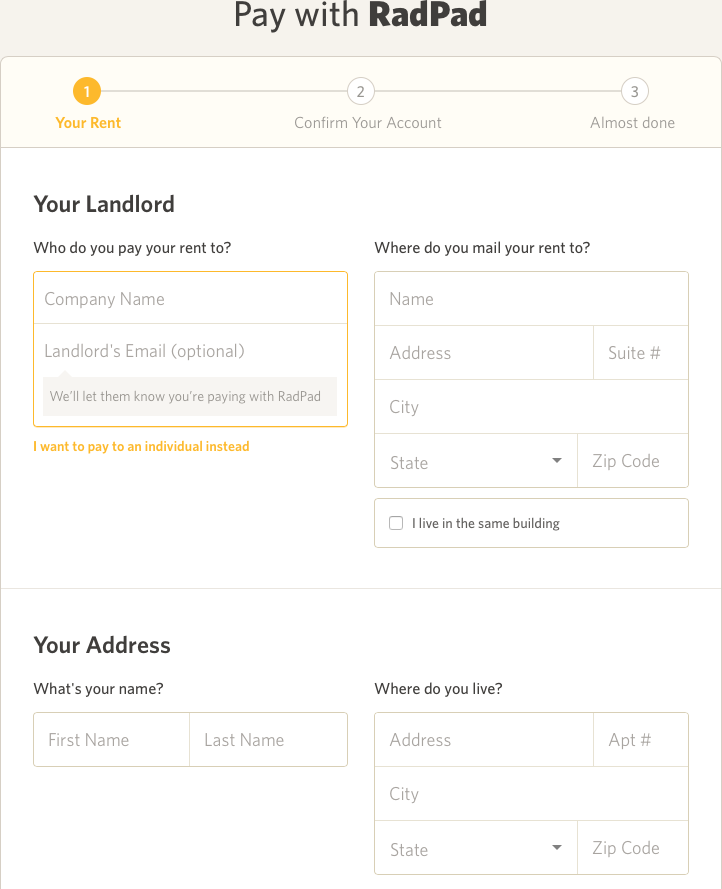

All you need to do is sign up for this service; your apartment does not need to sign up. A physical check will be mailed to your leasing center. RadPad also ensures that you won’t be subject to late fees, but they do require a 4 business day lead time. They’ll even send you an alert when the check is deposited by your landlord. Below you will see a screenshot of what the signup process is like which is pretty simple.

Conclusion

Very excited to see RadPad make a comeback in 2017 with the ability to pay your rent with a credit card or debit card. Standard fees do apply; 2.99% for credit cards and $4.95 for debit cards on apartments lower than $5k. This is easily one of the better ways to make your minimum spending as well as the added benefit that it codes as Travel purchases due to being a part of lodging and hotel categories. Pretty simple and self-explanatory service, however, if you have any questions you want to add, then you can go ahead and leave a comment in the comment section, if not, go ahead and check out our full list of our Best Bank Deals.