Credit score can get quite tricky and if you feel that your credit score is not adequate enough, then there are ways to improve your credit report without any hard pull whatsoever. One useful technique to strengthening your credit report is through installment loans also known as the “Savings Secured Loan Technique.”

Credit score can get quite tricky and if you feel that your credit score is not adequate enough, then there are ways to improve your credit report without any hard pull whatsoever. One useful technique to strengthening your credit report is through installment loans also known as the “Savings Secured Loan Technique.”

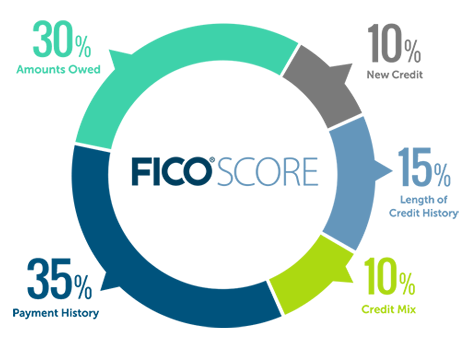

The biggest reason why credit score or credit rating is “tricky” to say the least, is that there’s quite a few factors that could potentially affect your credit score (positively and negatively). The system is intricate, yet delicate and maintaining stability means maintaining your credit utilization as well as your payment history. If you’re interested, be sure to read on and learn more.

| BONUS LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up To $700 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

Credit Report Factors:

Like I said above, there are quite a few things to consider when it comes to what affects your credit rating and credit score. Moreover, your credit utilization and payment history; How much of your available line of credit can be utilized and if you paid your bills on time. Now, other factors may also come into play, here’s a list of things you should take into consideration if you want to increase your credit score.

Major Factors that affect your credit are:

- Credit Utilization– how much available line of credit can be used, keep in mind that less is better (30%)

- Payment History– If you’ve paid all the necessary bills on time (35%)

Keep in mind that these two categories make up 65% of your credit score according to FICO.

Minor factors that affect your credit are:

- New Credit – Having a lot of new accounts isn’t very healthy on your credit. (10%)

- Credit Mix – having deviated types of credit could potentially help. (10%) Keep in mind that taking on different types of credit won’t automatically boost your score.

- Length of Credit History – the longer the credit history, the better. (15%)

What is Credit Mix

Most of us have many credit cards in which fall under the revolving loans. Installment loans is another type of loan that falls into your credit report and it’s often your mortgage or car loan. Keep in mind that someone paying off many credit cards on time isn’t really as stable to a bank as someone who’s allocated accordingly towards different types of loan.

To help your credit score, you can always apply for personal loan and immediately pay off most of the loan, leaving a remainder that you slowly pay off over time. In doing so, since you’re paying off interest on a smaller balance, you wouldn’t be subject to higher cost.

Now, there is a potential conflict with this method and it’s the fact that you’re subject to a hard pull when applying for a loan and they could pull from more than one credit bureau if deemed necessary. Also, loans aren’t always an easy matter in term of getting approval, particularly someone with lower income or a non-sustainable credit background.

Savings Secured Loan Technique Trick:

Most prominent banks will offer you the option to apply for a Savings Secure Loan. In doing so, you will have the full amount of money deposited with the bank in a designated savings account so that if you fail to meet any legal obligations or conditions, you won’t be missing out. Usually, how secured loans work is the borrower pledges some asset (e.g. a car or property) as collateral for the loan.

You can say that the Savings Secured Loan sort of deviates from a secured loan in terms of strength considering that the loan is backed by actual money held in a savings account with a trusted bank. Money that is kept in the savings account is frozen until an individual has the ability to pay off his loan. As an individual pays off the loan, the money will slowly be unfrozen in which they can utilize the unfrozen money. This leaves banking establishments satisfied without jeopardizing anything.

Savings Secured Loan Technique Advantages:

- Beneficial for the people have no installment loans, open or closed, on their credit report.

- Beneficial for the People who do have a closed installment loan but who have no open installment loans.

- Savings Secured Loans could potentially benefit your credit utilization since your installment utilization will be low and calculated separate from your revolving loan utilization (most of your loan was paid off and only a small amount is carried over month to month)

Savings Secured Loan Technique Cons:

- This trick is not useful for anyone who has had a mortgage, car loan, or other installment loan.

- This trick will disappoint people who need to improve their score very fast (e.g. < 60 days)

- If you don’t have $510 to open an account and maintain, then this technique won’t work.

How-To:

When you’re applying for a SSL, there are some banks or credit unions that won’t do any hard pulls on the basis that the money is guaranteed. Keep in mind that this loans main purpose is to help individuals built their credit considering that it’s quite easy to get approved for and the borrower isn’t putting the bank in any jeopardy.

One simple trick is to just look for a banking establishment that doesn’t do a hard pull for joining or applying for a checking or savings account. (e.g. Alliant Credit Union, Navy Federal Credit Union)

We want a small loan for a long period of time with concerns to his technique. If we were to use Alliant as an example, we’ll go for a $500 loan for a 48-month loan period.

- Become a member. Alliant is exclusive for certain groups, however, most of us can become a member just by donating $10 to Foster Care to Success and accomplishing the $5 net cost.

- Mention that you want to open a savings account during the membership sign-up process. Their savings accounts may be worth looking into because of an exceptional APY rate attached to it.

- Add $510 to your Alliant Savings account and wait for 2-3 business days until the money is process

- You will then apply for a Shared Secure Loan (Savings Secure Loan). Apply for a $500 loan for a 48-month duration

- Pay off most of your loan; pay off $450 and leave $50 remaining. From a credit standpoint, this is an excellent remainder for a loan.

- You should be most of the way paid of through the loan by now and you wouldn’t have to make payments until close to the end of your term. Try to make a payment every here and there to avoid in activities or being considered dormant

- As you get to the end of your terms with the loan, nearly 6 months to a year, you’re required to make real payments on the loan. I strongly urge that you stay on top of your payments regarding this stage and whatever you do, do not fall off on any banking obligations you’ve made.

Conclusion:

Now, certainly there are many factors that plays a part in affecting your credit score and credit rating and we emphasize that Credit Mix, although it is 10% of your credit report from FICO, it’s still a legal contender in determining your score. Those that want to improve their score and do not have any installment loans could apply for a Share Secured Loan or “Savings Secured Loan” and gradually increase their credit utilization as well as their credit score. This trick may not be very useful for those of you with car, mortgage or installment loans.

Of course, there are other ways to improve your FICO. I recommend that you first focus on the Derogs and Credit Card debt before even attempting this technique. Getting your credit card balance in perfect shape will most likely help you more. Don’t forget to check out our full list of Credit Card Bonuses if you’re not interested at the moment.