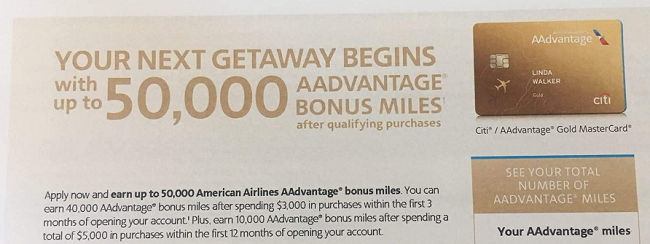

Citi has been sending out invitations for a chance to earn 50,000 American Airlines AAdvantage Bonus Miles when you open a new Citi® / AAdvantage® Gold MasterCard®. You will effectively earn 40,000 AA Bonus Miles when you make a spend of $1,000 in purchases within a given 3 months of card activation. You will then earn an additional 10,000 AA Bonus Miles when you spend the first $5,000 within a 12 months span. Redeem your points for booked award flights on American Airlines and their eligible partners and take advantage of the utter convenience of no blackout dates, 25% discount on in-flight merchandise, and so much more.

Citi has been sending out invitations for a chance to earn 50,000 American Airlines AAdvantage Bonus Miles when you open a new Citi® / AAdvantage® Gold MasterCard®. You will effectively earn 40,000 AA Bonus Miles when you make a spend of $1,000 in purchases within a given 3 months of card activation. You will then earn an additional 10,000 AA Bonus Miles when you spend the first $5,000 within a 12 months span. Redeem your points for booked award flights on American Airlines and their eligible partners and take advantage of the utter convenience of no blackout dates, 25% discount on in-flight merchandise, and so much more.

Editor’s Note: This is a Targeted Offer; YMMV. There has been reports of individuals getting a match-up of this promotion from their current public offer of 25,000 miles after $750 in spend within three months.

If you are adamant on this card, be sure to apply prior to August 28, 2016. Be sure to read our review on the “New Terms” concerning Citi’s Churning Rules. American Airlines AAdvantage bonus miles will not be available if you have had any Citi / AAdvantage card (other than a CitiBusiness / AAdvantage card) opened or closed within past 24 months.

| BONUS LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up To $700 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

Citi AAdvantage Gold MasterCard Summary:

- Maximum Bonus: 25,000 AAdvantage Bonus Miles

- Spending Requirement: You must spend $750 within 3 months of account opening.

- Annual Fee:$50 (Fee waived for the first 12 months)

- Bonus Worth: The 25,000 bonus points is enough for a domestic flight

- Expiration Date: None

- Additional Advice: If you are a regular flyer of American Airlines, you could use your card to receive a 25% savings

on eligible in–flight food and beverage purchases when you use your card. - Alternative Credit Card Bonuses:

Citi AAdvantage Gold MasterCard Features:

- Earn 40,000 American Airlines AAdvantage® bonus miles after making $1000 in purchases within the first 3 months of account opening

- Earn 10,000 American Airlines AAdvantage Bonus Miles when you make a spend of $5,000 within 12 months of account opening.

- 1x mile per $1 spent everywhere

- 25% savings on eligible in-flight food and beverage purchases

- Annual fee of $50 is waived for the first 12 months

Citi AAdvantage Gold Pros:

- Generous Sign-Up Bonus

- Good Card for Moderate Spenders

- Low annual fee of $50 for credit card

Citi AAdvantage Gold Cons:

- Slow mileage accumulation rate

- Foreign transaction fee of 3%

Citi AAdvantage Gold Subject to Citi’s New Rule:

For quite some time now, Citi didn’t have any published churning rules for credit cards (The Golden Age of Churning), but lets face it, Banks deem churners as invaluable, or unreliable customers. Some cards could be churned every few months while others couldn’t be churned, which eventually led to them instituting a 18 months rule. This 18 month rule has now been extended to a pretty strenuous 24 months. To summarize this, American Airlines AAdvantage Bonus miles will not be available if you have had any Citi / AAdvantage card (other than a CitiBusiness / AAdvantage card) opened or closed within past 24 months.

Conclusion:

If you’re targeted for 50,000 AA Bonus Miles on the Citi® / AAdvantage® Gold MasterCard®, then all I can really say is that it’s a no-brainer, considering that the AAdvantage Gold offered a 25,000 AA Bonus MIles to the public that could earn you a round-trip flight with American Airlines. How this promotion works is, you’ll earn 40,000 AA miles when you make $1,000 in purchases within the first 3 months of account opening with an additional 10,000 when you make a spend on purchases totaling in $5,000 within 12 months of account opening.

Considering that there’s no annual fee for the first year, this could be a great opportunity for you to take advantage of before the new Citi Rules take it’s hold. Also, be sure to check out our full list of Citi Card Promotions as well as our Best Credit Card Promotions for your credit card needs.