Triumph Mortgage is a community bank centralized in Memphis Tennessee with their services expanded to folks in other areas as well. Efficiency with customer satisfaction is definitely integrated into their business practices with what is personalized services, and unlike most mortgage companies these days, you don’t have to send your loan for approval elsewhere since they’re a direct lender that makes their own loan decisions allowing utmost flexibility and efficiency with regards to the mortgage process. Some things I’d like to emphasize is that there’s no lender fees on top of guaranteed closing costs.

Triumph Mortgage is a community bank centralized in Memphis Tennessee with their services expanded to folks in other areas as well. Efficiency with customer satisfaction is definitely integrated into their business practices with what is personalized services, and unlike most mortgage companies these days, you don’t have to send your loan for approval elsewhere since they’re a direct lender that makes their own loan decisions allowing utmost flexibility and efficiency with regards to the mortgage process. Some things I’d like to emphasize is that there’s no lender fees on top of guaranteed closing costs.

| BONUS LINK | OFFER | REVIEW |

Triump Mortgage In-depth Analysis:

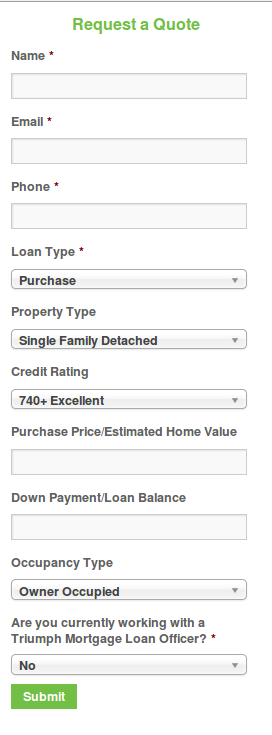

Triump Mortgage offers a full suite of mortgage products, that would include your Conventional, FHA, VA, USDA, THDA, and of course, Jumbos. Just fill out the little application on the left-side of their mortgage page in bolded flamboyant green “Request a Quote.” This survey will be your gateway into approval for a loan with the essential questions such as your credit score, income, home value, down payment percentage, etc.

You will get a notification on whether you’ve been approved or not within 5 minutes. They may recommend a product based on the information that you’ve put on this pre-approval survey. Their mortgage loan officers are seasoned professional who will make the mortgage process easier on you, practically walking you through each and every necessary step until you’ve closed the loan and since they offer personalized services, you can say that this would go hand-in-hand with nationally lower-rates on what you’d typically consider to be a larger purchase.

Triump Mortgage Summary:

- Apply Now

- Maximum Loan: Not Specified

- Account Type: Conventional, FHA, VA, USDA, THDA, Jumbo

- Availability: Nationwide

- Additional Advise: Have the necessary documents and validation information ready to make your process as smooth as possible.

- Closing Loan:

- Unknown

Triump Mortgage Services

Applying for a mortgage should be simple, not stressful. Triumph’s job is to guide you to the right mortgage in the most convenient way possible. Here are a few reasons why you should plant your roots with Triumph Mortgage:

Local Underwriting – Their underwriters are familiar with the local market and use common sense underwriting. That allows them the flexibility needed to close your loan on time, every time.

Free Pre-Qualification – At no cost to you, Triumph’s Loan Officers can let you know the amount you can borrow based on basic financial data provided. The Loan Officer will also clearly explain the loan process and answer any general questions you have before you put in an offer on your dream home.

Fast Loan Approval – After you have found your home, Triumph’s streamlined mortgage process allows your loan to be approved quickly so that you can close on your new home in a matter of weeks.

Triump Mortgage Basic Requirements:

Income Documents:

- Pay Stubs covering the customer’s most recent two pay periods for each applicant.

- W-2 Forms for the previous two years.

- Two most recent years’ federal tax returns (e.g. for a loan in 2015, the customer need to submit the customer’s 2014 and 2013 federal tax returns). All the pages and all schedules.

- If the customer is self-employed, the two most recent years’ business tax returns are also needed.

- For self–employed or investment income, the two most recent years’ 1099’s and K-1 forms are also needed

- For self–employed business income,year-to-date profit and loss statement and balance sheet.

- For retired customers, copy of Social Security and/or Pension “award letters” detailing the amount of retirement income.

Asset Documents:

- Two most recent months’ bank statements. All of the pages.

Other Documents:

- Homeowner’s Insurance statement(s) for all properties owned showing the customer’s coverage and the annual premium.

- Mortgage statements for all properties owned that have liens.

- Copy of driver’s license or State I.D.card for all customers.

- If divorced, the customer’s fully executed divorce decree.

Conclusion:

With a wide variety of loan types to choose fromn, personalized services, low-rates at Triumph Mortgage, this could be your flexible, hassle-free mortgage lender and better yet, there’s no lender fees, local underwriting and fast loan approval making every step of the mortgage process a breeze, and an inexpensive one at that. It’s worth noting that you still have to do your part; Be sure that you have all the necessary documents and validation forms/information ready to make sure that your mortgage process is as smooth as promised. Be sure to check out our Best Mortgage Rates for all your home-buying needs!

With the American Express® High Yield Savings Account: • Earn 1.90% APY as of 9/15/22 on your deposits. Your High Yield Savings account earns interest daily and is posted to your account monthly. • Links easily with your current bank accounts. No need to switch banks. • FDIC Insured. Your account is insured to at least $250,000 per depositor. • 24/7 Account Access |

Leave a Reply