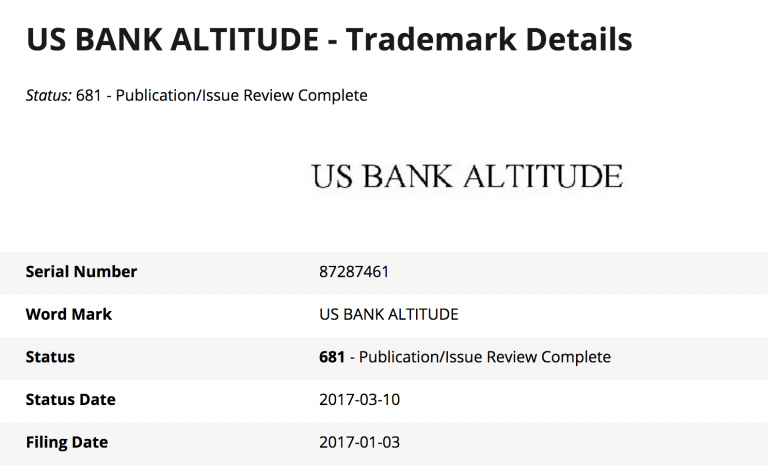

Confirmed, U.S. Bank’s been leaving crumb-trail hints regarding what appears to be a new Premium Card in their collection. Astonishingly enough, U.S. Bank has never pushed a premium card to the market before, so this is definitely good vibes considering it was approved late March.

Confirmed, U.S. Bank’s been leaving crumb-trail hints regarding what appears to be a new Premium Card in their collection. Astonishingly enough, U.S. Bank has never pushed a premium card to the market before, so this is definitely good vibes considering it was approved late March.

This is big moves for U.S. Bank and here’s what you should expect from the U.S. Bank Altitude Reserve Credit Card set to launch in May 2, 2017. Let’s see if it holds up to the anticipation, namely, competitively rivaling American Express’s Platinum Card, Citi’s Prestige and Chase’s Sapphire Reserve.

| BONUS LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up To $700 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

Alternative Credit Card Bonuses:

- Platinum Card® from American Express – 60K Membership Rewards points w/ $5,000 in 3 months

- Citi Prestige® Card – 40K Points & $250 Air Travel Credit w/ $4,000 in 3 months

- Chase Ink Business PreferredSM Card – 80K Bonus Points w/ $5,000 in 3 months

Eligibility:

U.S. Bank customers with the following relationships will be eligible for this card:

- U.S. Bank Checking or Savings account

- Certificate of Deposit

- Mortgage

- Home Equity Loan

- Home Equity Line of Credit

- Auto/Boat/RV Loan

- Personal Loans and Lines

- Private Banking account

- Consumer Credit Card

U.S. Bank Altitude Editorial Section:

This section will be strictly in terms of what we value the card regarding the circumstances and benefits we received thus far. For further evidence towards this drop, below is a memo from U.S. Bank, sent out April 04, 2017.

Reiterating that this card’s intentions may be towards rivaling the Platinum, Prestige and Reserve Card, we were presented with benefits that may do just that, with 3x the travel, 3x on all mobile wallet purchases, a beautiful $325 Annual Travel Credit, and is a custom engraved metal card, we just can’t help but wait on the unboxing to happen!

Now, along the lines of airport lounge access and TSA/Global Entry perks, it seems these perks are widely saturated as well as the market for premium cards, so we really do hope to see some more appealing perks considering that most of you may already have a card that offers just that. Now, one thing I do want you guys to consider is that points will be worth 1.5% with travel being worth up to 4.5%.

U.S. Bank Altitude VISA Infinite Card Summary:

- Maximum Bonus: 50,000 Bonus Points

- Spending Requirement: Make $4,500 in spend during the first 90 days of account opening.

- Bonus Worth: This will be worth $750 redeemed towards travel.

- Best Features: $325 Annual Travel Credit, 3X points on travel

- Annual Fee: $400

- Expiration Date: None

- Additional Advice: U.S. Bank will allow you to transfer your points to flexperks at a 1:1 ratio, making your points worth 2 cents apiece.

U.S. Bank Altitude Reserve Card Features:

- Earn 50,000 points after $4,500 in spend during the first 90 days

- 3X points on travel

- 3X points on all mobile payments (This only includes NFC transactions)

- 1X on everything else

- $325 Annual Travel Credit – purchases made directly from airlines, hotels, car rental companies, taxis, limousines, passenger trains and cruise lines are eligible.

- 12 free gogo wifi passes

- Airport Lounge Access – Limited to four visits/four guests visits each membership year.

- TSA Pre-check

- Black car and car rental service – 15% discount and $30 off first ride

- Silvercar discount – When you rent an Audi A4, you won’t have to deal with lines or paperwork from your designated airport location in select cities. Also, you’ll receive a discount of up to 30% on rentals of two days or more.

- Rent an Audi A4 with no lines or paperwork from airport locations in select cities and receive a discount of up to 30% on rentals of two days or more.

- Visa Infinite Concierge service and more

- Custom Engraved Metal Card

- Annual fee is $400 for the primary cardholder and $75 for authorized users.

U.S. Bank Altitude Reserve Card Travel Credit

When you’re looking at a premium card, the benefits can either make or break the card, putting more emphasis, this card has a $325 annual travel credit attached with a chance that the travel credit will apply automatically (similar to the Sapphire Reserve). Now, whether the annual travel credit will be in regards to cardmember’s or calendar year is still unknown. I’m swaying towards them going for the cardmember’s year option, but don’t put my money on that! Hopefully the credit will be in terms of calendar years, but if there’s any update regarding this aspect, I’ll surely keep you all posted!

Conclusion:

It’s confirmed, U.S. Bank is stepping into the premium card game with their new premium credit card coined the U.S. Bank Altitude Reserve VISA Infinite Credit Card. Now, you should expect this card to earn 3X on travel on top of a beautiful $325 Annual Travel Credit and so much more. The $400 annual fee definitely improves prospects of getting this card, you can offset the annual fee with 35,000 points (1.14¢ per point).

I’m very much anticipating that they render the annual travel credit under a calendar year basis. Considering that you only get 4 priority passes per membership year, this card makes up for it with the 3x on Mobile Wallet Purchases. Meaning 3x on Apple/Samsung Pay, which is completely satisfying for me considering that I practically use apple-pay anywhere that accepts it already.

This could mean 3x everywhere and makes me so much less reluctant to get this card! Would love to see some Ritz Infinite Travel Discount attached, but we’ll just see how U.S.Bank rolls the dice. Find out which card is right for you by checking out our complete list of Credit Card Promotions today!