How important is your credit? Credit is everything in today’s society especially in America. Millions of people depend on their credit to get loans for a home, car, school, to start a business, and for extra funds with credit cards among many other reasons. Your credit score and your credit health and history allows lenders to measure your level of risk and trustworthiness to approve a line of credit and at what rates and terms. 90% of all lenders rely on the FICO Score(Fair Isaac Corporation) ranging from 300 which is considered poor or high risk to 850 which is considered excellent or low risk. Not only does your credit affects you financially, there are studies showing how it can also affect you non-financially including your personal relationships, where you live, and chances of getting a job.

How important is your credit? Credit is everything in today’s society especially in America. Millions of people depend on their credit to get loans for a home, car, school, to start a business, and for extra funds with credit cards among many other reasons. Your credit score and your credit health and history allows lenders to measure your level of risk and trustworthiness to approve a line of credit and at what rates and terms. 90% of all lenders rely on the FICO Score(Fair Isaac Corporation) ranging from 300 which is considered poor or high risk to 850 which is considered excellent or low risk. Not only does your credit affects you financially, there are studies showing how it can also affect you non-financially including your personal relationships, where you live, and chances of getting a job.

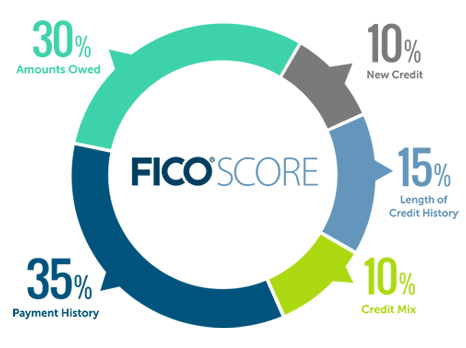

5 Factors of FICO Credit Score:

There are 5 factors that make up your FICO credit score. Your credit history report will have positive and/or negative data that are categorized into these 5 factors to determine your overall FICO credit score. The importance of each factor is weighed by percentage and varies by each individual but is summarized for the general population.

- Payment History 35%: One of the most important factors is whether you’ve paid past credit accounts on time. Lenders are more willing to approve loans if you’ve proven that you can make the payments.

- Amounts Owed 30%: When a high percentage of a person’s available credit is reached, this can indicate that a person is overextended and is more likely to make late or missed payments.

- Length of Credit History 15%: How long your credit accounts have been established will raise your score, including the age of your oldest account, how long credit accounts have been established, and how long it has been since you used certain accounts.

- Credit Mix in Use 10%: Having a variety of credit lines of finance accounts, credit cards and installment loans with a good payment history will increase your credit score.

- New Credit 10%: Opening several credit accounts in a short period of time represents a greater risk especially for people who don’t have a long credit history.

How to Improve your Credit Score:

The best way to improve your credit score or to ensure that it stays in a healthy range is to manage it responsibly over time. Do not fall for any quick-fix remedies because they typically do not work and may actually hurt your credit.

- Make Payments On Time: The easiest way to never miss a payment is to set up automatic payments or reminders. Try not to ever be late or miss a payment.

- Check your Credit Report: Checking your credit will allow you to dispute any errors and understand your score and spot areas of improvement. Knowing your credit history and score will also help you when shop for the best rates and terms with lenders. Request a free copy and doing so will not affect your score negatively.

- Pay Down or Reduce Debt: Not only will this improve your score, you’ll feel a huge sense of accomplishment. If you have multiple large debts, create a manageable payment plan and commit to it to be successful.

- Refrain from Maxing Out: Over extending on available credit will reflect negatively on your credit. Also refrain from opening new accounts too rapidly.

- Keep Older Accounts: Manage old accounts and keep them in good terms. Having a small balance and making payments on time shows that you have managed credit responsibly and may be better than carrying no balance at all.

Conclusion:

Understanding and managing your credit will allow you to attain your goals and major milestones in life. It also makes you a smart consumer by preventing unfair rates and fees, getting loans approved quickly, and overall piece of mind. Credit cards often get a bad rap but consider them as a way to build your credit as long as you make timely payments and abide by the rules. There are countless excellent bonuses and benefits when signing up for a credit card that meets your needs and suits your personality. For example, if you enjoy traveling, the Chase Sapphire Preferred allows you to earn 40,000 bonus point(after meeting the spending requirement) that can be redeemed for flights and hotel accommodations. For many more bonus offers and benefits, be sure to review our complete list of Credit Card Promotions